This is a end of the month report of real estate activity in the United States, specifically the state of Georgia. What we see in Georgia is typically what is occurring on a nationwide basis. Data is from the Georgia Multiple Listing Service.

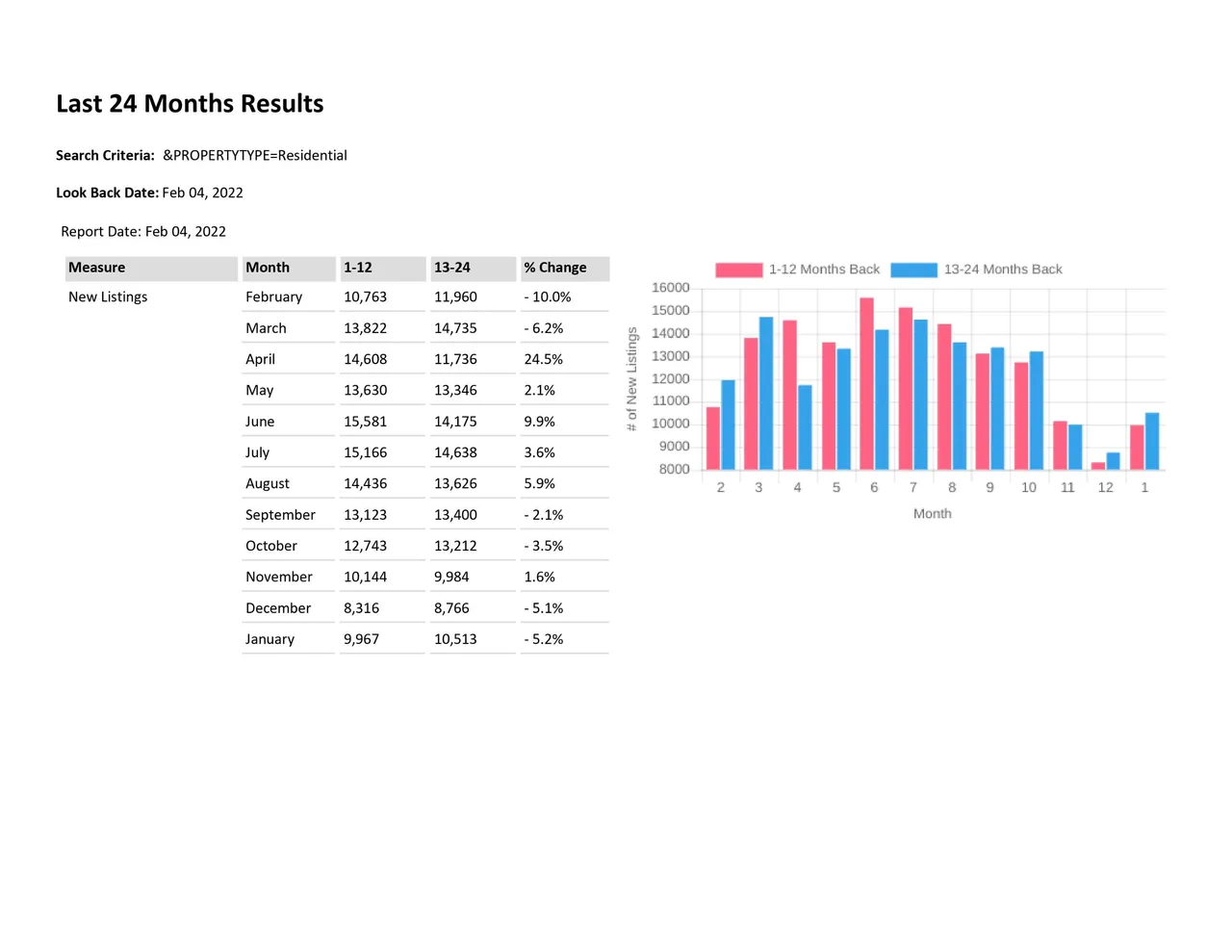

Observation 1: Listings are down

After peaking in June 2021 at 15,800 new listings per month, new listings are down to 9,967. In four of the last five months, new listings have declined. What does this mean? Inventory remains tight. New construction is not happening at a significant rate to increase the number of homes available for resale.

