I bought some more AVAX recently in anticipation of AVAX-Cub being released later on this year, just a little as I'm leaving most of my assets in PolyCub for the time being, but I wanted to get ahead of the curve with diversifying further into this chain.

The problem is that having been exploring DEFI options on the Avalanche network for a few months now, and while I appreciate the extra asset-security-in-diversity another chain gives me TBH I've been a little bit disappointed with the staking options I've found on AVAX.

In terms of yields there are some competitors for other networks such as Polygon or Binance Smart Chain but the relatively high AVAX fees means it's just not worth dealing with relatively small amounts of funds on AVAX....

For example on Yield Yak we've got a 20% return on UST-USDC which is OK

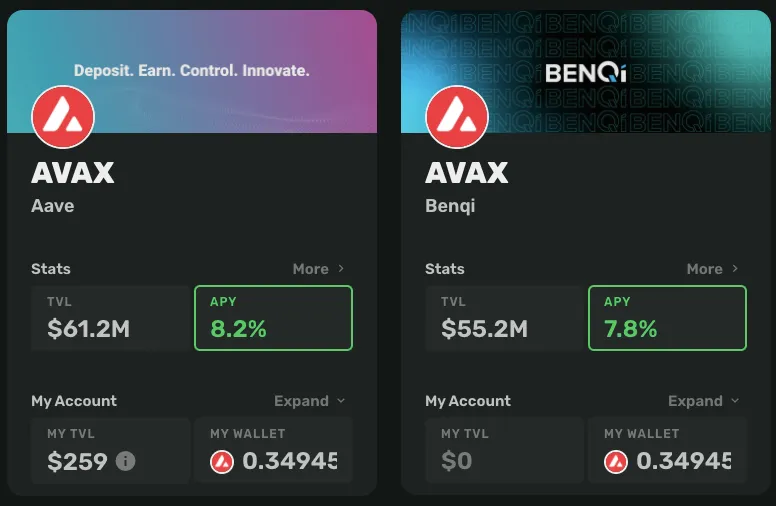

And an 8% return for staking AVAX pure, which is also OK....

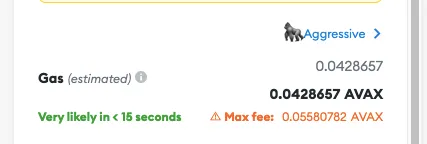

However the fees for staking to AVAX are pricey...

At the current AVAX price of > $80 that's > $3 for a tx, NB the market rate isn't that much cheaper than aggressive.....

So Avalanche is probably a place where you want to be staking > $1000 in one go....

So if you're aiming to LP and you need to approve, swap, stake, and harvest, especially harvest, you are really going to need to be staking over $1000 otherwise ALL your profits are going to be soaked up just by the AVAX fees!