Lions,

LEO is up over 100% since the introduction of LEO 2.0. This change in tokenomics marks a drastic shift - truly a completely different model and ability to capture value - in the way the LEO operates as a token.

In LEO 1.0, the INLEO platform inflated the LEO token via the social media rewards pool on INLEO.io. This rewards pool paid LEO to users every single day for interacting on the platform.

In LEO 2.0, we pay users for interacting on the platform but the key difference is where do the rewards come from. This is the #1 hole that people poke in the model of projects like Hive and Leo. When they ask this question, you have to respond with "token dilution (inflation) is used to pay users on the platform".

This is a LEO 1.0 answer. In an era of LEO 2.0, the new answer is: "The SIRP (Buybacks from sustainable system income revenues) pay users LEO by bringing in exogenous capital, purchasing LEO on the open market and then sending that LEO to the rewards pool."

The ability to earn LEO remains the same but WHERE THAT LEO COMES FROM has dramatically changed from inflation to buybacks.

With this change, we also made LEO deflationary. How? Because we turned off inflation and changed the LeoBridge technology to an "earn and burn" model. When users want to send LEO cross-chain, they pay a small fee to the Bridge Oracles. The oracles burn that fee and this creates deflation on the LEO token. You can track the real time supply of LEO by checking on the new https://leodex.io/leo page (when it's live). Spoiler: it started at 30M with the launch of LEO 2.0 and drops every single day.

Is the SIRP Model Sustainable?

The SIRP model is the most sustainable model ever invented for Web3 Social Media rewards. The old model that is used by other Web3 projects - inflating their token and paying users - is inherently unsustainable. Those tokens are all trending to 0 until they do something about it.

LEO 2.0 marks the first ever truly sustainable Web3 Rewards Model.

Now, users earn LEO every day based on their activities on the platform. The same way they did before. However, they earn LEO based on buybacks. If the platform generates revenue (Premium, Creator Subscriptions and Ads & Other features in the future), then the rewards pool grows because there is more revenue capture to buyback more LEO.

If the revenue of the platform isn't growing, then the rewards become less. True sustainability is achieved because every user on the platform knows that if they want to keep earning LEO, they need to focus their efforts on growing System Income.

LEO Token Value to 100x

Meanwhile, the LEO token value is now based upon a:

- Ever-deflating token supply (bridges are constantly burning LEO every day and supply is dwindling)

- Buybacks from the SIRP model which creates built-in demand

- Buybacks from 100% of LeoDex revenue which has already surpassed SIRP revenue on INLEO

- Buybacks from LeoDex POL (after 90 days)

- Market demand for an income-producing, deflationary asset (sLEO on LeoDex after 90 days)

The supply is decreasing and the built-in demand is increasing. This is without the market demanding more LEO (which is quite likely once we release the new sLEO contract on Arbitrum).

What will happen to the LEO price? One can only speculate. What is obvious is that the token is already up 100% since LEO 2.0 went live and our team & community believes this is merely the starting point.

The key is that LEO isn't just shooting up because of speculation. This is natively-driven demand for the token while the supply is decreasing. It is the most fundamental economic principle at work: supply & demand.

SIRP Becomes More Valuable

As the LEO token increases in price, the SIRP becomes even more valuable.

For example, if LEO 10x's in value then the SIRP can pay 1/10th as much LEO each day for the same USD value in rewards as we were paying in LEO 1.0.

With a token that is reliably increasing in price over long timeframes, the ability for a buyback-based rewards pool model for social media to flourish becomes ever more viable.

Transparency

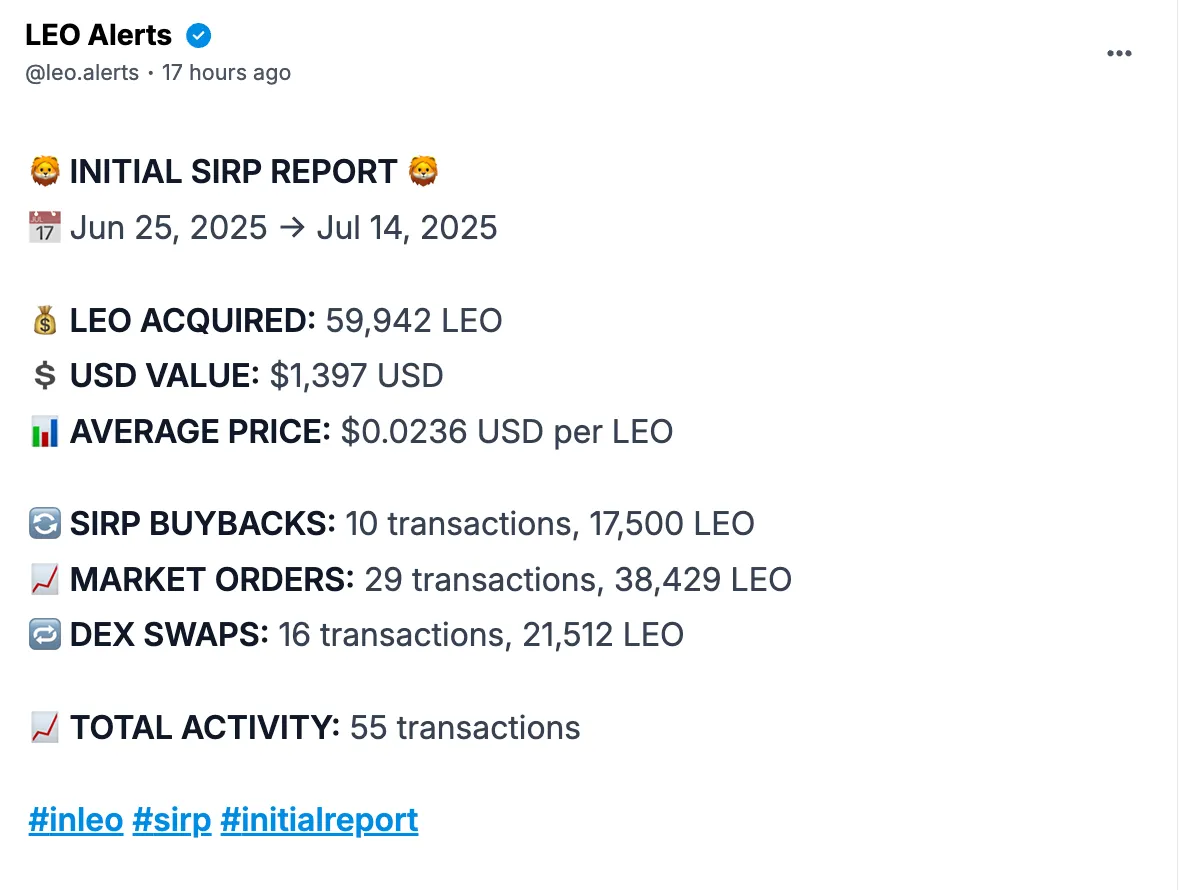

At LEO, we are all about transparency. We built the @leo.alerts agent to track the SIRP buybacks in real time. It also reports every Monday about the prior 7 days of buybacks (the screenshot you saw at the top of this post).

You can also track all of this activity onchain:

- SIRP buyback account: @leopool

- System Income Rewards Pool account (where users get paid from): @leo.tokens

- LeoDex POL Buybacks account (where 100% of LeoDex revenue is buying back LEO off the market): https://arbiscan.io/address/0x00263920Ece9cf7B4FCB7BA12DD820f747f0e67f