LeoDex is a cross-chain DEX interface that allows you to trade on THORChain, Maya Protocol, ChainFlip, Rango, Relay and (Soon) Near Intents.

The LEO Token is the token of the LEO ecosystem. Our token was launched via fair launch distribution through our Web3 Social Media app: Inleo.io. We've been building Web3 products for 6 years and the LEO Token is at the heart of our economy.

You can learn more about LEO and our tokenomics via the LeoDex Docs. The short version:

- 30M Max Supply

- Fully Issued via fair launch (no VCs or designated team stake)

- Utilized for social media rewards via buybacks (SIRP on INLEO)

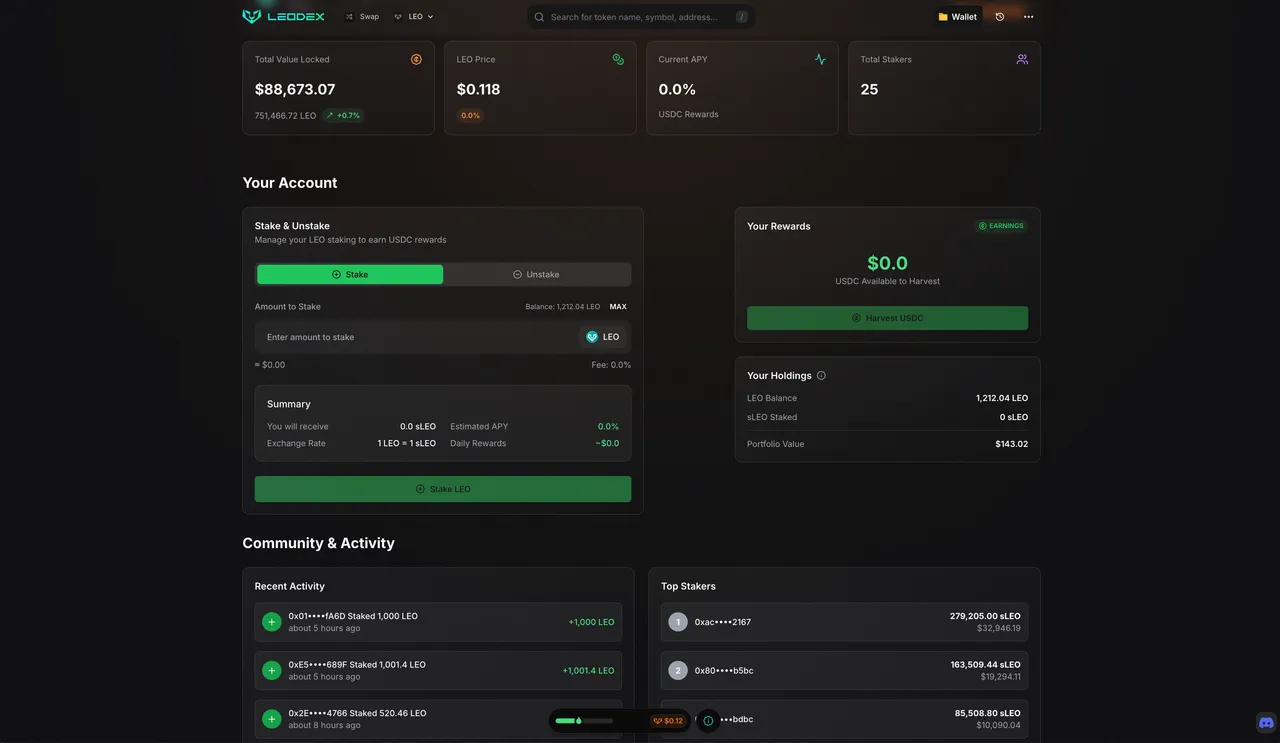

- Staking on LeoDex allows users to earn 100% of LeoDex Affiliate Fees as daily USDC payouts

- Protocol Owned LEO earns a fair share of USDC payouts and autonomously buys LEO and perma-stakes it

- Tradeable on Arbitrum, BSC, Polygon and Hive-Engine. LeoBridge technology connects all 4 chains and charges a small fee for bridging. 100% of fee revenue burns LEO

LEO is LIVE on Maya Protocol and LeoDex

Trade LEO with any L1 asset on Maya via LeoDex

LEO is natively an Arbitrum token and the main pool for trading LEO is on Maya Protocol. Maya listed our token nearly 1 year ago and recently, Arbitrum trading was offline for Maya. As of today, Arbitrum trading is back online and that means you can now trade LEO on Maya once again.

Maya is our best pool to trade LEO for a number of reasons:

- Liquidity

- Native Asset Pairs (trade with BTC, ETH, USDT, RUNE etc.)

