WiseAlpha is the UK's leading digital corporate bond market, offering fractional Bond trading for high net worth and sophisticated investors. They provide trading and automated portfolio services to gain exposure to the corporate bond asset class. All assets are held with Bank of New York Mellon, the largest bond custodian in the world and the digital investment programme is overseen by IQ-EQ, the 4th largest investor service firm in the world. WiseAlpha employs multiple layers of investor protection to ensure the highest level of trust for their users.

I first seen them on Crowdcube, in 2016, while they were crowdfunding the company. The £350,000 target was overachieved and I invested £10 because it was looking as a bright idea. Two years later I started investing whenever I had some extra income, on power brands. The minimum investment in a company is £100 but after you add it in your portfolio, you can invest any amount, or reinvest the profit.

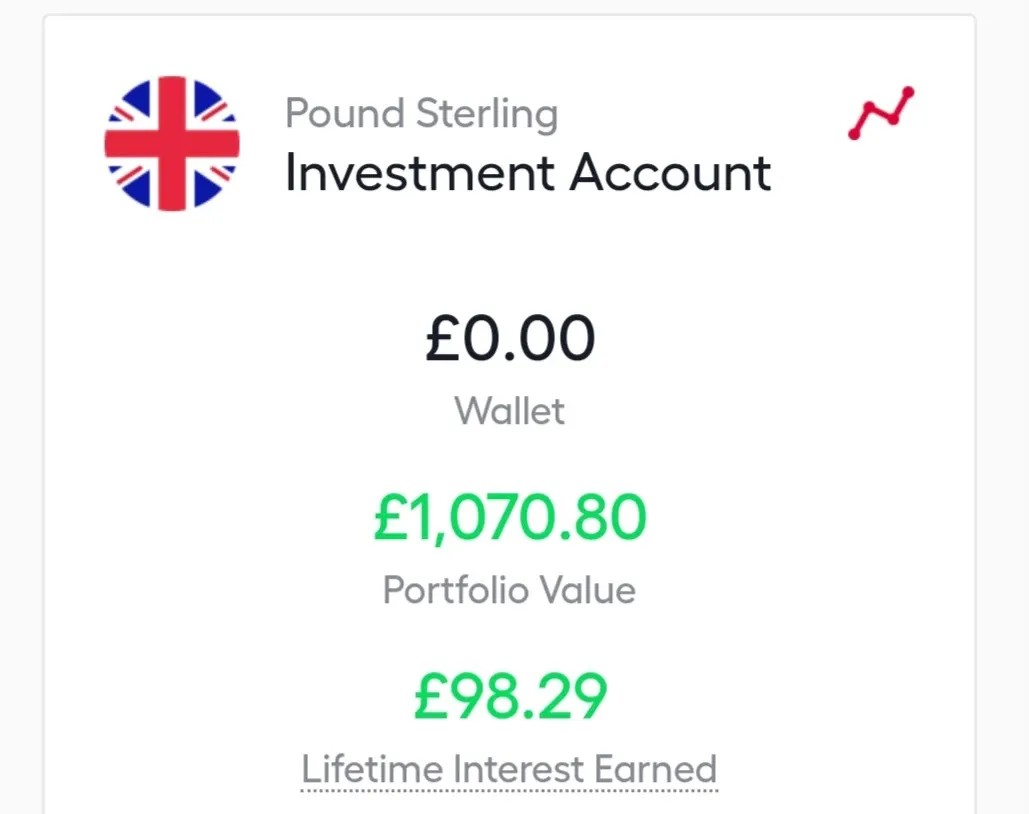

Since the summer of 2018 I invested now and then, and the Lifetime Interest Earned is £98.29. I chose to reinvest the profits in the same companies that produce them, growing the portfolio. I invested only on UK Market but there are many good investment options in the EURO Market.

