Image created with Canva Pro

Want discounted Ethereum or Luna? Then Kujira is for you!

A lesser known investment opportunity within the cryptosphere is that of liquidations on lent and borrowed assets. Once only available to bots Terra (Luna) Network has really advanced in this space to bring this opportunity to the masses.

At current there are a number of liquidation protocols in development such as White Whale and Lighthouse which are building UST pools that will enable people to buy into liquidations. But there is a protocol already on the market which appears to have teamed up with Anchor Protocol in recent months called Orca by Kujira.

What are Liquidations?

Before we progress onto what Orca is it is important to understand what it's use case is and in simple terms it's a liquidator of collateral. Just like in real life when someone has a loan they can not repay the lender will move in to claim whatever assets are of value to repay the debt.

Lending protocols in cryptocurrency are no different in this regard except where in purchasing a home or taking out a personal loan the assessment is based against your income and ability to repay. Crypto lending protocols require borrowers to provide an asset of value to secure their loan.

Borrowers also need to maintain a set Loan to Value Ratio (LTV) at all times which can be quite dangerous in the crypto space given the high volatility of the crypto market. In the event that your LTV ratio drops below your agreed upon position the protocol will automatically sell part of your collateral to ensure you meet the terms of your agreement. You still get to keep the borrowed asset.

The House Wins in the Real World

In the real world if you lose your income or your ability to repay the loan you may end up losing everything and the house comes in and takes the pot. But in Crypto you only lose the portion to cover your position while retaining the majority of your asset and the borrowed asset.

You ever hear about a bank not selling an entire home to cover a $20k debt if someone lost the ability to pay their loan? nope- you'll lose the lot and they tend to sell for under market value for a quick sale because all they are after is the remainder of the debt.

In crypto the house isn't selling your asset because there is no house it is just a protocol matching borrowers with lenders but it does need someone to buy assets to cover LTV. This was only ever really possible by using back ends which were often dominated by bots. But now Terra (Luna) Network is brining this feature to the people with Kujira's Orca protocol.

Orca Liquidations

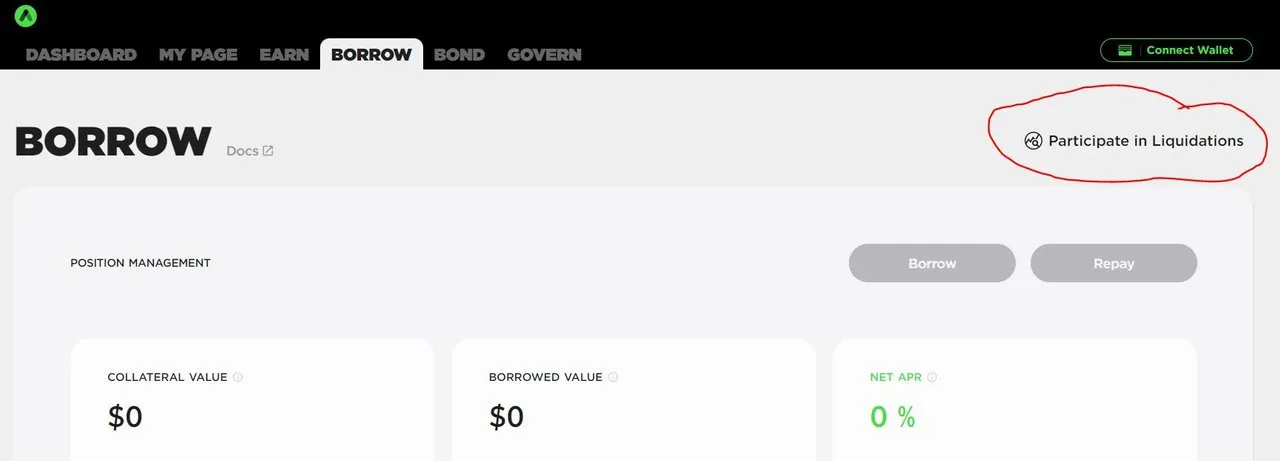

You may have noticed a new icon over at Anchor protocol that popped up a little while ago and clicking on it takes you to Orca which is a liquidation protocol that helps support the borrowing and lending of assets. One would think the borrower is the one that profits from a fault on the LTV but it is not. Where the lender will receive an APY for lending assets they won't get the chunk is a borrower faults, unless of course they jump across to Orca to participate in liquidations.

