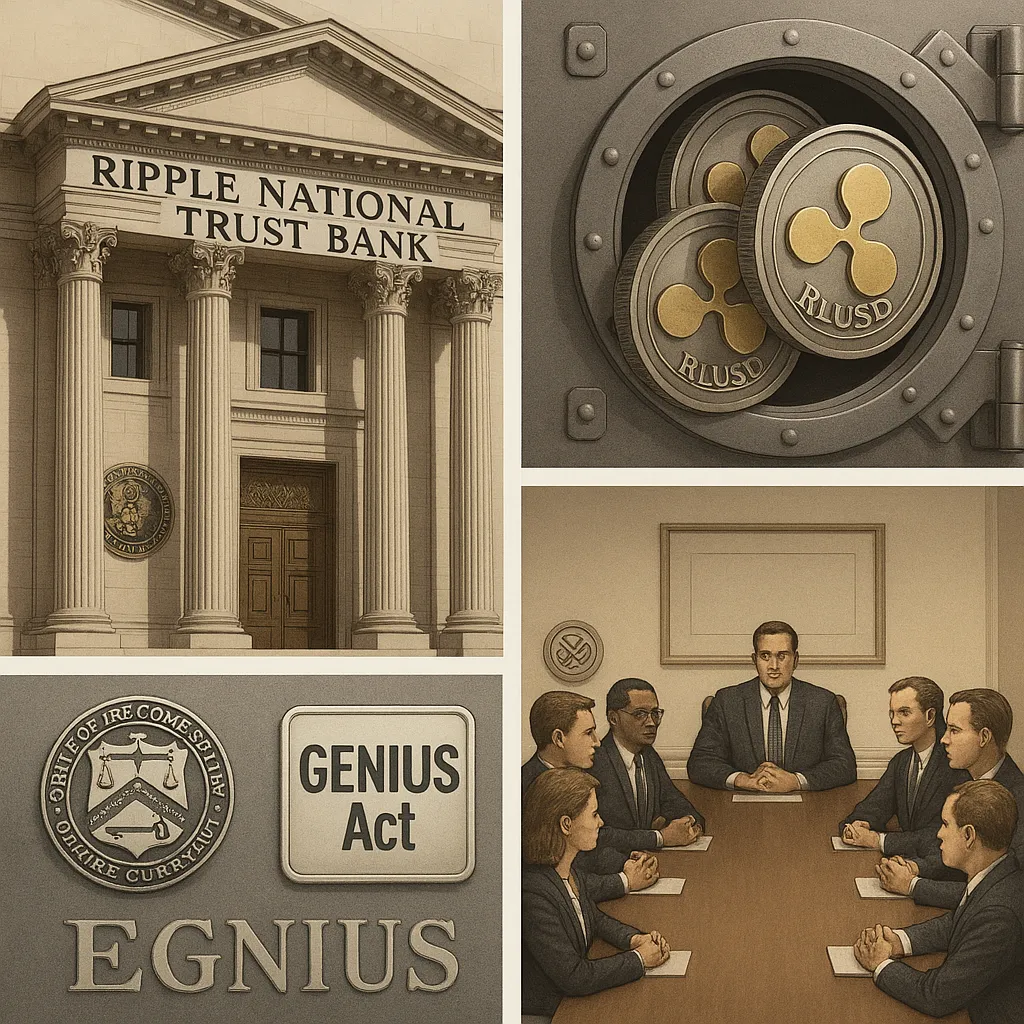

Ripple has formally applied for a U.S. national trust bank charter via the Office of the Comptroller of the Currency (OCC), a landmark move intended to bring its RLUSD stablecoin under federal oversight and institutional credibility. If approved, Ripple’s subsidiary, the Ripple National Trust Bank, would legally issue RLUSD and manage reserves through direct Federal Reserve access, bypassing third-party commercial banks entirely.

This application is not about deposit-taking or lending—it's structured to support custody, tokenization infrastructure, and secure reserve operations. Importantly, Ripple's trust bank charter is exempt from the Community Reinvestment Act, highlighting its B2B focus on blockchain and stablecoin infrastructure rather than retail banking services.

However, the move has drawn pushback. The Bank Policy Institute and 42 U.S. banks have formally opposed Ripple’s charter application, citing inadequate time for public review (only 2.5 weeks) and concerns about upending traditional banking norms. At the same time, with GENIUS Act legislation advancing in Congress, stablecoin issuers are expected to become federally regulated, making Ripple’s bid timely and strategic.

Ripple has also released Volume 1 of its OCC application, revealing a five-member governance panel with leaders from Standard Custody & Trust and broader regulatory experience, reflecting its commitment to compliance and transparency. If granted, this trust bank would set a new benchmark in stablecoin legitimacy, bridging digital asset markets with regulated finance infrastructure.