The goal of investment advisors and brokers is to never get you to take your money and run. They always want to keep your money in the casino so it recirculates. That’s how they get paid. Every time there’s a transaction, they get a vig. One of the most iconic investment movie quotes of all time is Alec Baldwin in Glengarry, Glen Ross… “Always Be Closing!”. This applies in sales as well as investment. You don’t make a profit until you realize that profit. That means a sale or a purchase of something else. Which also means you should never enter an investment without some concept of where you’re going to take profit or get out of dodge if everything heads south.

Not Too Many Buying Signals

Looking across a lot of the markets, there aren’t very many buying signals. However, I do see A LOT of selling signals and potential reversals. This means the overall demand within the market is beginning to wane. As I walk through the usual suspects, you’ll see what I’m talking about.

Bitcoin (BTC)

The weekly chart remains in a downtrend being pulled toward a longer term trendline back towards $23,000. Will it get there? It would require a complete reversal in policy on the part of the Federal Reserve in my opinion. There would be a huge surge if the Fed said their inflation target needs to be higher because inflation is so sticky. But that’s not going to happen. Jerome Powell will continue to be restrictive until the economy breaks. That isn’t a good sign for risk assets that are affected by inflation, like Bitcoin, Gold and Silver. The daily chart is showing a slight uptick but until the near-term downward trend line is broken and held, Bitcoin looks like it continues to fall. If you’re stacking, keep doing so but maybe lighten up a bit on each purchase for right now.

Ethereum (ETH)

Same song, different singer. This has been a big gripe of mine for a long time. BTC and ETH trade in tandem a lot of the time (meaning they mirror each other). If the crypto ecosystem is so diverse and the use cases so different, why would these two majors trade identically? The answer is that there is still Wall Street money invovled to a high degree as far as the day to day is concerned. Especially after the ETF’s for these crypto’s hit the street. ETH looks to be headed lower like BTC. If you’re stacking, you might want to lighten up on the purchases.

Monero (XMR)

Monero’s chart appears to be less messy than the larger coins. It’s entirely possible this is because of the lack of Wall Street involvement and ETF’s tracking the moves. The trend continues lower but I wouldn’t make many changes if you’re stacking XMR. Slow and steady wins the race here. Short-term traders may want to book profits with the pop from the last couple days. But longer term, this is still a downward facing chart and any purchases should be small and structured into the future.

Pirate Chain (ARRR)

ARRR has been in a downtrend ever since its’ launch. As a privacy coin, it has taken a back seat in attention to XMR. I do think this will change over time however. The anonymity and encryption offered by ARRR is superior to XMR. This may win out over the long term as a commonly used privacy coin for daily transactions. Keep stacking this one in a structured manner. There is some possibility of a bottom forming on the weekly. However, the recent low price will need to see a bounce and then a retest of that price before we know for sure.

HIVE

Hive actually looks like it’s forming a bottom. Recent lows of $0.25 are being rested right now. If they hold, this could be a great entry point for a big purchase or to amp up your stacking purchases. I have been holding Hive Backed Dollars (HBD) which are their stable coin and I get 20% interest for staking. But recently I have been converting them back into Hive as the price falls. I’m keeping some of my HBD in reserve to keep some powder dry in case Hive heads lower again but I’m anticipating a move higher here in the near term.

Oil

Oil is marking time around $70 per barrel. This is similar to many commodities like Copper. There have been bounces off the lows but now a period of consolidation is happening because investors are trying to determine if inflation is dead and whether we’re headed into recession (which isn’t good for commodities unless its stagflation which would be the Fed’s nightmare scenario). Something else to keep in mind is that Oil is typically one of the last commodities to fall right before a major recession. Even if you’re not interested in investing in oil, watch where it goes. Oil is a huge indicator when the crash is nigh. As far as investing, I’m not a buyer here until more evidence is compiled.

