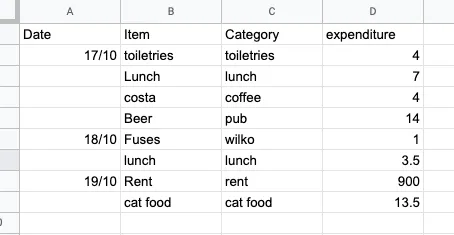

I just recently started using Google Sheets to track my daily expenditure again...

I haven't done this in a while, not since back in 2015 when I was saving money to retire early.

Back then it worked a treat to help reduce my expenditure as I could see in black and white (I didn't colour code the numbers) how much I was spending on certain categories - coffee stood out as being a bit mentally high I remember, so that got cut down on.

I also got into a mind-set of trying to have no-spend days - obviously auto-spends would go out but I mean no buying food/ coffee/ no online shopping which also helped.

I'm pretty flush these days so don't need to keep an eye on my expenditure ATM due to lack of income, but I also think it's good practice to track in order to help prevent an upward-drift.

And it's better to spend less so I can pay more to pay down the mortgage early in the context of interest rates going up.

It'll also be interesting to compare spend month by month with inflation on the rise!