In the world of cryptocurrency, one term that often comes up is liquidity. It's a vital concept, especially in decentralized finance (DeFi) projects like THORChain. You might have noticed the recent surge in the value of $RUNE, the native token of THORChain, and wondered about its significance beyond just price speculation. In this article, we'll delve into the fundamentals of THORChain's liquidity protocol and how it influences the value of RUNE.

THORChain's Primary Goal: A Liquidity Protocol

THORChain is designed primarily as a liquidity protocol. Its main objective is to enable seamless and decentralized swaps between different Layer 1 blockchains (L1s) without the need for intermediaries. This decentralized, non-custodial, and unwrapped approach to swapping cryptocurrencies is THORChain's core mission. To achieve this, the protocol heavily relies on liquidity pools.

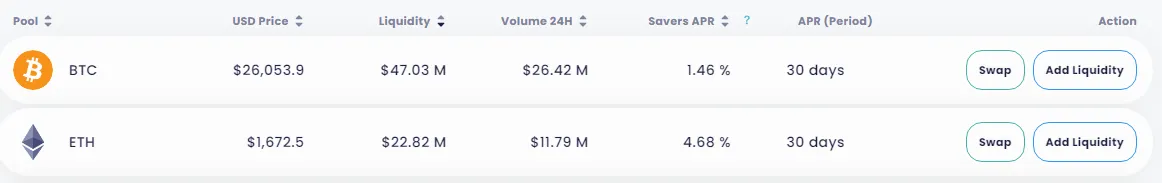

screensho from THORSwap 21.8.23

Liquidity Pools: The Backbone of THORChain

Imagine a pool as a digital reservoir that holds a certain amount of cryptocurrency assets. In THORChain's case, these assets are paired in a 50/50 ratio with RUNE. For example, let's consider two liquidity pools: one for Bitcoin ($BTC) and another for Ethereum ($ETH).

screenshot from THORSwap 21.8.23

BTC pool: $47 million total liquidity

ETH pool: $23 million total liquidity

Total liquidity in both pools: $70 million

Each pool's liquidity is paired 50/50 with RUNE. This means that for every $1 worth of non-RUNE assets in the pool, there's $1 worth of RUNE. The total value of RUNE in the system is therefore $35 million for these both assets.

The Node Bonding Mechanism

In THORChain's ecosystem, nodes play a crucial role in securing the network. These nodes are required to bond $2 worth of RUNE for every $1 worth of non-RUNE assets in the pools - in our scenario 70 million RUNE . This 2:1 bonding ratio ensures the network's security. If any malicious activity occurs, the bonded RUNE can be slashed, rendering the attacker's funds worthless.

Creating Positive Price Pressure

Now, let's explore how this setup creates positive price pressure for RUNE:

Scenario 1: RUNE Price Drops, Non-RUNE Stays or Increases:

If the price of RUNE falls while the value of non-RUNE assets remains stable or rises, the node bonding becomes under-collateralized. This prompts nodes to buy more RUNE to maintain the required ratio, thus putting upward pressure on RUNE's price.

Scenario 2: RUNE Price Stays Stable, Non-RUNE Surges:

A similar scenario to the previous one occurs when the price of non-RUNE assets (e.g., BTC, ETH) increases. Nodes must rebalance their bond by purchasing more RUNE, leading to upward pressure on RUNE's value.

Scenario 3: Non-RUNE Assets Decline, RUNE Holds or Increases:

If the value of non-RUNE assets drops while RUNE remains steady or appreciates, nodes end up over-bonding. In this case, liquidity providers (LPs) become incentivized to add more liquidity to the pools. This increases the demand for RUNE, as more LPs join the ecosystem.

The Ripple Effect

The value of RUNE is intricately tied to the health and activity of the liquidity pools. As other non-RUNE assets in the pools fluctuate, RUNE's value responds accordingly. For instance, if Bitcoin's price surges, RUNE is likely to benefit as well, considering that the BTC pool is a significant part of THORChain's ecosystem.

In Conclusion, More to Come

THORChain's approach differs significantly from traditional governance tokens. It serves a practical purpose within the network and derives its value from its active participation. Additionally, todays launch of the Lending feature, which burns RUNE, will further impact its value dynamics - but this is a topic for another article.

Remember, though, that no investment is without risk. While THORChain's model is designed to create upward price pressure for $RUNE, it's essential to conduct thorough research (DYOR) before making any investment decisions. As the crypto landscape evolves, understanding the underlying mechanisms of projects like THORChain can provide insights into their potential value trajectory.

I have a position in RUNE, TGT and THOR and i am not a financial advisor.

This is @no-advice