A lot has changed since my last review of Stable Coin yield options on Binance Smart Chain....

Primarily the collapse of UST with its near 20% yield has shaken people's faith in algorithmic stable coins (or rather revealed trust as mere faith?) and thus maybe lowered the bench mark for expectations of yield on other centralised stable coin proxies on chains such as BSC.

And there's also the fact of the wider crypto crash which in itself is an amplification of a wider economic downturn, which you would also expect to mean lower yields...

The reasons I keep an eye on BSC as for me it's the largest and most accessible Chain for DEFI....

Current Stable Yields on BSC...

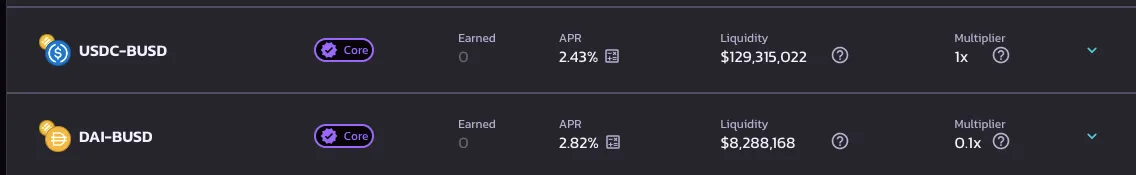

On Pancake Swap we are now looking at a dismal (but realistic?) yield of under 3% on stable farms such as BUSD-USDC....

We see a similar pattern on Apeswap with the more sensible stable pools around 2.5-3% while the slighty risker stable pools are a bit more, up to almost 9% for FRAX-BUSD...

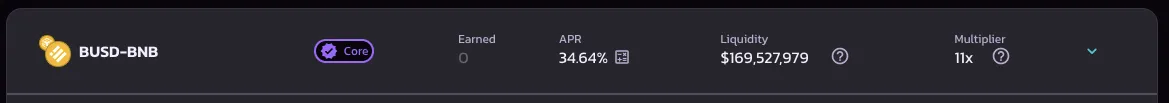

However if you're willing to pair BUSC with BNB you can get a 34% APR still....

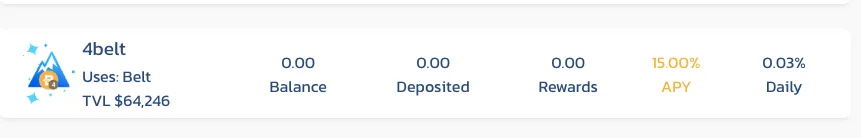

The 4Belt Kingdom on Cub comes out at a very competitive 15%, if the display is right(?!)

Probably one of the best on BSC!

And also competitive are some of the farms on Knight Financial offering around a 5% return on stable farms...

Final Thoughts - stables not worth staking on BSC?

I can hardly see the point ataking the kind of amounts I'd like to stake as the returns are too low.

However, something worth considering is pooling to hedge against another BTC downside...

I wouldn't want to pool the native shit-defi-coin with stables (or anything else) but pooling some with BTC or other crypto with stables for a yield is something I'd consider, and there are still plenty options offering > 10% for that!