Since Uniswap has extremely shit marketing I never used the useless thing but always just thought "Oh that is kinda cool."

Also, they are just expensive and why use it if most of the tokens I like have proper exchanges anyway. One thing decentralization does well is to make a person realise just how convenient centralization is.

Anyway, here is the problem. I mainly have a lot of 1up tokens which actually has good potential to X again. I do not have a lot of Eth so seeing as Uniswap screwed me out of UNI tokens with their shit marketing. I thought not again.

Lemme use the fucking thing right.

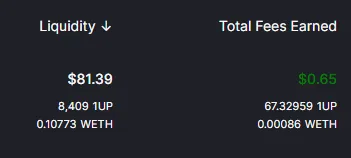

I happen to have $40 Eth so matched that with some 1UP and did the liquidity thing. I paid 85cents for the transaction and it has been 12 days I am yet to make that money back.

I am not too sure what the graph is for but it looks pretty.

So I wonder if I should not just increase my liquidy, since I have another $100 1up and can match that I with Eth if I sell.

I think that is more an example of the kinds of questions a person has in the sphere and it really is a hassle having to research all this shit only to have more options that complicate the choice.

Choice paralysis.

Uniswap them can do well to add a more informative interface with the projected costs etc I mention here. I think many people do just prefer to hold on to what they have.

It really is about convenience.

Fair enough I should do some proper research on these things, and maybe not just look at green numbers.

The more I kinda peruse the Uniswap Docs the more I think unless I add a ton of money on something that is being rallied then it does not really matter.

Oooh look pretty green numbers... Yet there may be a loss...

That is probably the main factor, having a token that has proper volume and liquidity. The volume just indicates people actually care to use the thing which really is a very small % of tokens.

So with that alone, it does in a way narrow down the options. Then it is all about the risk. I think I am kind of safe with something like 1UP which has an actual social media platform behind it. There is a ton of liquid in 1UP albeit idiots selling every cent they get... At least the money flows right.

Nope not selling

I am definitely in a position where my the tokens I have like Hive and 1UP are not worth selling just so I can make 0.03% on fees and the value is so low that it makes no sense to provide liquidity for a $100 BTC and ETH and think you will make a little at a time just be patient.

I might be wrong but at this point I will be patient get my 85 fucking cents back and while I do not really care much for the bit of 1UP that is tied up in there I might yet let it go for a few months and make 100% profit.

Maybe Leo Finance makes a pair again because I think at this point I might see the worth in that considering they may be small but they shill like crazy.

Anyhooo, those are my random musings.