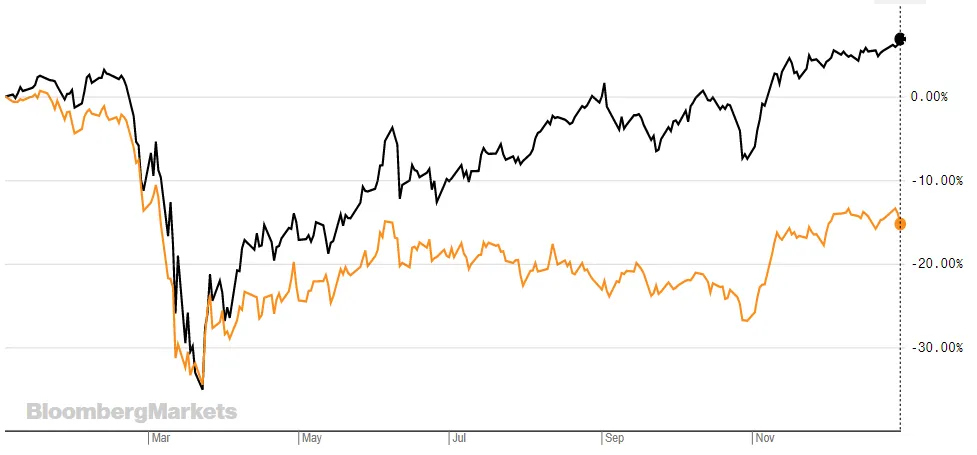

The FTSE100 is the Index of the UK's top shares by market capitalization and since the beginning of the pandemic, it's taken rather a battering!

According to Bloomberg, a drop of 15.24%. Anyone with any form of share portfolios, trusts and pensions has taken a hit. This sort of crash hasn't been seen since the massive financial crisis in the not too distant (for some of us!) 2007/8 when it dumped by over 30%.

Source

What's interesting though is the Dow Jones (in black) is actually up by a fraction over 6% in the same one-year time-scale.

I'm sure that could be explained by a proper economist but I'd suggest the US has a much stronger and resilient manufacturing base than the UK which is grossly over-dependent on service industries and also the uncertainty around Brexit.

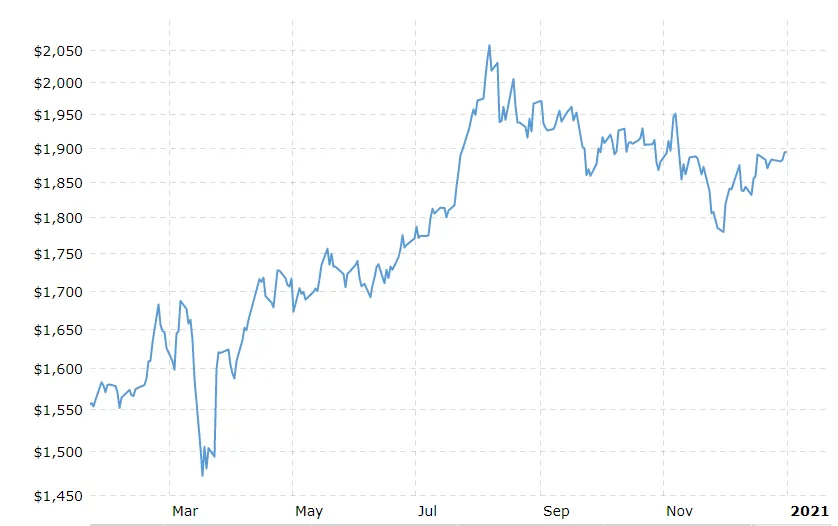

Let's take a look at Gold...

which is often the safe place for capital in a storm...

source

A very tidy 24% increase over the year which I would have totally expected...if only I knew where the wife has hidden hers lol

And now....Bitcoin...

source

I, of course, have no idea for the sudden spike, Like many, I was expecting a fairly rapid rise throughout the last year as people looked to remove funds from an ailing, traditional economic model but although there was a price rise almost consistently throughout the year, until recently, it was gradual rather than meteoric.

Let's see where the price is going to take us!

Finally, some genuine and heartfelt advice.....

The last time BTC rocketed moonward was three years ago, and greed took a hold as people held on and held on, waiting for an infinite price increase that didn't come. Then they waited for the reversal in fortunes as it slid down and down.