The LSTR initial sale is now 50% sold out. The demand to buy LSTR has really heated up in the past 48 hours. We're seeing a lot of buyers and a handful of whales stepping up to buy LSTR and sell out the initial sale.

With only 50,000 LSTR left for grabs and the demand climbing this fast, LSTR will be sold out in less than 5 days at this pace.

When the initial sale is sold out, LSTR will launch an LSTR:LEO liquidity pool. This pool will be priced at the current 1:1 mNav price of LSTR.

In simple terms, this means that LSTR will be priced fairly at a $1 for $1 valuation of our LEO holdings which back the fund value of LSTR.

For example, if we hold $200,000 worth of LEO when the LSTR initial sale is sold out, then LSTR will be priced at $2.00.

Why Has Buy Demand Heated Up?

There are a lot of contributing factors. For one, the mNav value of LSTR's holdings have reached nearly $1.5.

This means that LSTR is trading close to a 50% discount to book value of the LEO holdings that back the value of LSTR.

This discount only exists because of the Initial Sale. Once this is sold out, that discount will be gone.

What will follow is the LSTR:LEO pool which will create a market dynamic for LSTR. People will likely value us based on the LEO we hold at that point.

LPS aka LEO Per Share

We had a meeting yesterday and Khal suggested we create a new metric to value the LeoStrategy fund: LPS.

LPS or LEO Per Share tracks the revenue that LeoStrategy generated in LEO terms.

For example, if 100,000 LSTR shares exist and we generate 10,000 LEO per month in revenue, then our LPS would be 0.10.

Tracking this metric over time will allow us to create some cool analytics around fund performance.

If you have any feedback on this LPS metric and potentially other metrics, drop them below.

The Point of LeoStrategy

The point of LeoStrategy is to follow the ideas of Microstrategy and others but to do them for LEO instead of BTC.

What we're building here is a fund that buys LEO permanently (we never sell our LEO. Physically cannot sell it).

We also generate revenue in any way possible and use the business revenue to buyback and stake more LEO which earns USDC on LeoDex. This USDC will buy more LEO and autocompound it into the fund.

The entire goal of LeoStrategy is to raise our LPS. We are accreting value to LSTR stakeholders simply by acquiring as much LEO as possible over a long period of time.

LeoStrategy is nearing 1M LEO accumulated. By the time our initial sale is over, we aim to have ~1.5M - 2M LEO accumulated.

100% of this LEO will get staked for sLEO on LeoDex and start earning USDC on September 23rd. 100% of the USDC we earn will autocompound for more LEO.

We will also launch our first revenue-generating service this week. This will generate LPS (LEO Revenue per share of LSTR) and raise the fund value.

We have about 5-10 ideas right now of different services to build that generate LPS.

Everything we do will simply raise the LEO per share of LSTR and permanently stake all the LEO we hold as sLEO to earn USDC and autocompound - this not only further increases the LEO Per Share of LSTR, it also helps the value of LEO as it creates permanent buyback pressure (a perpetual buyer).

Our goal in the long run is to own north of 10M LEO. This would make us the largest holder of LEO but it would also mean that LEO is permanently staked in the sLEO staking contract and earning USDC every day to buyback more LEO.

LeoStrategy can never sell its LEO. So this 10M LEO would be effectively removed from future sell pressure.

Last Call for the Initial Sale!

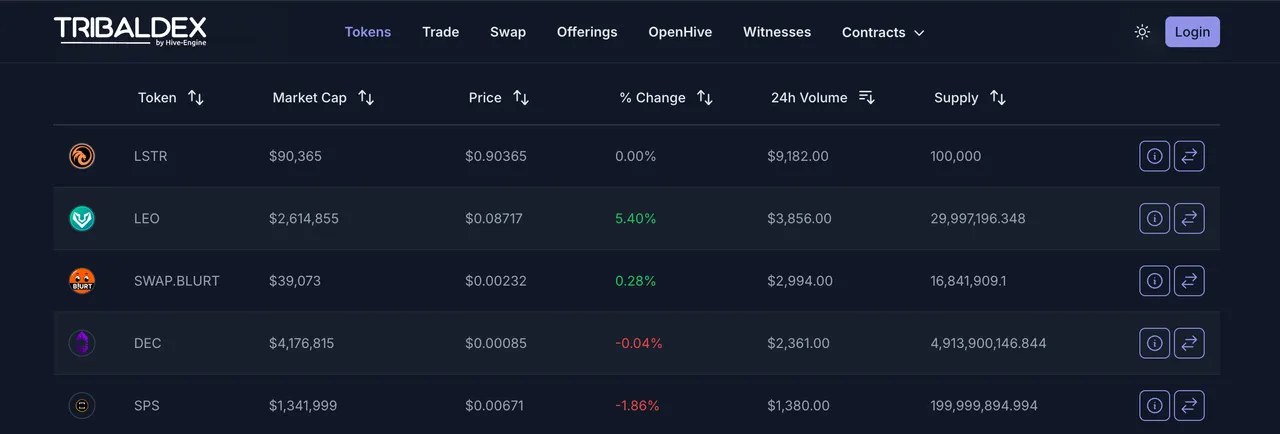

The whales have caught on and we believe LSTR will be sold out in 5 days or less. Check the pace of selling on Hive-Engine - more than $10k per day of LSTR is now being sold. One the initial sale is over, the price of LSTR will likely be 2x higher on Day 1 in the LSTR:LEO liquidity pool.