Lions,

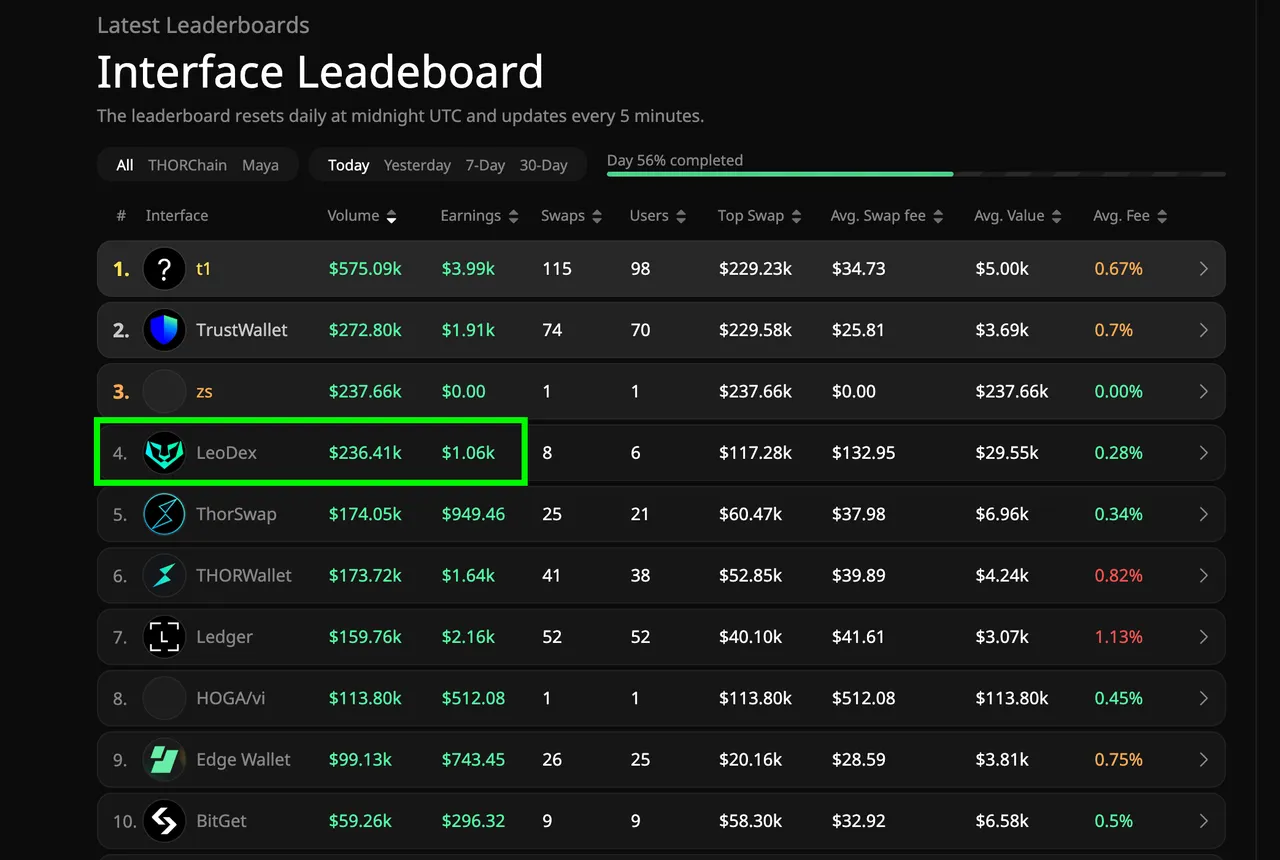

LeoDex has been climbing the rankings of cross-chain interfaces. In the screenshot above, you'll see our position today as the 4th largest interface for THORChain and Maya Protocol based on volume in the last 24 hours.

The battle is far from over. We continue to innovate new features and rapidly improve the interface we are building at https://leodex.io.

We started this journey around April of this year. Most of these other interfaces have a multi-year head start in building their technology. Through relentless innovation and iteration - the LEO way - we have climbed the rankings and done over $1M in volume the past 30 days. This volume is growing exponentially week-over-week.

The entire focus of our team and community is on growing these volumes. If you want to be a part of this and earn rewards that are vastly greater than anywhere else you can earn rewards, here's how.