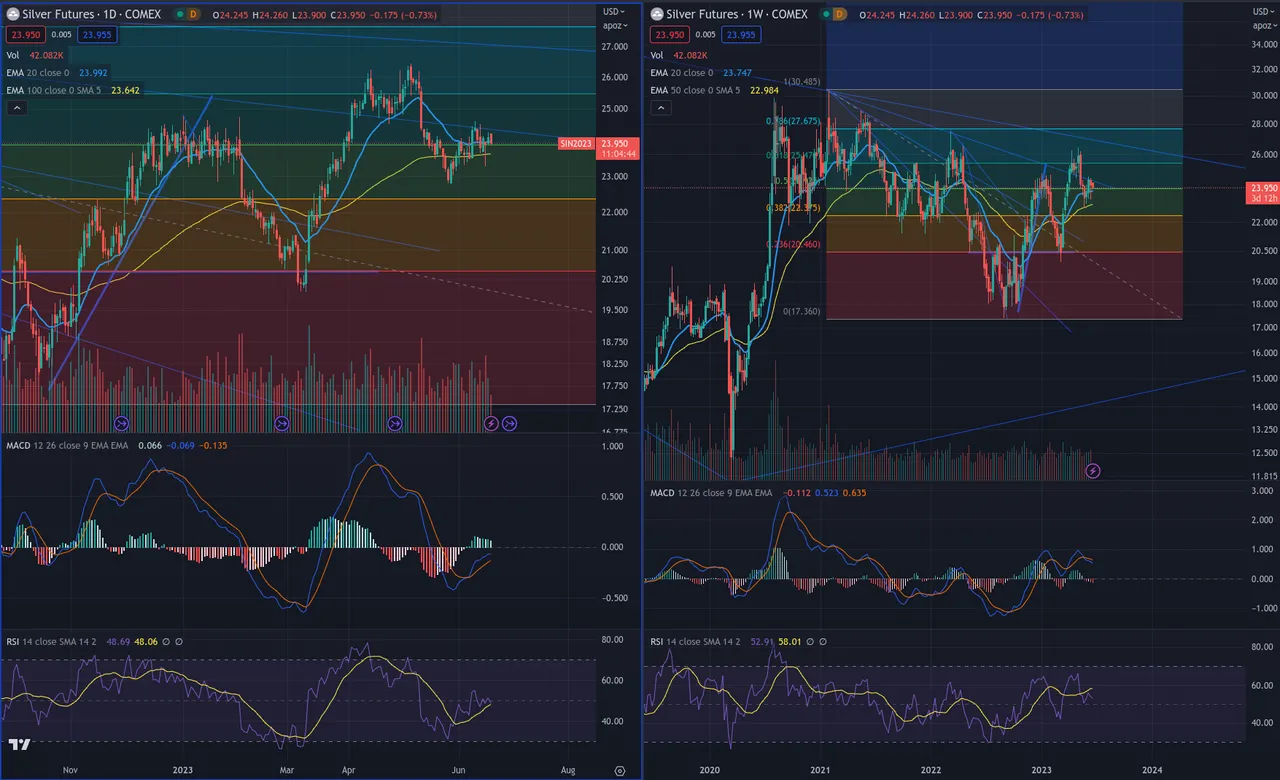

Gold & Silver

Gold has formed a triple top on the weekly chart. The relative strength with each successive top has been lower. This doesn’t bode well for Gold in the near to medium term. If Gold is to head higher it will need to continue to pull back to gain strength from buyers to challenge the all-time highs again. Gold and Silver will fall along with other commodities if the recession hit in the next couple months. Right now is a prime time to be trimming your gold holdings if you’re sitting on some sizeable gains. Perhaps rotate them into Hive or Dollars. Short-term US Treasuries via a money market fund (vomit) is also an option.

Silver is interesting here. It hasn’t performed exactly like Gold. The trend is similar but the pullback hasn’t been what I would’ve expected. This may change but Silver is holding up despite the potential for falling inflation and a recession. Silver performs magnificently during stagflation by the way. If you’re sitting on gains without having taken profit, no one ever went broke by taking a profit. If you’re just starting out, probably keep your stacking at the same level each purchase. Silver could break either way here and a lot depends on if we’re headed into stagflation or deep recession.

The Dog Days of Summer

Also keep in mind we’re headed into the dog days of summer. Asset prices tend to move slowly during this period and volumes of transactions shrink due to vacations and other dynamics in the market. Don’t get too hasty and chase moves. Stay the course.

How to Get Involved

The main newsletter will be free to all. Follow here on HIVE or sub at anarchistinvestor.substack.com to get the daily post in your email. In the coming months, I will begin building a paid offering that will provide a ‘model portfolio’.

Share this with friends and family that could make use of this info.

***Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation.