So I'm sure we are all aware that interest rates are going up in order to combat high inflation and high employment (in increasingly crap jobs).

And of course the Pandemic and Energy squeeze have something to do with this....

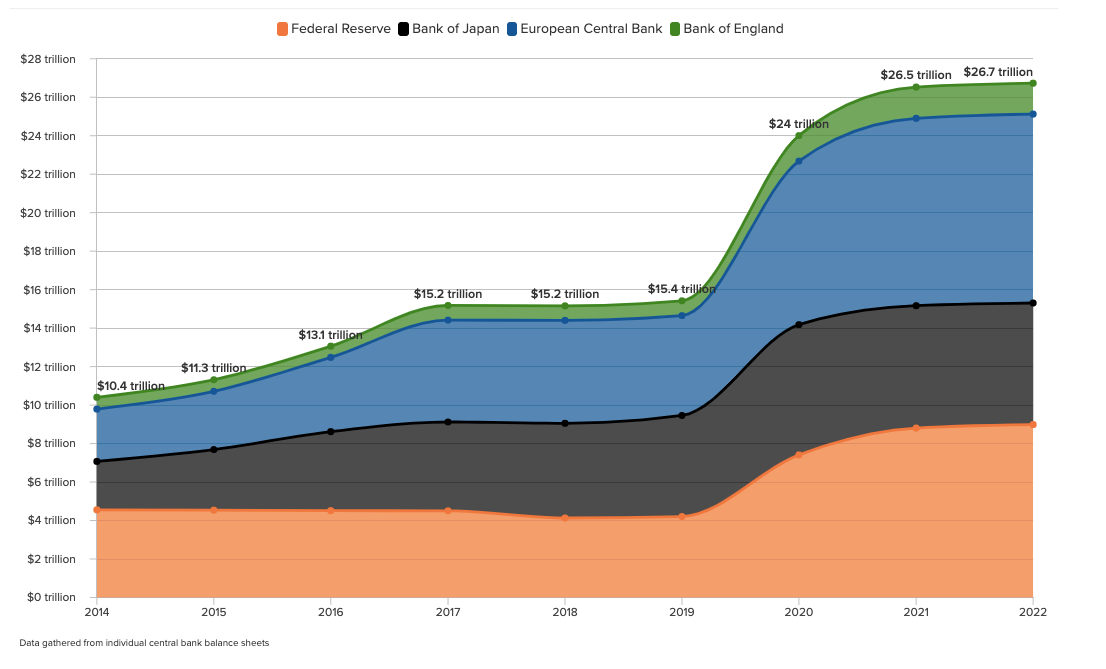

But I don't think we should be surprised that a hike in interest rates is coming either given the last couple of years of Quantitative Easing - the major central banks have collectively doubled their money supply since 2019 (!).

No wonder currencies are devaluing against real world goods...

One question you might want to ask yourself is this: what kind of interest rate hike is going to be enough....?

A second question - if you have debts that are going to be exposed to these increasing interest rates over the next couple years - what strategies do you have in place to pay your increased costs....?

I think the next couple of years especially could be painful for many, but of course the Vultures are already cutting their teeth, ready to swoop in on any bargains!

Source...

I use the Global QE tracker to find out the info above, kind of cool!