How to Earn More Rewards

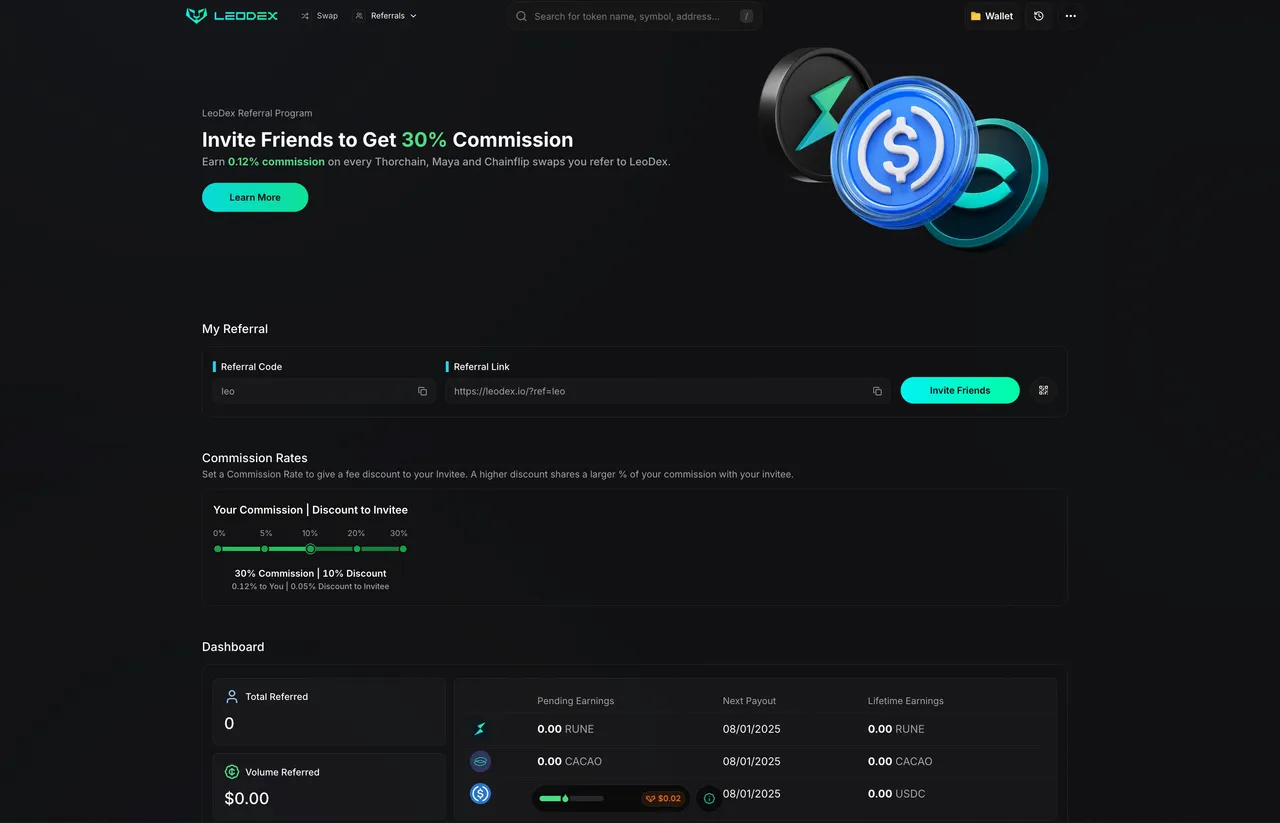

You can earn rewards by helping us grow LeoDex in a very simple way. Go to https://leodex.io/referrals, connect a wallet and generate a unique Referral ID.

Then, share this ID (or link) with the world in your posts on Hive, Reddit, LinkedIn, X, etc. etc.

Share your referral link and earn rewards. 1/3rd of all LeoDex affiliate rewards are paid to the user who referred the swapper. This means that if you refer $1k in swap revenue to LeoDex, you get to keep over $300 of it.

If you are a LEO holder, growing LeoDex should be your #1 priority.

What Happens to LeoDex Affiliate Fees?

