Reactor Big Bang Event

Terra (Luna) Network is starting to advance and we are seeing a rapid expansion of projects and protocols being built and established on Terra (Luna) Network. But a core issue still plagues many current and emerging protocols and that's trading volume. Amongst other things incentivising governance participation has also been a challenge for many protocols.

Decentralised Finance (De-Fi) brings many solutions but also many unresolved problems and in its current form the main driver of De-Fi is liquidity pool (LP) farming. In which many people will join an initial pool to receive high yields and automatically sell those yields until there is no money left in the LP. Once it is completed then participants often jump to the next De-Fi project to farm their LP.

This also creates a race to the bottom with a divide in some people securing bonus funds while leaving many other investors high and dry and poses risks for the future of the sector.

The Reactor Plan

Reactor hopes to solve this by implementing a curve + Uniswap DEX that is native to Terra (Luna) Network and will onboard a range of different stable coins as well as a range of different trading pairs of established cryptocurrencies to encourage trading.

Reactor will also offer participants who are providing LP on Astroport increased farming rewards if they stake their LP on Reactor. But they're also providing a lot more than just rewards.

One Token to Vote on all Projects

Reactor wants to increase the participation in governance to ensure everyone is represented across multiple blockchain projects on the Terra (Luna) Network ecosystem. As such Reactor has come up with a unique model where Holders of their token RCT will be able to participate in multiple governance polls. This will be made possible as Reactor will be focusing on the governance aspect of blockchains by staking participants.

Reactor is also implementing a model that will reward participants for actively participating in governance and voting through rewarding them in RCT tokens.

Launch now live

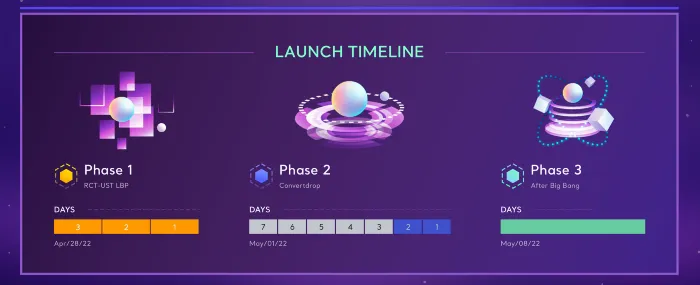

The protocol is now launching with 500,000 of RCT tokens being airdropped to ASTRO-UST LP, ASTRO stakers (xAstro holders), Astroport bLuna-Luna LP holders and ANC token stakers are eligible for the RCT airdrop. Visit Reactor to see if you qualify for the airdrop.

Airdrop will be allocated at the end of phase 2 once Liquidity pools are established.

At current Reactor is offering a fair launch where participants have the ability to purchase RCT tokens after the fair launch 30% of the funds will be allocated in an Astroport RCT-UST pool while the other 70% will be used to develop Reactors strategic fund.

Phase 2 will be open for 7 days with the ability to participate in Convertdrop within the 7 day period which will enable ASTRO, xASTRO, and ANC holders to convert their tokens into reASTRO and reANC and stake them with a locking period to earn early-stage convert rewards.

The tokens will be lockable with different lock periods, each lock period will have a single chance to withdraw in the first five days. from day 6 onwards, participants will only be able to withdraw up to 50% of their tokens. On day 7, each participant’s withdrawal allowance will fall linearly from 50% to 0% source.

LOCKDROP BOOST

Each lock period also has it's own boost allocated to it which is the increased yields you will receive in each lock period.

Phase 3 the protocol will be launched and users will be able to collect their airdrops and withdraw their unlocked rewards and any other claims from the previous phases.

Opinion

Reactor seems set on increasing governance from all protocols on Terra (Luna) Network in the hopes of building a more inclusive and active ecosystem. Given the problems arising with LP farming which often puts people off of staking tokens for governance purposes due to heavy financial losses, this could be a viable option.

In effect, Reactor is pooling everyone's funds together across all ecosystem and enabling a transparent and fair governance frame work. It is left to be seen if it will lift participation in governance but rewarding users for their participation in voting polls will likely see an increase so long as Reactor can maintain a healthy LP to enable those rewards to be cashed out.

Reactor has some really good ideas in solving some of De-Fi's problems and we look forward to seeing how the protocol manages to overcome and further develop their protocol.

Image sources provided supplemented with Canva Pro subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.