Just a few days ago, it was announced that Kroger (the largest grocery retailer in the US was going to start accepting Bitcoin Cash as payment. For crypto enthusiasts like me who want to see the mass adoption of crypto, it seemed too good to be true…..and it was. In fact, the Kroger press release was the result of a hack and Kroger has NOT officially announced plans to allow Bitcoin Cash payments. That being said, there are several major, big name retailers that DO accept cryptocurrency as payments. In this post, I’ll cover several of the major retailers that accept crypto as payment, discuss some of the pros and cons of accepting crypto as payment and introduce payment services like Bitpay and Flexa that facilitate crypto payments and make the process smoother for both businesses and consumers.

Companies Accepting Crypto

Unfortunately, the announcement that Kroger was going to start accepting crypto as a payment wasn't real, but there are several big name companies that do accept crypto for payments. For years, tech companies such as Microsoft an Newegg have accepted crypto as payment for technology products. As I was researching for this article, I was pleased to find that both Home Depot and Whole Foods accept crypto though a service known as Flexa (more on that later).

The announcement that Home Depot accepts crypto is HUGE news as it means you can literally build your house from the ground up using crypto. Likewise, Whole Foods accepting crypto is fantastic because it finally refutes the no-coiner argument that "I can't pay for groceries with my Bitcoin."

Advantages and Disadvantages of Crypto Payments

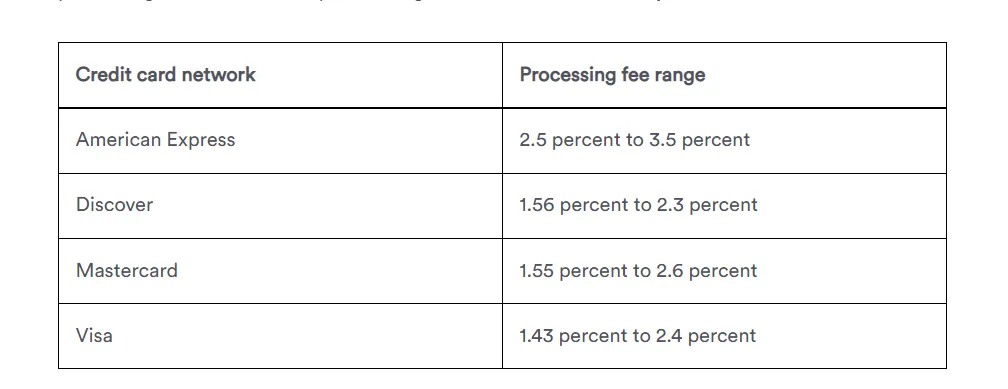

Although it's great news that companies are beginning to accept crypto, I try to present a balanced approach and point out that there are both risks and benefits of accepting crypto. On the one hand, it seems evident to me that accepting crypto allows a business to expand its customer base and cater to customers who prefer to pay with crypto. Secondly, the direct P2P payment channel that cryptocurrencies offer allow companies to potentially bypass the high fees that credit cards charge to process payments.

Those cost savings can be built into lower prices for customers giving the company a price advantage or retained thus increasing profit margin. I say potentially decrease costs because this will depend on a variety of factors. For example, lets assume an average credit card processing fee of 2%.

In order to process a $1,000 purchase, the business would have to pay about $20. This would be considerably more expensive than the price to process a BCH transaction (around a cent) but could (depending on network congestion) also be considerably lower than processing an Ethereum network transaction if the customer was paying with ETH or any number of ERC-20 based stable coins. However, its also important to note that paying with crypto places the burden of the transaction fee on the customer. Thus, they would presumably either pay in a crypto with a low transaction fee or simply use a credit card depending on the optimal situation.

On the flip side, accepting crypto as payments can be a nightmare for tax purposes given that each transaction is treated as "property" and that a store that accepts crypto would have to preform hundreds or even thousands of cost basis/capital gains tax requirements every time they accepted crypto as payment and then used that crypto to purchase additional supplies.

Crypto Payment Services

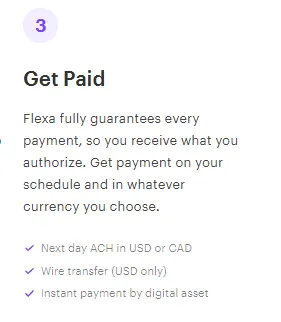

Thankfully, many services such as Bitpay and Flexa allow companies to accept a wide variety of cryptos as payment while simultaneously allowing settlement in crypto OR fiat. In my opinion, this is a win-win situation as it allows businesses to reach a large community of crypto enthusiasts by accepting their preferred payment method while also retaining the tax advantages of settling in fiat.

