In one of my earlier blogs, I mentioned about different types of Hive users (aka 'citizens'). Splinterlands (NFT game) was my way of introduction into Hive, and I'm happy that aside from finding a game, I got to learn more about blockchain technology.

I've always enjoyed investing. For me, it's another form of a game except that it has real-life effect as it involves money. I guess growing older makes one shift from being an active trader, and more into increasing passive income.

To increase passive income, one needs to seek which investments offer the best yields.

Here is my attempt in listing the areas within Hive where I earn some yield:

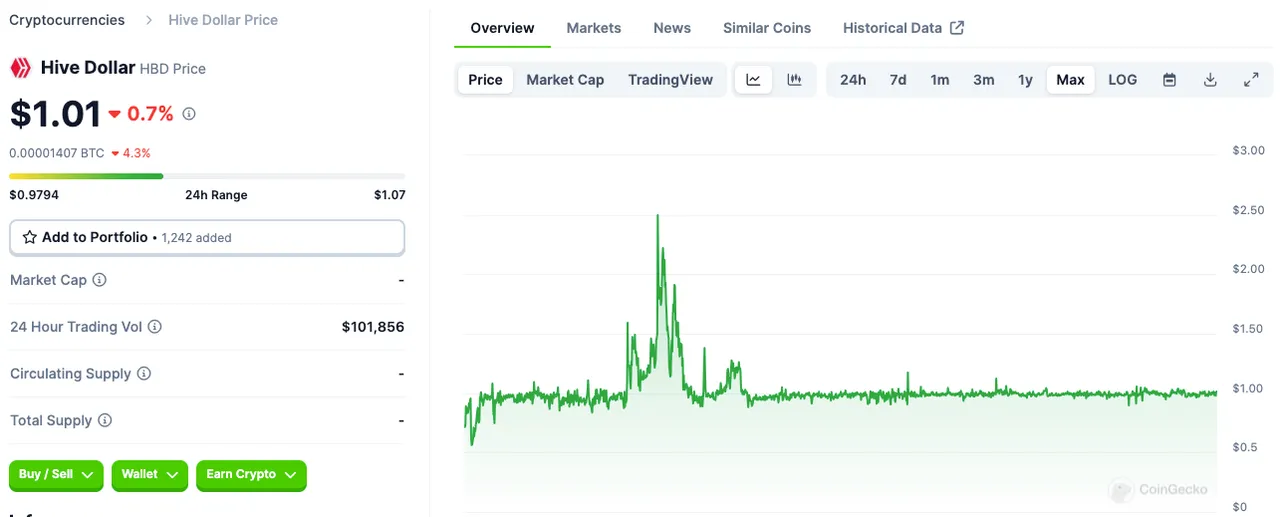

1.) Hive-Backed Dollar (HBD) Savings

HBD is like having a US Dollar savings account; however, if you 'stake' (savings) it, current APR is at 20%. This gives my portfolio USD exposure and acts as my stablecoin. I plan to put in more money here as my form of 'savings' as I want to take advantage while it has good yield and relatively low risk. Caveat: I have yet to understand the economics of HBD to see if it is sustainable; hence, the risk is on the default probability of HBD.

APR: 20%

Risks

- currency risk (USD)

- network/technology (aka default) risk (HBD)

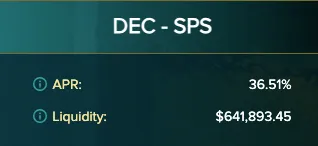

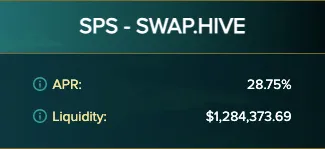

2.) Liquidity Pools

These currently give out the highest APRs so far but with larger risk (i.e. impermanent loss) as compared to just simply staking a coin. As a splinterlands player, I tend to use DEC and SPS, so it's ok for me to put in some of my coins in the liquidity pool. It's just a bit of a challenge tracking my actual cost as I have invested in multiple occasions already. But if we base it on currently listed APR, not bad for the long term.

Earnings are in SPS.

APR: 29-37%

Risks

- Impermanent Loss risk (DEC, SPS, Hive)

- market risk (SPS)

3.) Splinterlands

The game that started it all for me in Hive. By simply playing the game, one earns! How cool is that?

There are actually multiple ways to earn, The choice is yours!

a.) Ranked Wild (bot) - average 10 SPS per day (7.36%)

b.) Ranked Modern (manual) - average 10 SPS per day

c.) Voucher - average 1.2 vouchers per day (~3 SPS)

d.) SPS Staking (13.28%) - This used to be high and is expected to go down as more gets staked.

e.) Rental yield (%)- Extra cards? Rent it out! Although rental market went down, this has potential. Currently have around 100 DEC per day (Php~5)

f.) SPS Delegation/Rental - can give around +6% more yield if you have unused sps (not active in ranked rewards)

g.) Land rewards - currently gaining grain which is not yet tradeable to fiat right now. May have more utility soon.

h.) NFT sales - Splinterlands cards are all NFT. I haven't sold any of my cards yet though as I hope everything else will go up in the right time.

Except for (b), everything else is passive income!

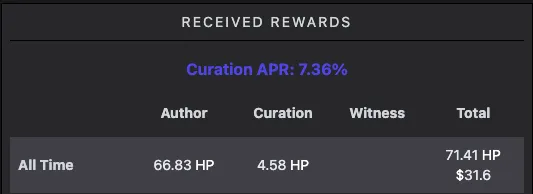

4.) Hive Staking (Hive Power) and Curation Rewards

Simply staking your Hive already gives an APR of 2.8%.

I haven't been active into Hive blogging. Looking back, I wish I had myself onboarded with a mentor. Anyway, considering the few posts I had, it's still interesting to see how much rewards were gained. I have joined around 2 curation trails to be optimal in my HP usage. In a way, without applying too much pressure into blogging/curating, there are still earnings. Another APR of 7.36% to gain (could be higher).

Multiple Options available in Hive

Not sure if I'm able to capture all my yield earnings so far. One challenge with crypto investing is on how one can track earnings and cost. Would you know of any app (i.e. accounting) that can handle that?

Anything I've missed on my list that I could also be earning from? Or probably other worthwhile yields you recommend? In this Proof-of-Stake world, happy to invest more!

Screenshots taken from the ff sites:

hivestats.io

Splinterlands

coingecko