USDC dramatically lost its peg yesterday, dropping well below $0.90 in what appears to be a response to the collapse of Silicon Valley Bank (SVB).

Circle had $3.3 billion of its $40 billion held in SVB, so its Market Cap dropped from $40 to $37 billion overnight.

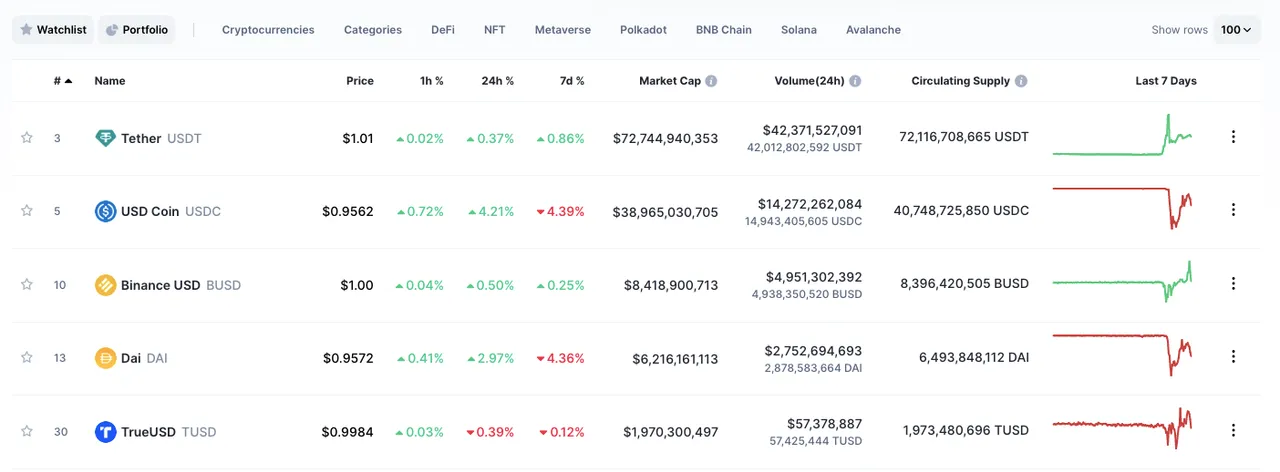

The encouraging news is that USDC is already on its way back up to the $1 peg, currently trading at $0.96.

This is a fiat world problem...

SVB is the largest bank to collapse since the 2008 financial crises

The cause of the SVB collapse seems to have been the banks' in hindsight ill informed decision to sell $21 billion of long term low-return government bonds at $1.8 billion loss, with the intention of moving that money into higher yielding short term options now that interest rates are relatively high.

The problem was the massive sell off at a loss spooked enough investors to demand their money from SVB and they couldn't cover it, hence the collapse.

That's the brief summary of course.

NB there may be more to it of course: according to Press for Truth senior executives in the know sold $millions of dollars worth of SVB stock in the previous two weeks so this may be an orchestrated attack designed to induce the next massive financial crisis.

(This wouldn't surprise me, I mean we're just about getting over Covid, time for the next crisis which could well usher in a great reset).

The relatively small knock-on effect on crypto (so far)...

Overall I'd say the consequences of the SVB collapse so far have been minor, even encouraging in terms of the resilience of the crypto markets to hold up....

The main effect is that people have traded out of USDC and into USDT and BUSD while DAI also depegged but is climbing back up to $1 like USDC....

And the Bitcoin price also increased suggesting a fair few people are thinking 'real crypto safe haven time'....

Crypto's not fucked unless it's all fucked?

And if it's all fucked crypto might not be as fucked?

Now to my mind if this is just an isolated banking collapse then USDC and crypto are going to be OK.... Circle's got its assets diversified and 10% in one bank that's dead isn't great news but it's not a total disaster and it probably will be able to recoup some of those losses.

And other stable coins can just soak up the loss, which has basically already happened, some people have sold USDC at a loss as part of risk-mitigation.

This article from Decrypt offers a number of reasons why we shouldn't panic such as the fact that SVB had more assets than deposits (although there questions over liquidity), and that Circle holds MOSTLY very liquid assets which suggest a floor for USDC of $0.77.

So this doesn't all seem too bad.

And if this is the start of the next 2008 style financial crisis then literally everything in the fIAT world is fucked anyway, so stocks and everything are going to sink probably along with crypto including stable coins depegging.

Final thoughts...

If we're not about to enter the next mega crisis I'm not worried by these events.

If we are about to enter the next financial crisis, I don't think it matters what assets you're holding, it's all a gamble over what's going to happen.

Monday could be interesting, but here's hoping it won't be!