When ICO's started to appear back in 2017 and token offering was all over, projects needed exchanges to list their tokens so investors will have a way to trade in a secondary market once the ICO was finished.

Having your token in a CEX started to be more and more difficult and costly and lack of liquidity became a problem.

During the long bear market, the bonding curve concept started to become a reality, especially when BANCOR offered their exchange service to the masses. A different use case was RAM selling when EOS launched its mainnet.

So what is a BC and what does its implementation suppose for a project?

In a traditional centralized exchange you need the exchange to list at least a pair of your token and then market makers to have offer liquidity in the market, otherwise your order can be there for ages. You also need to give away control of your assets and risking the service being hacked. Initial decentralized exchanges offer a nice way to control your assets but liquidity was even a harder issue.

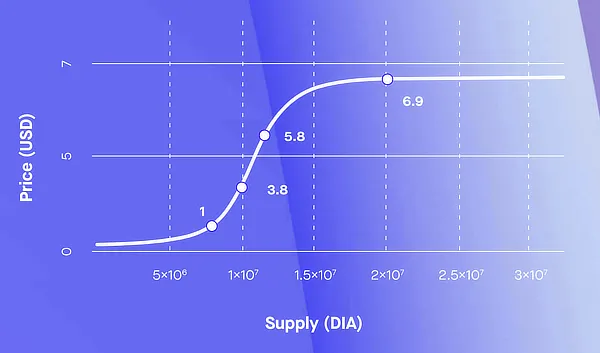

Bancor introduced a Bonding Curve exchange, which is basically a math formula the one calculating the price so you do not need a counterpart to take your order when trading. You buy or sell your token into the Bonding Curve.

As DefiPrime defines it. In the context of DeFi, a bonding curve is a mathematical formula used to set a relationship between a token’s price and its supply.

Although bancor introduced the concept to the masses, the big hit was Uniswap jumping into the arena which completely changed the way most projects offered their investors a way to buy and sell their tokens. But there are other uses of a bonding curve which will probably revolutionize again the crypto arena.

Imagine any small project wanting to get funding. It can launch a bonding curve and offer its supporters to join the project giving them a chance to leave any time if they wish, as there will always be a curve they will be able to trade against. The need to be listed in exchanges disappears so the project can be completely economically independent. Just see what Leo is doing using Uniswap and imagine having a chance to do so directly, without the need of Unishwap to get liquidity. Any Hive related token can do that!

As we enter the new bull market, I foresee big growth in new projects offering bonding curves to fund themselves.

Here's a post from Veronica Coutts in case you want to read a non-tech description of a bonding curve.