Daos was how I started getting deeply involved in crypto projects after my curiosity made me jump into one of them back in 2019. Many tools and projects have been launched since then and it keeps amazing me the capacity for innovation and the creation of groups of decentralized individuals around a common goal.

This is an Ethereum event and every project here is related to EVMs, but good products are chain agnostic and will evolve into other chanins sooner or later.

One of the most advanced open-source tools to launch and create a DAO in the Ethereum ecosystem right now is Aragon, especially after they released their latest version which is way more user-friendly than the previous one. Aragon was born to create DAO tools and after the years, even with their ups and downs, they still manage to do a great job.

There are quite a few other tools for DAOs besides governance, such as multi-sig wallets like Safe, signaling voting tools such as Snapshot, complete DAO operating systems such as Tally, and many others. But there is one concept that a few are aware of and has a great potential for DAO financing, which is an Augmented Bonding Curve.

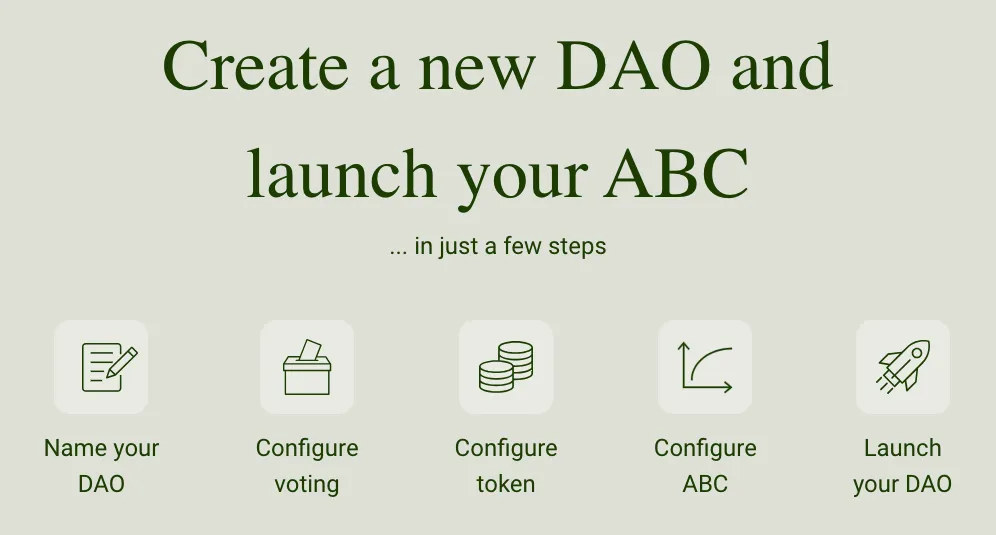

A bonding curve has been used only by a few crypto projects to raise funds and offer automatic real liquidity for those intending to swap the project token be it to enter or exit the community. Now, The Commons stack has created an open-source tool out of their experience launching Token Engineering Commons two years ago. You can launch a DAO and its financing bonding curve on their new site running on Optimism.

You can take a look at Adam Blumberg's video explaining what exactly is a Bonding Curve and specifically an Augmented Bonding Curve.

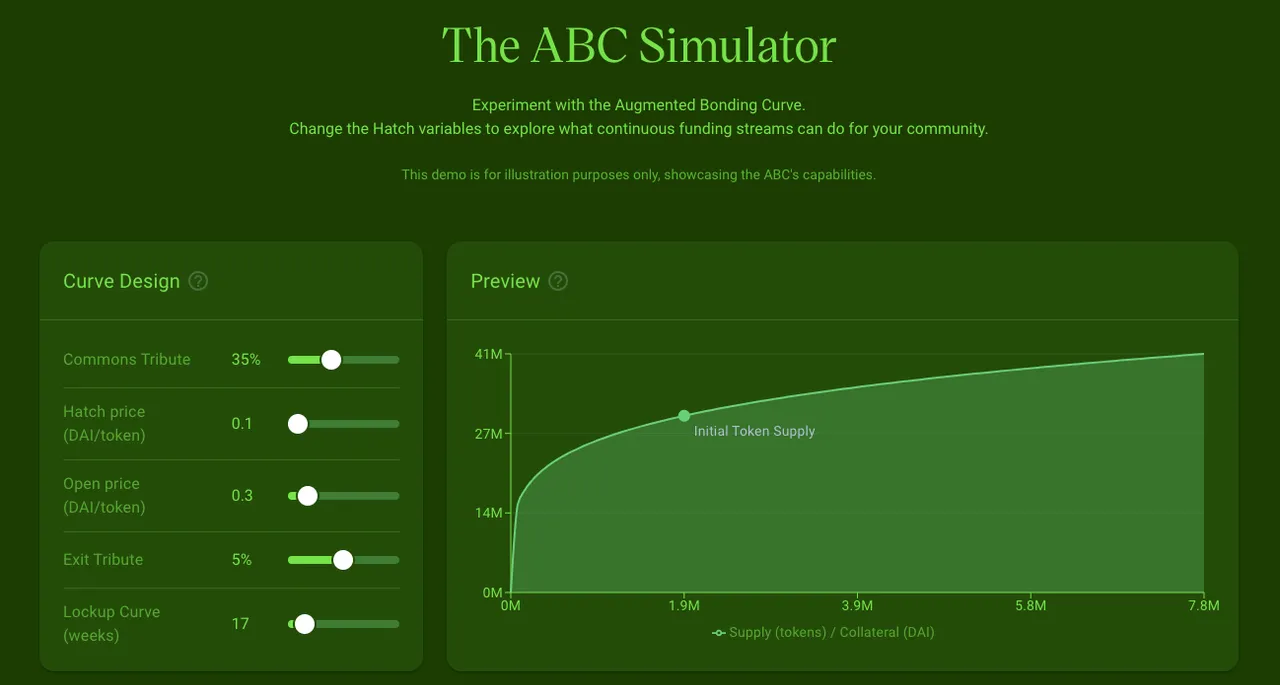

And play around with The Commons Stack Augmented Bonding Curve Simulator