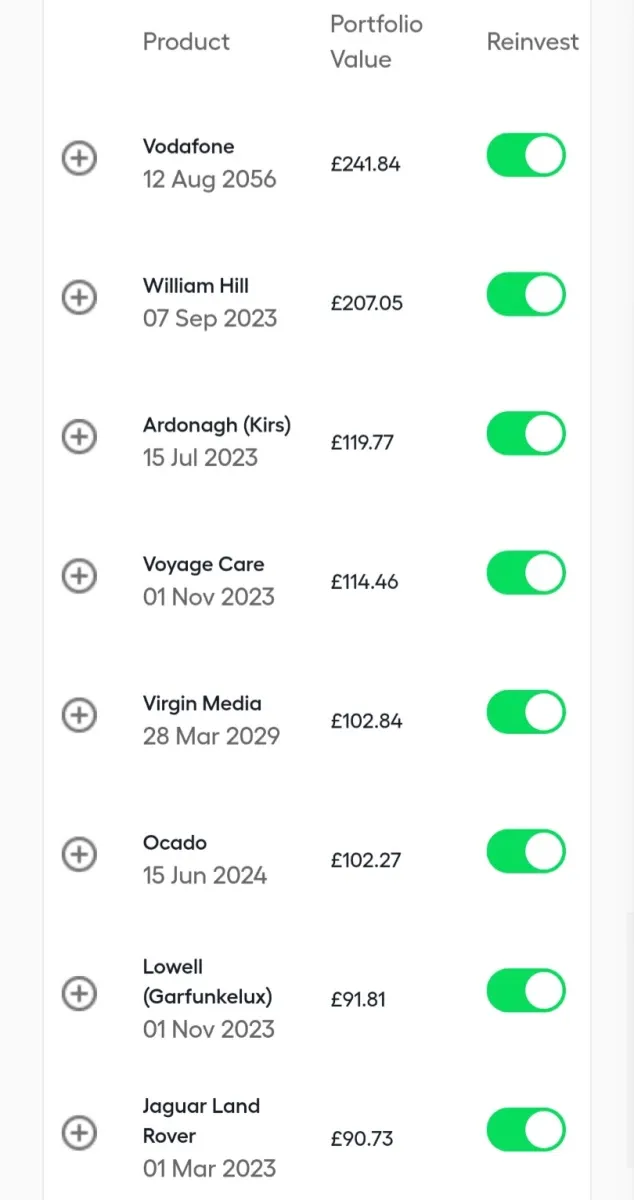

The interface is user friendly, showing details of your transactions, investments and upcoming payments. I currently hold Vodafone, William Hill, Ardonagh (Kirs), Voyage Care, Virgin Media , Ocado, Lowell (Garfunkelux) and Jaguar Land Rover in my portfolio, all of them with reinvestment of the profit. The interest will be added to the wallet if no shares are available to purchase. I had other investments in Ocado, Virgin Media, Travelodge and Pinewood Studios, which were paid in full before the due date, generating more profit.

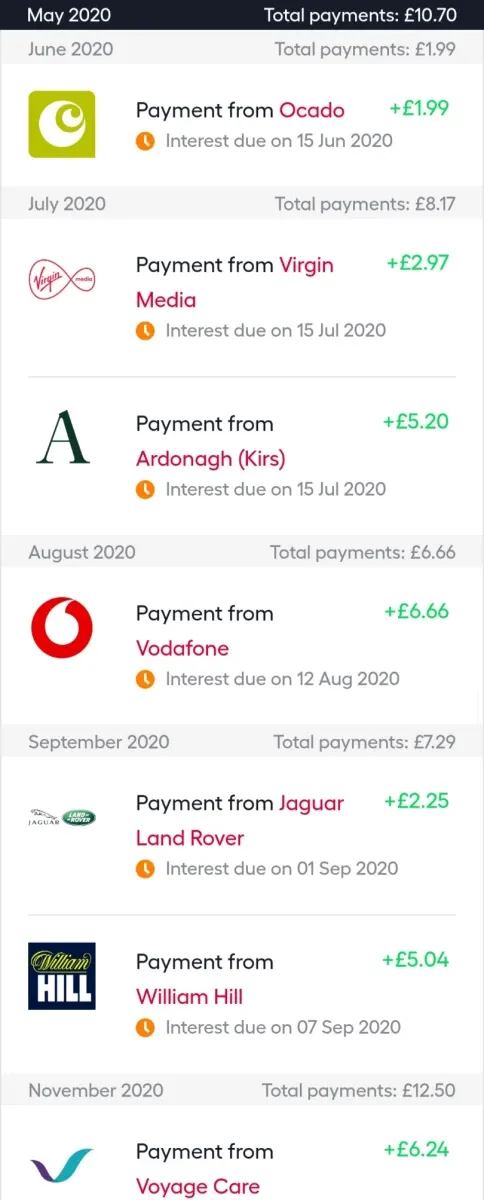

The repayments are listed month by month, with the date and amount clearly stated.

WiseAlpha is an award winning provider and the leader in financial innovation. The company was awarded the British Bank Awards in 2019 for the Best Investment Provider and the Good Money Guide Award 2019 for the Most Innovative Provider

WiseAlpha has liberalised the corporate bond market, allowing everyday investors to access high quality fixed income, by making senior secured corporate bonds accessible for the masses of people. However, WiseAlpha is not suitable for everyone.

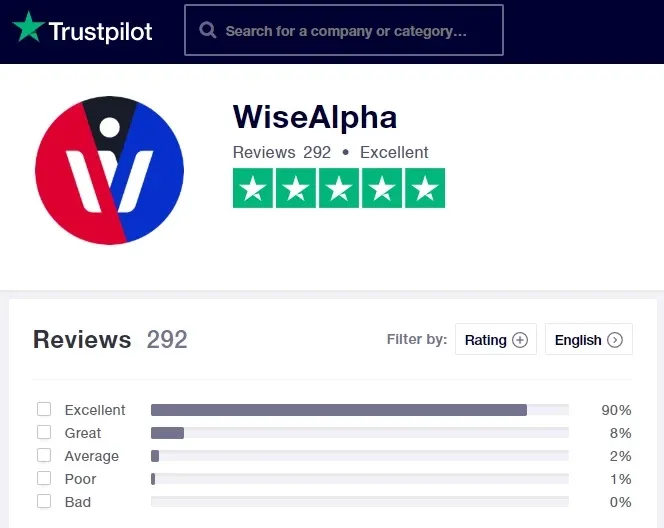

On Trustpilot, WiseAlpha has an Excellent rating, with 5 stars from 292 reviews.

To conclude the post, WiseAlpha is a fantastic platform, offering a good choice of investments and great way to access bonds. The information is clearly presented and explained, and I'm getting a good rate of return. This are the reasons why I highly recommend them.

Using my referral link, and opening and opening an WiseAlpha, can generate welcome bonus, up to£250, depending on the total investments in the first 30 days.

Links and referrals:

WiseAlpha

Join Publish0x to earn crypto for reading and writing

![image.png]

![image.png]