- Streaming Swaps

- Permissionless & Cross-Chain

Streaming Swaps are one of the best reasons to trade LEO via the Maya Pool as opposed to the other pools. When you stream a swap, you can swap with massive size. This breaks your large swaps into subswaps and allow

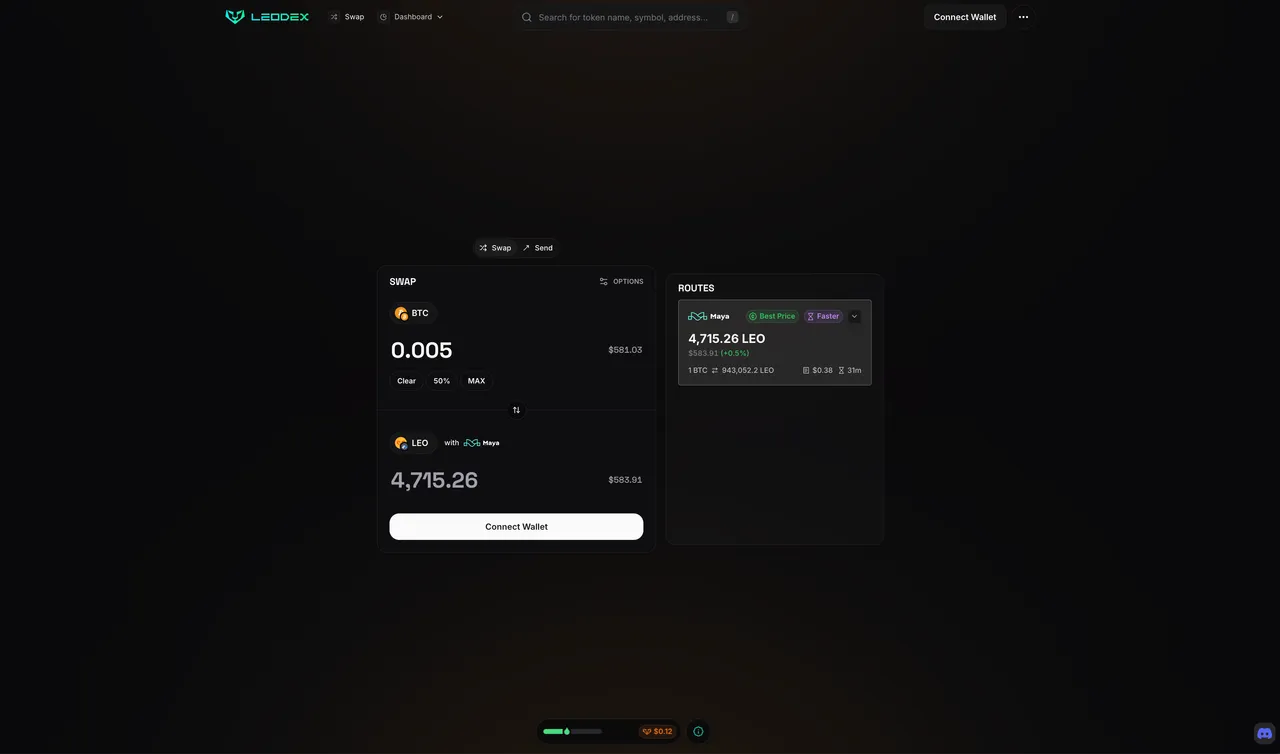

How to Trade LEO On LeoDex

You can trade any of the LEO pairs on LeoDex (LEO, bLEO, pLEO) but the LEO pair on Maya is by far the best. If you know how to trade on Cross-Chain, then you already know how to trade LEO.

1). Enter a Maya Protocol-Compatible Asset in the Input (BTC, ETH, USDT, RUNE, CACAO and dozens of others) and enter LEO (Arbitrum) in the output

For this swap, I entered CACAO in the input and LEO (Arbitrum) in the output.

2). Enter Amount and Click "Swap"

I entered 500 CACAO, selected Maya Protocol as the route and hit "Swap" and "Confirm Swap". Then in just a few seconds, my CACAO was swapped to LEO.

That's it! You now have native Arbitrum LEO.

What Can I Do With LEO?

LEO has a lot of utilities. You can stake it and earn USDC (USDC rewards begin on September 23rd) from 100% of LeoDex Affiliate Fee Revenue. Alternatively, you can stake it on our INLEO Social Media platform and use it to "power up" and increase your social influence.

The INLEO social media platform we've built allows users to create content directly onchain and tokenize that content to earn LEO rewards. LEO is paid via platform buybacks. The INLEO platform buys back the LEO token via INLEO Premium Revenue, Creator Subscriptions Revenue, Ads Revenue, Beneficiaries revenue and more.

For most users who want the passive approach, staking LEO on LeoDex to earn USDC rewards each day is the best approach. To stake on LeoDex, just click the LEO tab in the menu and click "Stake".

There are 0 fees and no lockup time on LeoDex-staked LEO. You'll receive sLEO tokens while you have your LEO staked and earn daily USDC Payouts starting September 23rd.

From now until September 23rd, Protocol Owned LEO (POL) is purchasing LEO off the open market using 100% of LeoDex Affiliate Fees. This is to create a permanent-staked fund of LEO that fairly earns USDC alongside all other stakers. This USDC then autocompounds into LEO. The POL can be transparently tracked in real time on the LEO Staking Page toward the bottom.

Ready to Trade LEO?

Head over to LeoDex and trade LEO with Streaming Swaps and native assets via Maya Protocol!

Got questions? Drop a comment or tag us on X.