LeoStrategy is a permanent capital vehicle (PCV) that is built to acquire LEO and permanently hodl it. We operate with a multi-sig treasury wallet and the mandate of our fund is that we cannot sell LEO. We have several team members who hold a piece of this key and we are committed to never breaking our mandate.

The LSTR initial sale of 100,000 tokens was outlined in our first blog post. This initial sale was designed to create a permanent capital base of ~$100,000 to purchase LEO token on the open market.

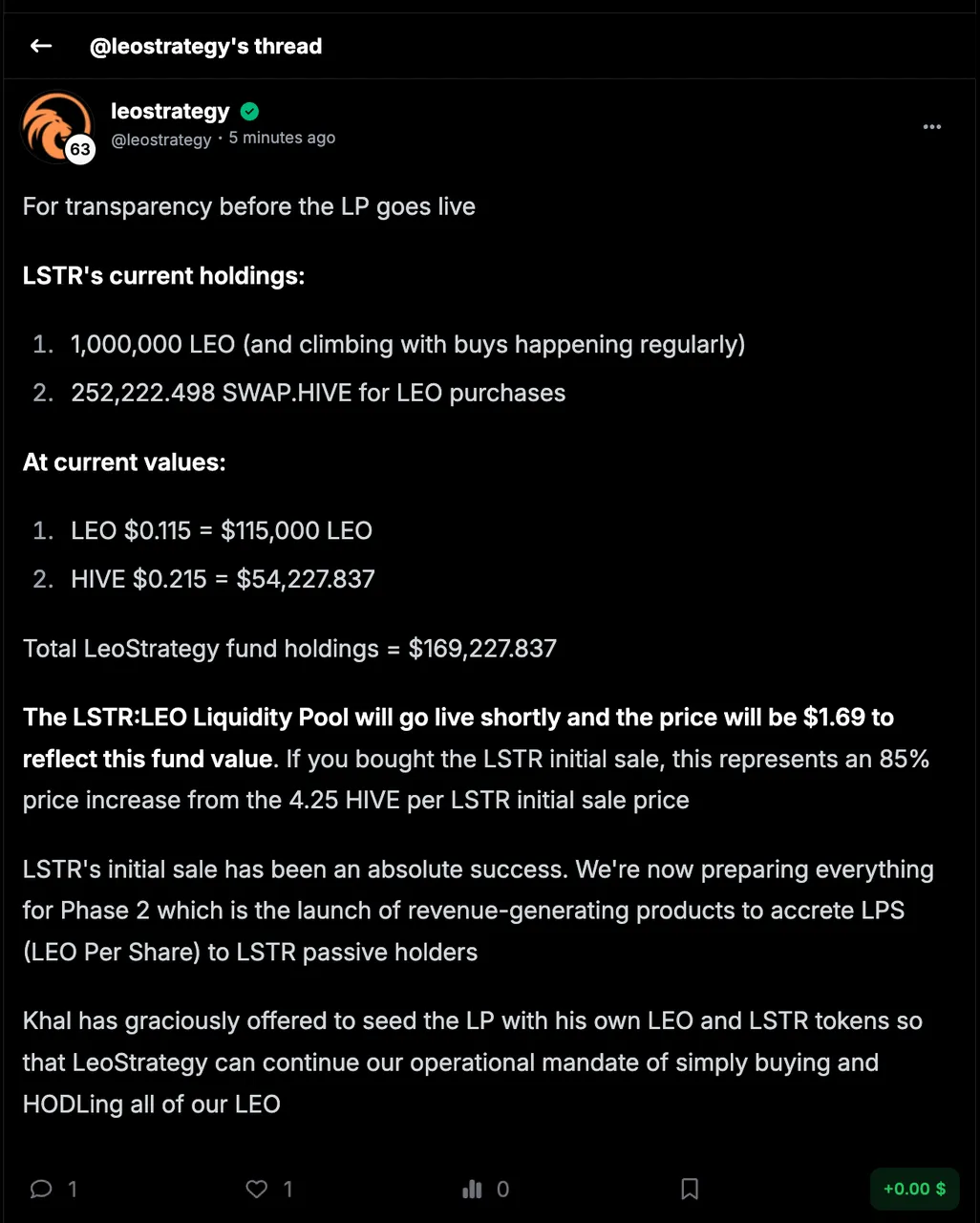

These initial purchases have been going marvelously. LeoStrategy now holds over 1,000,000 LEO and we still have over 150,000 HIVE left to purchase more LEO in the coming days/weeks. Some have asked about our buying habits and we purposely do not give the exact playbook as this would lead to frontrunning. We report on buys after the fact via INLEO Threads. If you want to read about our purchases, please keep your eyes out for our Threads on INLEO which report on the price, amount, date, etc.

LSTR:LEO Pool | What Comes Next

A few minutes after this post goes live, the LSTR:LEO pool will go live. Khal - our chairman - has graciously offered to seed the pool with his own LSTR:LEO holdings that he purchased off the market.

This initial seed will be $5,000. As a LeoStrategy team, we will evaluate market conditions and see if this LP should be raised over time. The goal here is that LSTR entrants and exitoooors have the liquidity they need to get in and out of the fund. Khal has offered to seed the pool up to $10,000 but we will start with $5,000 and evaluate raising it after the pool goes live.

Remember: LSTR is a permanent capital vehicle. The LEO held by LeoStrategy backs the funds value but to enter or exit the fund, you have to buy/sell LSTR on the open market.

With the rising LEO price, LSTR already holds 1,000,000+ LEO (and climbing fast). LEO's price rise has resulted in the current fund valuing at $169,000+.

The initial sale was for 100,000 LSTR at 4.25 HIVE per LSTR. This was intended to be $100,000 in starting capital however HIVE dropped a lot in price. The resulting raise was ~$91,000.

This means that the fund's value is already up over 80%. Anyone who bought the initial sale bought LSTR at a highly discounted rate and will have a nice profit once the LP goes live.

mNav

mNav stands for market cap to net asset value.

In simpler terms: you take the market cap of outstanding LSTR shares (there are 100,000 shares * $1.69 starting price for the LP = $169,000 market cap) and you take the value of the LEO we hodl ($169,000 between LEO already purchased and HIVE waiting to purchase more LEO) and you calculate the difference of them.

For the launch of the LP, we are 100% fairly pricing LSTR. This means that it is 1:1 with the USD value of our fund.

If LSTR trades underneath $1.69, then it is trading at a discount. If it trades over $1.69, then it is trading at a premium.

Keep this in mind as the LP goes live.

Also bear in mind the mNav changes based on market dynamics. If LEO 2x's in price from here, then our fund holdings 2x which means that (all-else being equal), the fair value of LSTR is the USD value of our current LEO holdings - which increase based on buybacks, capital raises and revenue-generating products.

First LSTR Product/Service Launch

LeoStrategy's first service will go live this week. This service is for LEO POWER holders and gives them a way to earn both LEO and LSTR in a passive income way. LeoStrategy takes a modest management fee for operating this service.

We're currently building this service and it should be live by the end of this week. This will be our first autonomous revenue-generating service.

It also gives utility to LSTR holders who will be able to command the service directly on threads in a stake-weighted manner directly tied to your LSTR Holdings. We're so excited for this unveil!