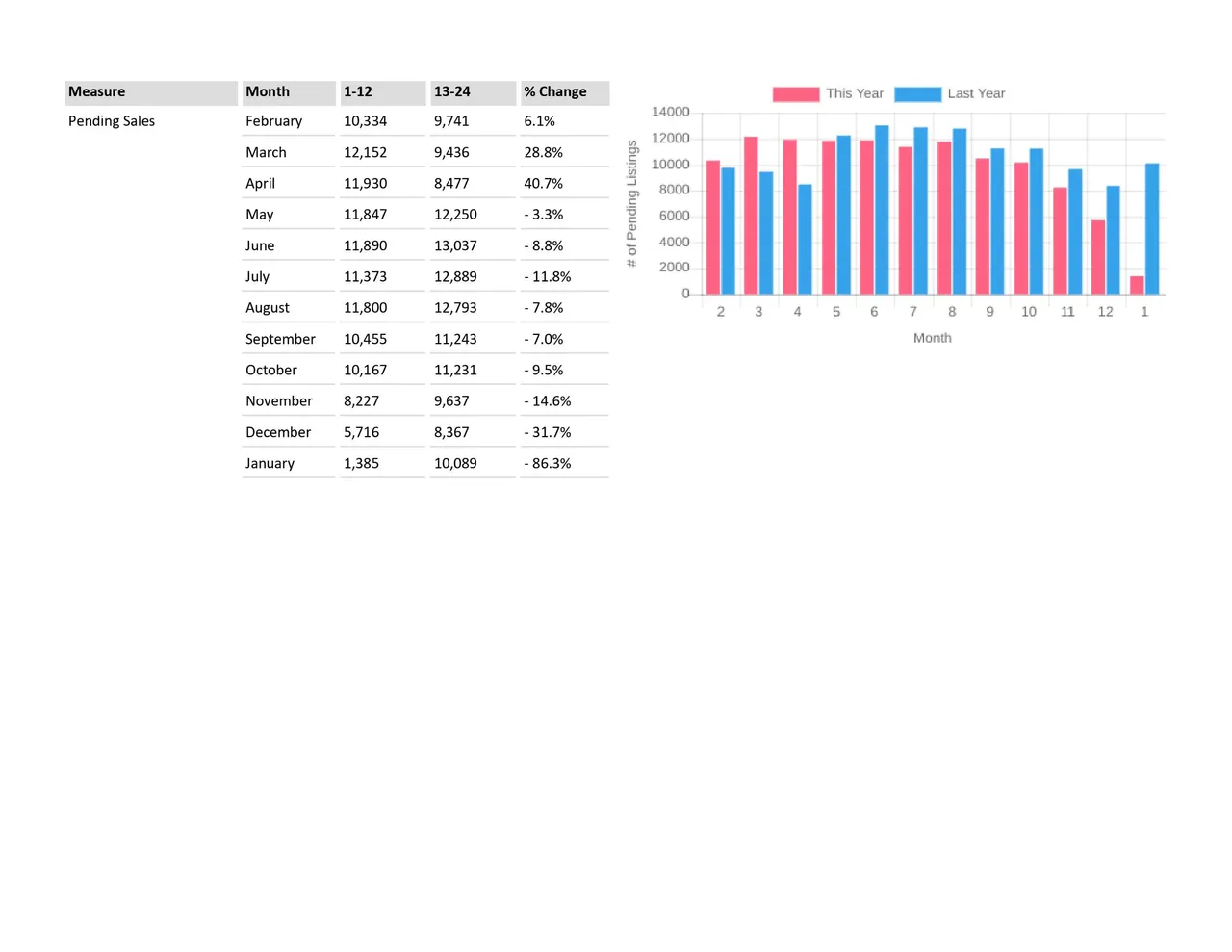

Observation 2: Pending Sales dropped off a cliff

There's an 86% decline in pending sales of January 2022 versus January 2021. And we saw something similar in December with a 32% decline. Fewer listings are reaching the market and the volume of sales is declining. The sales volume started dropping in April 2021.

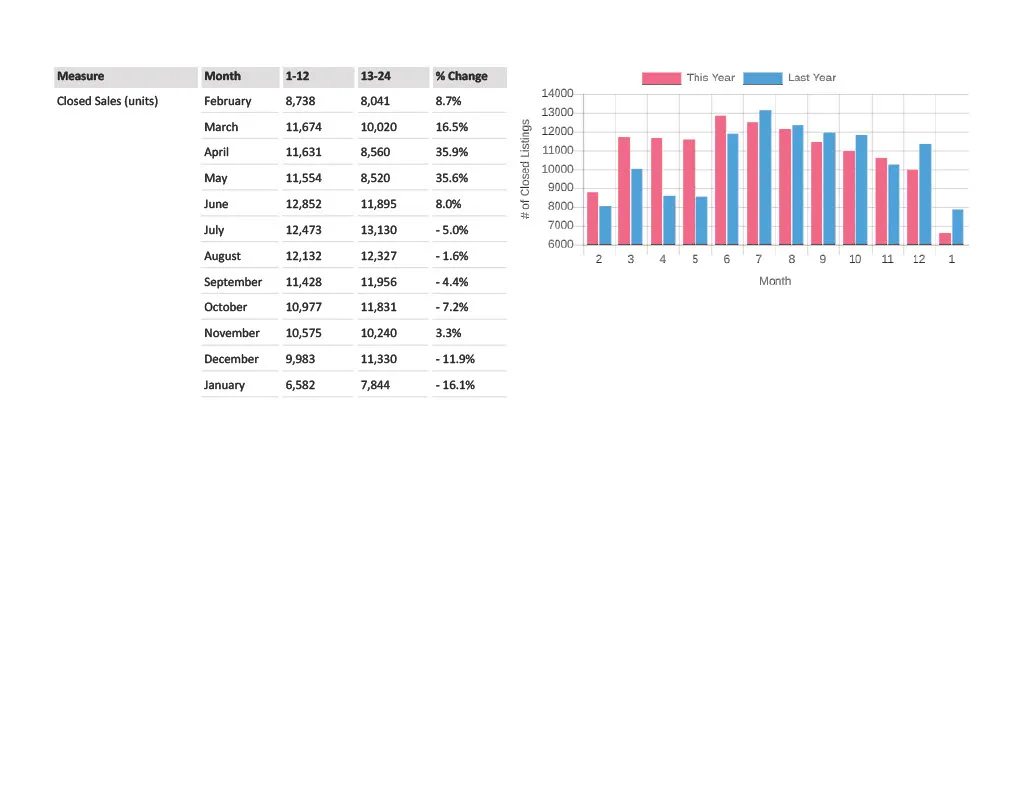

Observation 3: Closed Sales are declining as well

If new listings are down, and pending sales are down, what about the closed sales (homes actually sold in a month). Yep, that's on the decline as well. In fact, this trend has been going on since June 2021. January 2022 saw the biggest year to year decline with a 16% decrease when compared to January 2021.

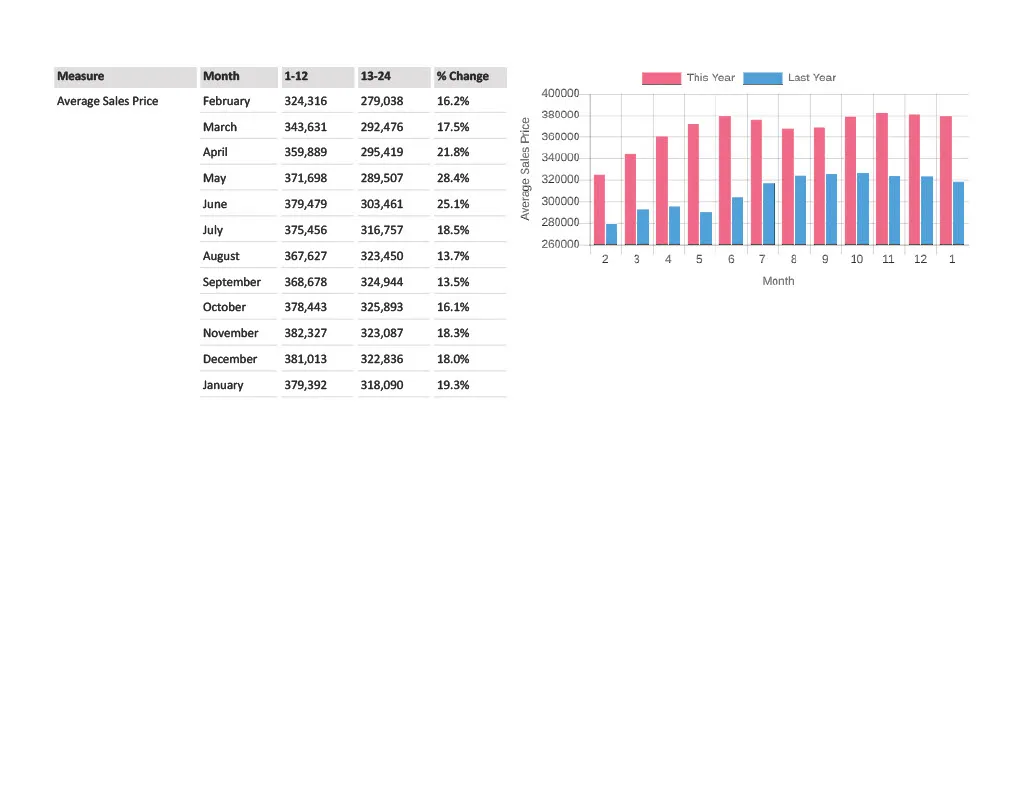

Observation 4: The average price of sold homes declined

At first glance, the average price of a home in Georgia looks good with year to year comparison for January up 19%. But, the peak of the home prices was in November 2022 at $382,327. Since peaking in November, the average price has slipped in Nov, Dec and Jan. One other important note, the average home price in February 2021 was $100,000 less than January 2022! What's this mean? The average is declining since the peak. The run-up has been huge in the last 12 months and would-be homeowner are being priced out of the market (see observation 2, pending sales are way down).

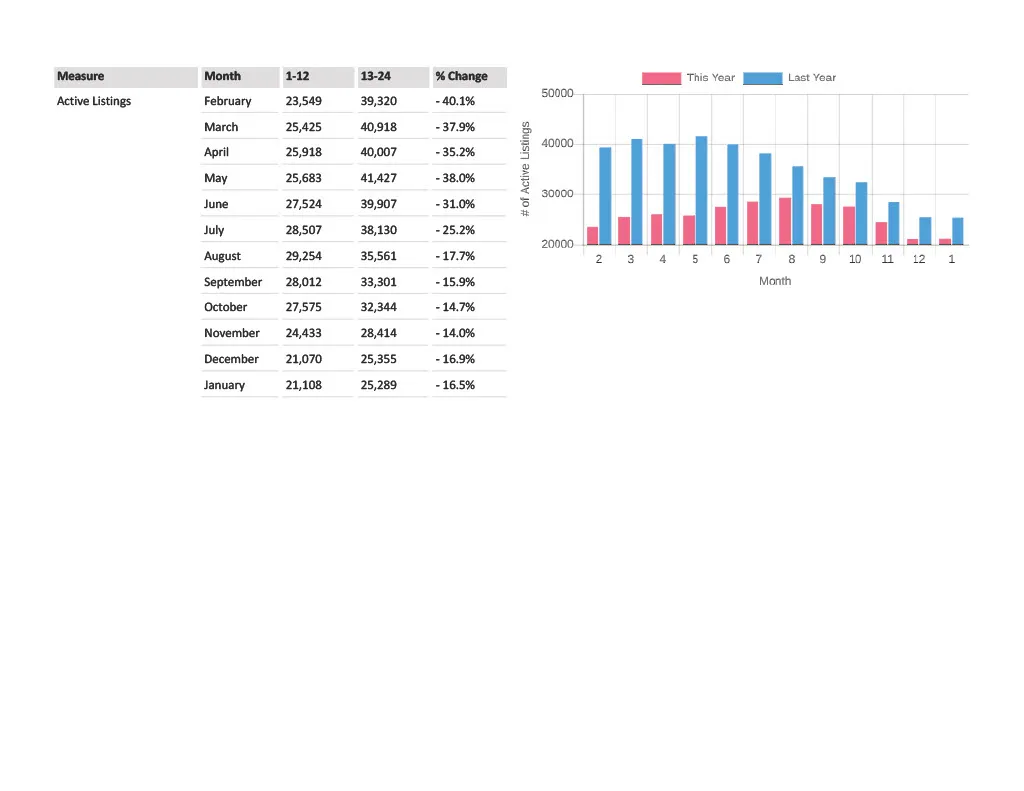

Observation 5: Active Listings are continuing to decline

So you ask, if there's fewer buyers and the average price has run-up 30% in a year, why can't I find a house? It's the number of active listings. Demand is still stronger than supply. There's almost 50% less active listings than in March a year ago. What comes on the market is still being soaked up quickly like a sponge. How long will this continue? Until new home construction reaches demand or until the average home price becomes more than what the buyer market can stand.

Opinions are all my own. Everyone always ask is housing headed for a crash? I think there will be a stagnation in 2022. Prices will drop a little. The available home inventory will start to build. The Fed will push mortgage rates higher, new construction will come onto the market. The nice thing about blockchain, I can check my post in a year and see! I don't see a crash yet, but we are probably past the pricing peak.

Charts are from Georgia Multiple Listing Service. All analysis is my own. Feel free to join Real Estate Investors on PeakD. We have a monthly market report and lots of good tips for real estate investors.