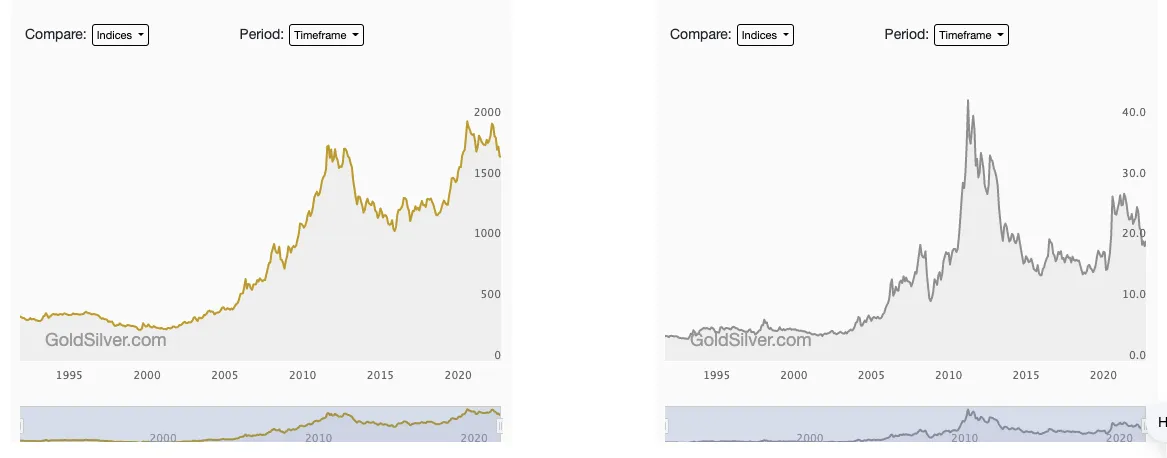

I was just looking at the long term price trends for gold and silver.

TBH I personally see little point in distinguishing between these two as they seem to follow each other pretty closely.

Now while I get that the years surrounding 2015 would have been the best time to buy precious metals, in fact I did buy some back then and I'm pretty happy with that decision, as prices doubled up to the highs of 2020.

But now it seems both Gold and Silver have dipped a little, as in they are 20% down of those Corona-period peaks.

However, what with there being so much economic instability the world, and governments being so much in debt that they can't even cut taxes any more to raise growth (as the recent UK case study demonstrates) then maybe Gold and Silver are a good investment ATM?

I mean interest rates and inflation look set continue to be substantially higher going forward into the 2020s than they have been so far this century, which means any fiat held is going to devalue more rapidly.

And this fact plus the shock potential in an uncertain world maybe means that holding precious metals is a good way to go.

NB I am thinking of physical gold and silver here BTW!