Kujira Orca

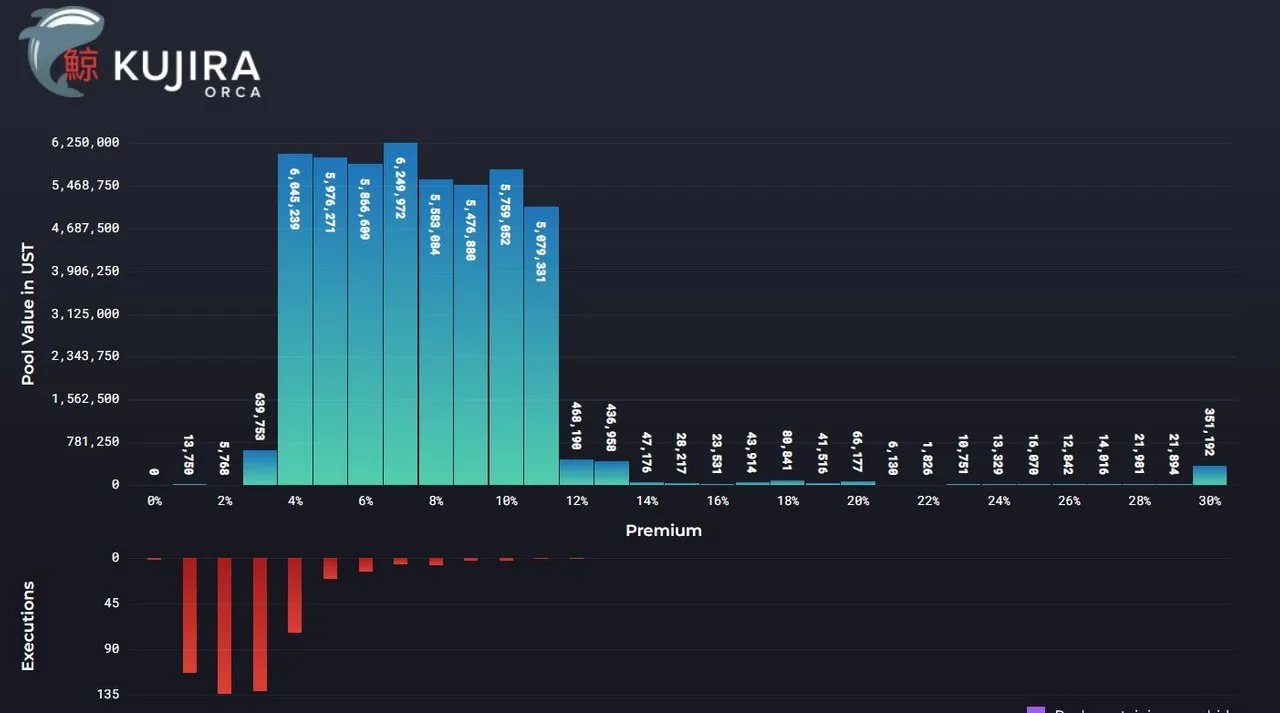

There isn't too much to this UI and it doesn't really need much which helps it being a simple to use dApp. In blue you have the pools and how many people are in them. Below in red is how many times those pools have been emptied i.e. liquidated.

Overall we get a quick overview that liquidations on Terra (Luna) Network aren't that bad with the majority taking place in the 1% - 4% range. There are a small handful of people dispersed across the graph and over at 30% is another small spike and none have occurred at the 45% range. This is why when I borrow money I borrow at the 45% range because chances of liquidation at that level are currently 0.

What Does it Mean?

In short those percentages are referred to as "premiums" or for simple terms a discount on Luna. A good example of how liquidations occur can be found on the Kujira website.

Bob has some LUNA. He mints $100 of bLUNA in Anchor and then deposits it. He’s eligible to borrow $60 of UST, which he may use however he likes.

Meanwhile, his buddy Ross has $100 UST, which he bids at 30% on ORCA.

Crypto is a volatile market and some FUD makes LUNA’s value slide. Bob’s $100 of bLUNA is now worth $95, and his loan is at risk.

ORCA leaps into action, and Ross’ bid comes into play. Bob’s loan is liquidated, and Ross receives the bLUNA at the premium he bid on.

The end result stands like this:

Anchor (the Lender) gets the $60 back they had loaned out by “selling” the bLUNA Bob bonded.

Bob has the $60 he borrowed, but the bLUNA is no longer his*.

Ross has $95 worth of bLUNA, which he paid $66.5 for. Ross still has $33.5 left in the ORCA contract should any other at risk liquidations pop up.

It sounds quite lucrative to be sitting in a 30% pool but to get to that all the premiums in front of you need to be met first and looking at the graph there is a lot to get through.

How to Bid

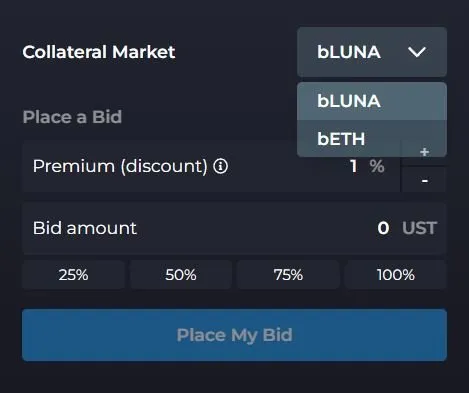

Entering the bidding process is easy as selecting the bAsset you want to big for the premium or discount you want and the amount of UST you want to spend. There are no maximum or minimum big amounts and you can put in as little or as much as you like.

I believe there is a que so if you join one of those larger pools you have a lot of waiting to do and as evidenced in the graph there appears to be a lot more moving to the front of the premium que. I'm not sure of the benefit of bidding less than 4% - 5% because in a down turn you could probably get a better deal just buying the asset from Terra Swap.

Claiming you won bids is as simple as clicking collect if you're fortunate enough to have successfully completed a big and had your bid matched.

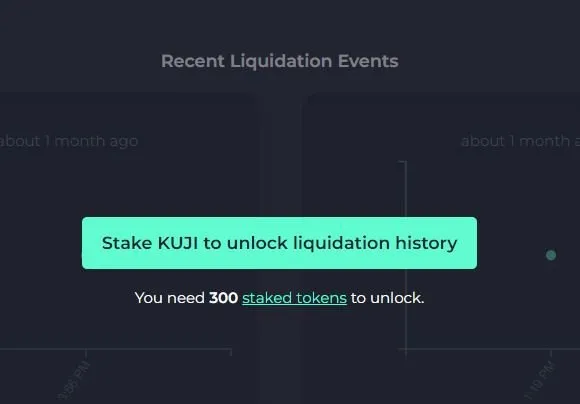

Refine your bidding with analytics

For those wanting an in-depth market overview and to be able to better plan their investment strategy like knowing times, dates, best bids etc Kujira does offer that but it will require purchasing and staking 300 of their tokens to receive the full breadth of analytics. This might be worth it for those wishing to know more and be able to better plan.

Kujira's Orca liquidation protocol definitely brings a new investment opportunity for many and one that is beneficial to all levels of investors those just starting out or those who have been around for a long time.

It adds an additional layer of fairness to decentralised finance and a deterrent to bots which can be costly and time consuming to maintain and develop. With more investors lining up to gain liquidations it also adds more competition and we can already see it's benefits in supporting the network with the brunt of liquidations undertaken between 1% - 4% which means borrowers are losing less of their collateral than having people hang out further down the line and take a larger chunk.

The disparity between 1% and 12% liquidation is even further indication of how successful it is with 1% being liquidated 113 times and 12% which is the highest liquidation to date only once. This data isn't just valuable to people wanting to liquidate assets but those who want to borrow funds and what limits are safe. 45% LTV seems to be a good position that safe guards against liquidation (not financial advice).

Image sources provided and supplemented by Canva Pro Subscription. This is not financial advise and readers are advised to undertake their own research or seek professional financial services