LSTR Exceed Expectations

LeoStrategy (LSTR) looks to be a permanent capital vehicle designed to accumulate and stake $LEO tokens and it is now in its final stretch of Phase 1.0. With fewer than 73,000 tokens remaining from its initial 100,000 LSTR offering, the fund has already surpassed expectations by holding over 1,000,000 LEO and gearing up for its next major step: Phase 2.0.

What’s happened and what’s all the fuss about? lets walk you through what’s next for LSTR holders, the value behind the token and why the upcoming liquidity pool and staking mechanics could unlock serious upside for early investors.

Phase 1 Recap

The initial LSTR sale was launched with a goal of raising USD $100,000 to buy LEO off the open market. Despite a dip in the HIVE price during the offering (LSTR was sold at 4.25 HIVE per token), LeoStrategy still managed to raise approximately USD 91,000 and put it to work acquiring LEO tokens.

As of today, LeoStrategy has acquired over 1 million LEO with more than 150,000 HIVE still earmarked to buy more. Purchases are reported transparently via INLEO Threads but with enough delay to prevent frontrunning. This smart approach has resulted in a rapidly growing LEO position and a surge in fund value which is now estimated at USD 169,000 an 80% increase from the initial raise.

Phase 2

Phase 2.0 has kicked off starting with the launch of the LSTR:LEO liquidity pool.

Here’s what you need to know:

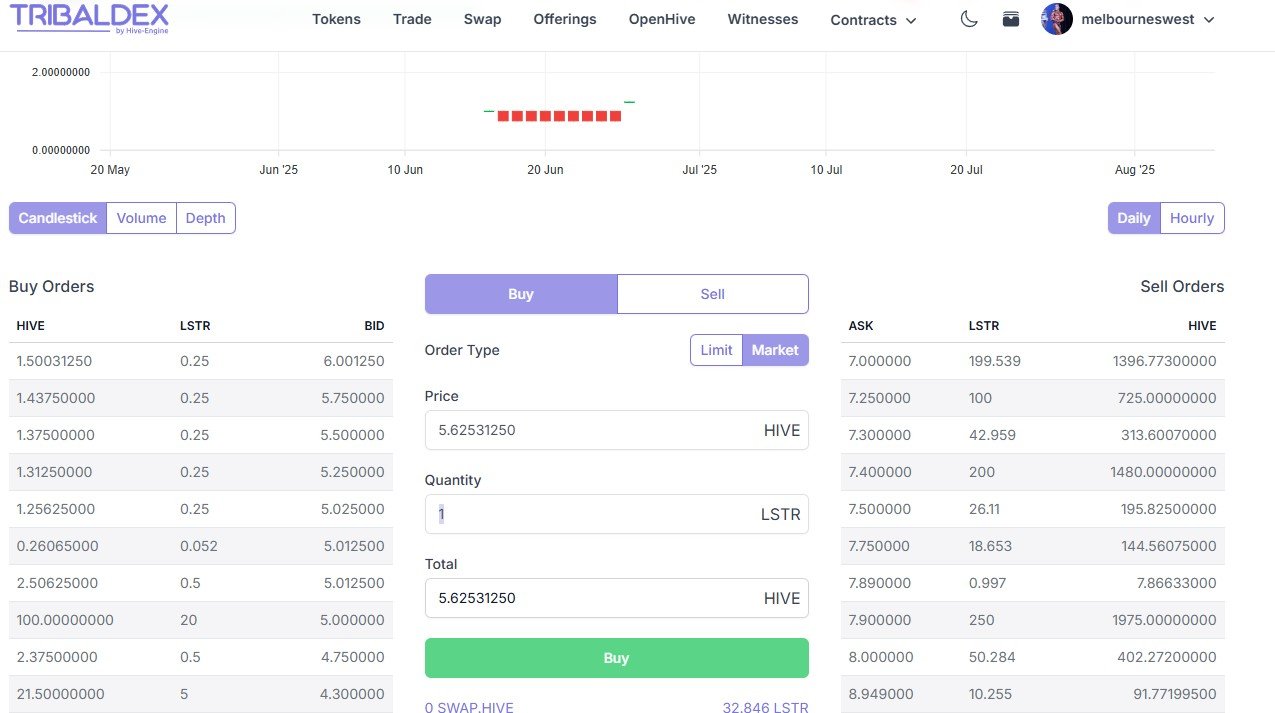

The LP will be seeded at a USD 1.69 LSTR valuation, fully backed by the net asset value (NAV) of the fund. Current buyers of LSTR are paying only USD 1.05– USD 1.10, meaning they stand to profit instantly once the LP goes live. This liquidity pool will be treasury owned, allowing LSTR to generate small but meaningful fee revenue that adds further value to holders.

To bootstrap the pool, Khal (LeoStrategy’s chairman) is personally seeding USD 5,000 worth of liquidity using his own LSTR and LEO holdings. If market demand proves strong, this may expand to USD 10,000.

Price Growth

The pool provides a market price and permissionless entry and exit for LSTR holders while preserving the fund’s core mission of permanently hodling LEO. LSTR’s long term value will increasingly derive from its participation in sLEO staking, which allows holders of native LEO on Arbitrum to earn USDC yield through the LeoDex.io platform.

This week, LeoStrategy began unwrapping its heLEO into native LEO to prepare for staking. The sLEO contract is live and staking begins September 23rd but LeoStrategy is getting in early to signal confidence and help bootstrap adoption.

100% of USDC rewards earned by LeoStrategy will be used to buy more LEO.

100% of that LEO will be staked again as sLEO, creating a compound loop of yield and accumulation.

The goal is to reach 1.5M LEO staked or 10% of LeoDex’s projected 15M LEO TVL.

At current yields (USD 400/day across all stakers), this would result in about USD 40 per day in USDC earnings for LSTR. This means the fund could be buying and staking 700 LEO per day, which would raise the LEO per-Share (LPS) of LSTR over time.

Continued Price Growth

As LeoStrategy continues to generate revenue it will convert all of it into LEO ownership. That means each LSTR token becomes worth more LEO every day and since LEO itself is rising in USD value the USD value of LSTR compounds even faster.

LeoStrategy is not a trading fund. It is a Permanent Capital Vehicle, locked via a multi-sig wallet with a public commitment never to sell LEO. Every dollar it generates is reinvested into LEO. Every LEO is staked. And every stake increases LSTR’s value.

What are your thoughts and have you jumped into LSTR?

image sources provided supplmented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.