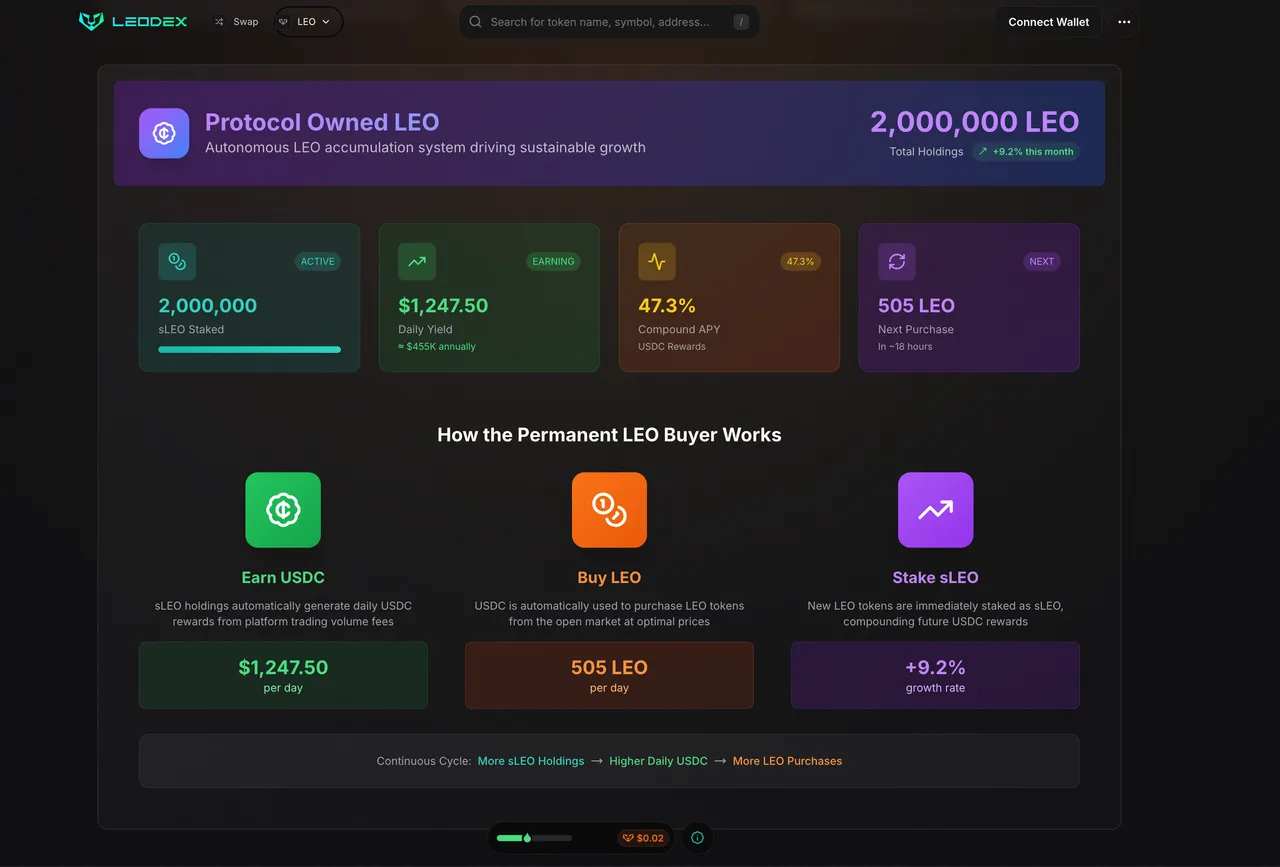

For the first 90 days of LEO 2.0 (June 25th ~ September 25th), 100% of LeoDex affiliate fees buyback LEO into the POL Vault Address. You can learn more about that in this blog post.

Today alone, over $1,000 was earned by LeoDex. At current prices this is about 35,000 LEO that will get purchased off the market and deposited into the POL Vault Address where it can never be sold.

ICYMI, this how POL works:

placeholder data.

The POL is getting LEO from the buybacks for the first 90 days of LEO 2.0. Then it is staking it for sLEO. It earns USDC (starting in September) alongside all other stakers. 100% of its earnings buyback more LEO and stake it for more sLEO. Creating a flywheel effect where the POL is a permanent buyer of LEO in perpetuity - absorbing a material percentage of the supply off the market forever and increasing the market cap of LEO.