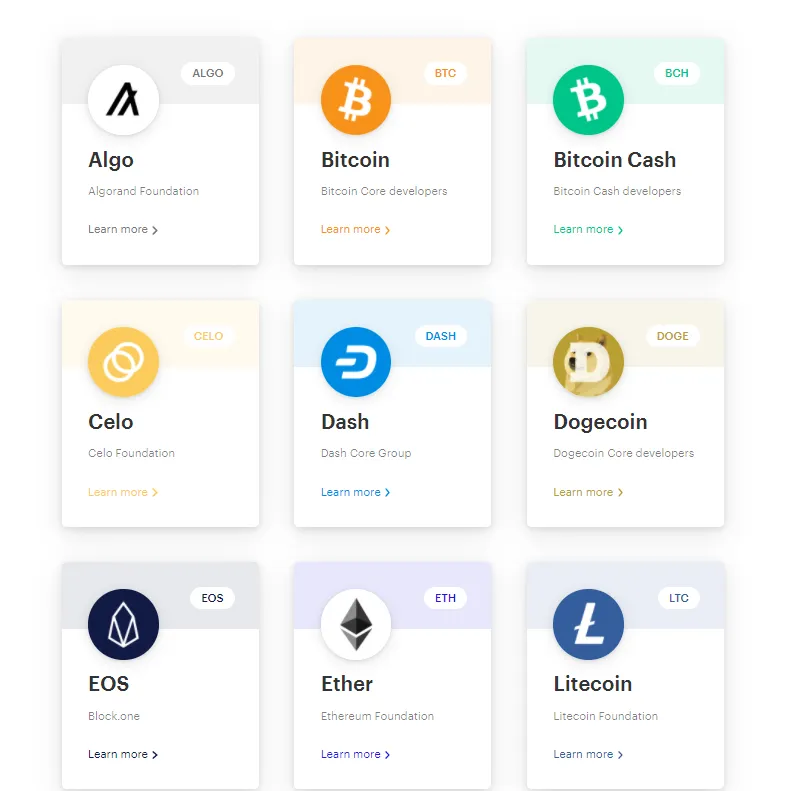

At the time of writing, Flexa allows customers to pay with Stellar Lumens, Tezos, Bitcoin Cash, Bitcoin, Ethereum, Litecoin, EOS, Celo, Dash, Doge, Algo, BAT, COMP, USDC, Dai and several other cryptos. For around a 1% fee, the business has the option of either accepting the pure crypto OR allowing fiat settlement for ease of accounting. Best of all, Flexa integrates easily with a business's existing hardware, so there is no need to purchase additional equipment.

Summary and Analysis

As always, I like to say that nothing is financial advice, and everything in this article should be considered my mere speculation, but I do think that services like Flexa and Bitpay show the way towards mass crypto adoption. Simply due to regulation and tax treatment, I think that it will be very difficult to imagine a business accepting 10-20 different cryptos, managing those wallets, and ordering supplies with 20 different coins.

Rather, I see crypto adoption happening in more of a background way through the use of services like Flexa and Bitpay as it will be a seamless transition that doesn't require expensive hardware upgrades and allows the business to accept a wide range of cryptos without having to worry about pricing a product in 20 different coins or computing tax basis for every transaction. Yes, companies like Flexa and Bitpay will take a cut of the transaction to provide their service, but it appears that this cut will be considerably less than the fees for a credit card.

I also see services like Bitpay and Flexa being superior to prepaid crypto credit cards as they allow users to HODL their crypto right up to the time of sale and realize those price gains, but that's a topic for another day.

I always like hearing your opinions, and what you think so feel free to leave your comments below!

References

https://www.cbsnews.com/news/kroger-bitcoin-fake-payment-news-release/

https://www.uschamber.com/co/run/finance/accepting-cryptocurrency-as-payment

https://www.buybitcoinworldwide.com/who-accepts-bitcoin/

https://bitpay.com/business/

https://flexa.network/currencies

https://medium.com/@cryptonumerist/flexa-eliminating-the-middleman-in-e-payments-f49294bfdf31

https://www.bankrate.com/finance/credit-cards/merchants-guide-to-credit-card-processing-fees/