Hello @LeoFinance friends, as I have mentioned before in the world of cryptocurrency trading, one of the insecurities that users face every day, is precisely how to capitalize or rather how to make more profits in the volatile cycles that are experiencing a particular market.

In this sense, one way to reduce the insecurities that traders face on a daily basis is to include in their strategies technical indicators that measure or project market volatility, in order to be able to find signals that give a more precise orientation that allows them to take a much more efficient position.

Therefore, indicators that project market volatility are essential technical analysis tools that allow us to set take profit or stop loss levels, hence, in this post we will focus on socializing key aspects of the Average True Range Indicator (ATR).

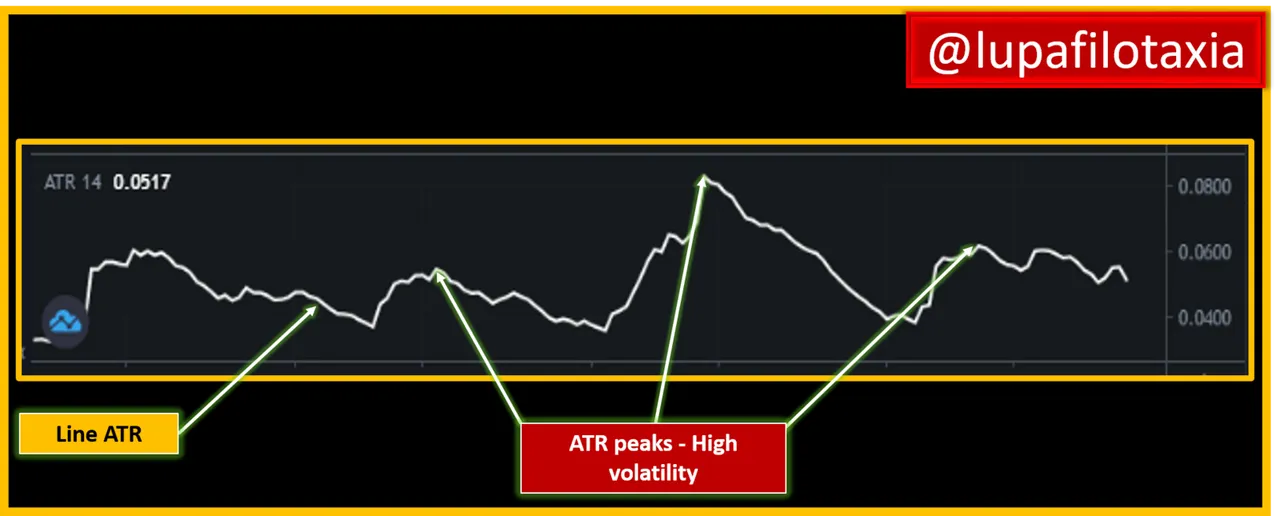

The Average True Range Indicator or ATR is an oscillator, which means that it moves in waves and peaks. However, the ATR, unlike the rest of the oscillators, has the particularity of projecting the volatility of the market in the price movement.

A point to note is that the ATR as the price action makes larger or smaller movements either up or down, the average true range indicator becomes larger or smaller, an action that reveals the volatility of the financial instrument.

Theoretically, it is assumed that the average of a financial instrument is directly proportional to its volatility, therefore, if the volatility of a stock increases, the ATR indicator serves as a guide to determine that the stock is entering a trend, and on the contrary, if the average of the true range slows down, it indicates a change in trend.

Formula to determine the ATR

The following formula is used to determine the ATR:

Current ATR = ((previous ATR * 13) + current TR) / 14

How ATR is calculated

Now, in order to calculate the Average True Range Indicator (ATR), a series of averages must first be known, namely:

Current high - previous close

Current high - current low

Current low - previous close

Example of how to calculate the current ATR value

In this segment, I will exemplify how to determine the ATR by considering the following data:

Data:

Current high: 578

Current minimum: 570

Previous closing: 545

Solution:

Current high - previous close = 578 – 545

Current high - current low

= 578 - 570

Current low - previous close

= 570 - 545

Result:

Current high - previous close = 33

Current high - current low

= 8

Current low - previous close = 25

☑ Current ATR = ((33 * 13) + 8) / 14 = 31,21

In the next post I will share with you all some trading strategies using the ATR indicator, and how we can take entry and exit points by incorporating other indicators that decrease the noise on the chart and increase our probabilities of hits.

SOURCES CONSULTED

Cory Mitchell How Average True Range (ATR) Can Improve Your Trading. Link

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating image: TradingView