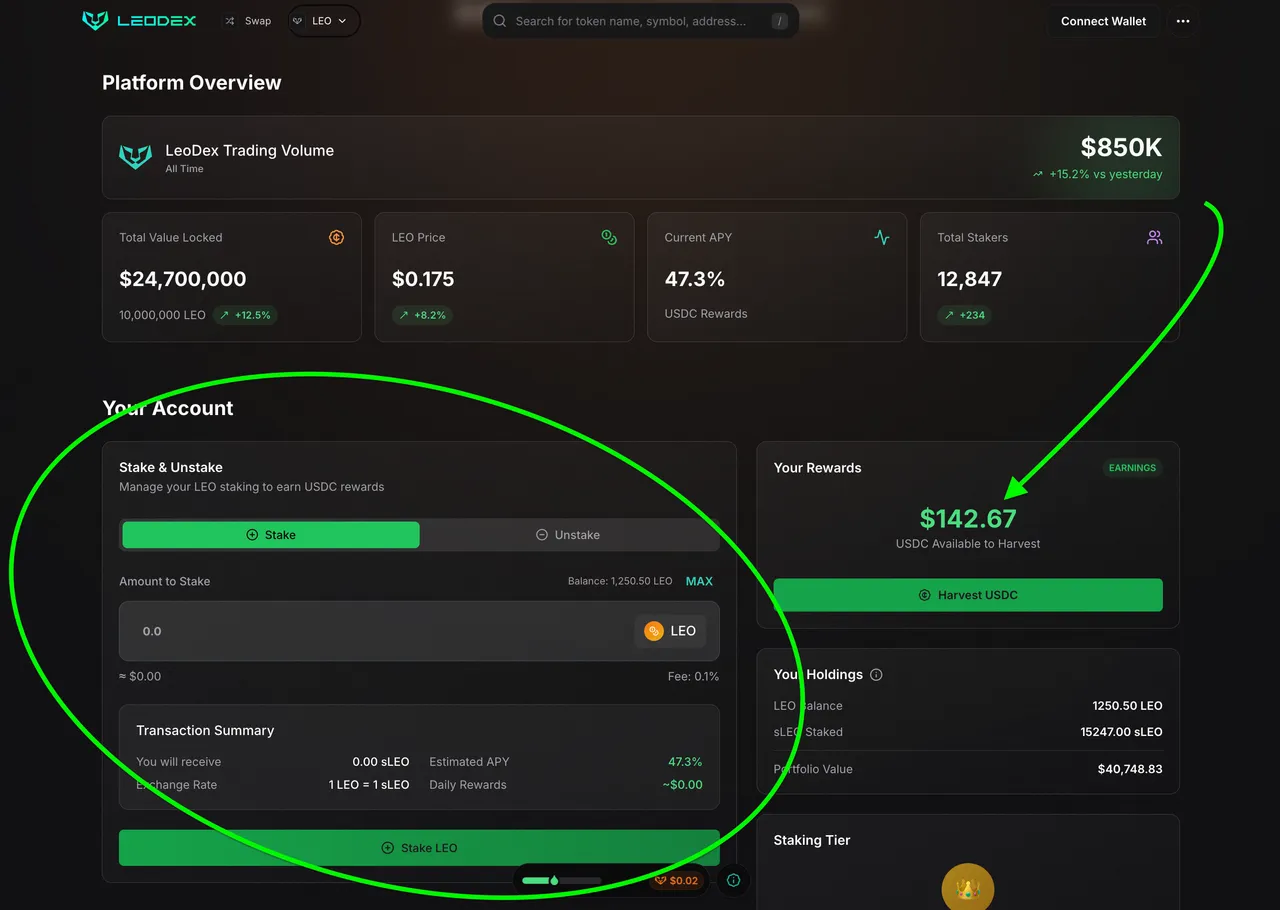

Stake LEO to Earn USDC Each Day

placeholder data.

After the buyback phase ends in September, 100% of affiliate fees will automatically flow into the staking contract on Arbitrum.

Anyone who stakes LEO as sLEO on https://leodex.io/leo (when the staking page goes live) will earn USDC starting in September.

Daily USDC rewards are paid directly from the LeoDex affiliate fees as they are autonomously sent to the sLEO contract on Arbitrum.

Utility and Flywheel

The utility of buying and staking LEO on Arbitrum is clear. The flywheel of the POL vault accumulating more LEO is clear.

The lead domino? More LeoDex volumes. As you can see, we're climbing the ranks to become a top interface for THORChain and Maya Protocol. We're also integrating more protocols and aiming to grow within those communities as well. We already have:

- THORChain

- Maya Protocol

- ChainFlip

- Rango

- Relay

And soon, we are adding Near Intents and other protocols that emerge and gain traction.

The future is bright, we will relentlessly build the best cross-chain DEX UI on the planet.