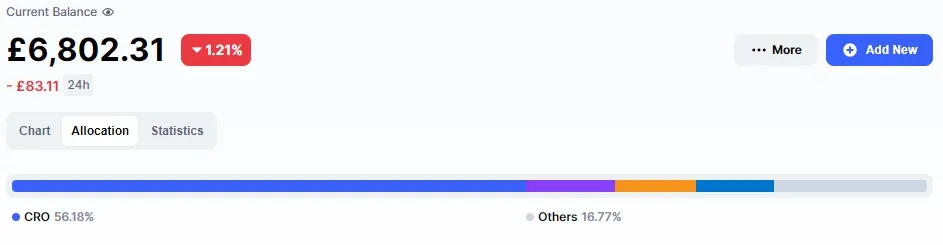

I have been in the Crypto space for about a year now and have been doing ok financially, mainly due to the pump in the Crypto.com token CRO earlier this year. I was and still am bullish on CRO and it is a large portion of my portfolio and as you can see below, this year has been good to me, my total investment into the Crypto space is £1000.

My focus this last year has been on building up my crypto portfolio. I have been doing this through play to earn, staking, cashback from the Crypto.com debit card and faucets. I have used DeFi sites before to exchange tokens but I have never tried farming and earning from them.

I am currently not investing into the Cryptocurrency space. I have a loan I took out for a new car I am repaying and I am building my stock portfolio so for this experiment I needed to find the funds from current Crypto wallets.

I did not want to touch any of my capital or my staking rewards as I am compounding, however due to the large exposure I currently have to CRO I decided to use my CRO rewards I was holding on the Crypto.com app from staking and card cashback and just reinvest the CRO I have staked on chain in my Ledger hardware wallet. I also had some Starbits I had accumulated from playing the Rising Star game and some SPS tokens from the ongoing Splinterlands airdrop campaign which I converted to Hive and sent to my Binance account.

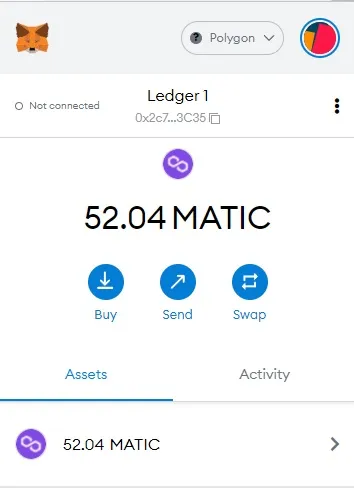

In total I managed to scrape together 52.04 Matic (£54.31 at current prices) which I sent to my Ledger hardware wallet. I can access this with Metamask to interact with the DEX. I have chosen Polygon due to the low transaction fees as I have a small amount of capital to start with.

I have been researching the DeFi space and have chosen Quickswap for this experiment. I do not want to over leverage so I have decided not to borrow against my funds and just use what I have. Maybe further down the line I will change my mind, but first I need to test and see if I can earn more than the interest I would need to pay.

Looking at some of the farms on Quickswap there are some good APYs on offer, so we will gamble on some of these high APY farms.

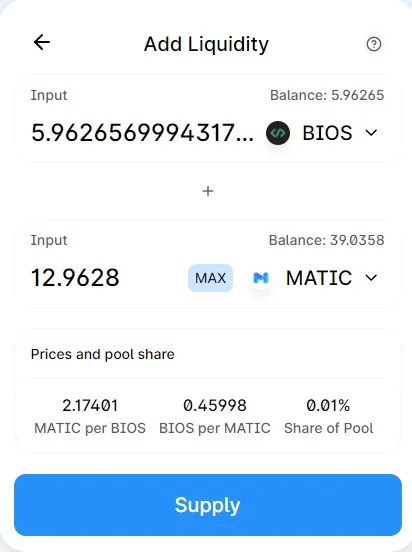

I decided to not risk all on one pool, so I will split it 50/50 into 2 pools. For the first I have chosen BIOS. I exchanged 13 Matic to BIOS and then supplied this BIOS with the matching Matic as liquidity to the pool.

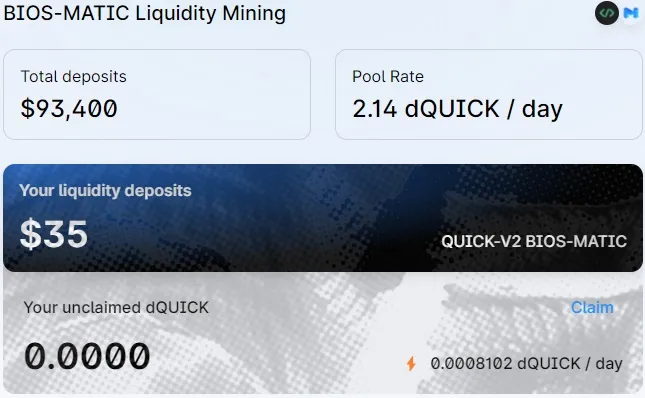

I then put these liquidity tokens into the farm

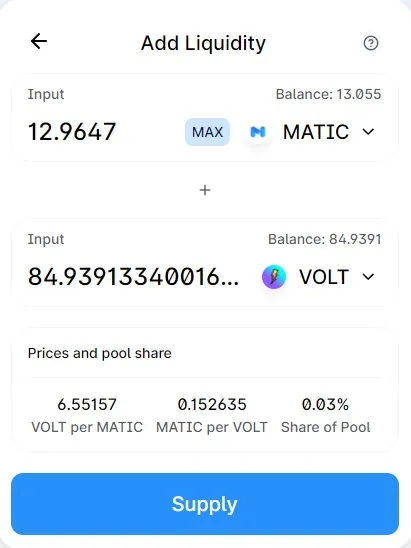

For the other 50% I have decided to go with the Volt-Matic pool. I swapped 13 Matic to Volt and have then supplied this Volt with the matching amount of Matic to the liquidity pool.

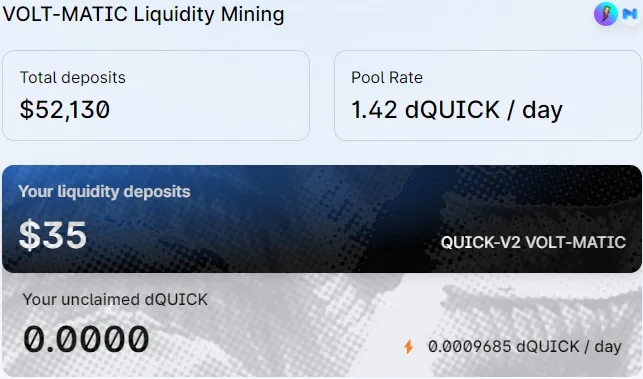

I have then added these liquidity tokens to the farm

If I am totally honest I did not do much research into these tokens apart from looking at them on Coingecko. If you are inspired to try your hand at DeFi then I would recommend that you do your own research into any tokens you will be investing in and dive deeper into them than I have. You might also want to research and understand the implications of impermanent loss. Do not take any of this post as financial advice, this is purely for entertainment.

I will update this blog in a week and we will see how this experiment is doing. I have lost some Matic to fees so first I hope to make these back.