DeFi accounts for 50 Billion Dollars in assets deposited in lend platforms Aave, Compound and MakerDao.

source

A recent post by @khaleelzaki the founder and Leofinance, and a recent AMA clip explained the coming feature of Collateralized loans to the Leofinance PolyCub protocol on Polygon.

I wrote a post explaining the special safety features for investors in the Lending portion of PolyCub, and as always investor safety is a big priority with Leofinance projects, all are forks of time tested projects like PanCakeSwap, and CertiK Audited.

Then I asked myself how big is Collateralized lending, and is it declining in popularity? Are investors still putting their money into it? Or is there some other Next Big Thing siphoning off investors investment dollars.

Dune Analytics

I started researching whether lending was growing, and I found it had continued to grow since it started back in the summer of 2020, and in one year it went from millions of USD to billions, breaking the one billion dollar in total value invested in the summer of 2021. Since then it has continued to grow, but just not as fast. The point when DeFi broke one billion dollars in TVL has been surpassed by current figures as of January, 2022 of over 50 billion dollars deposited.

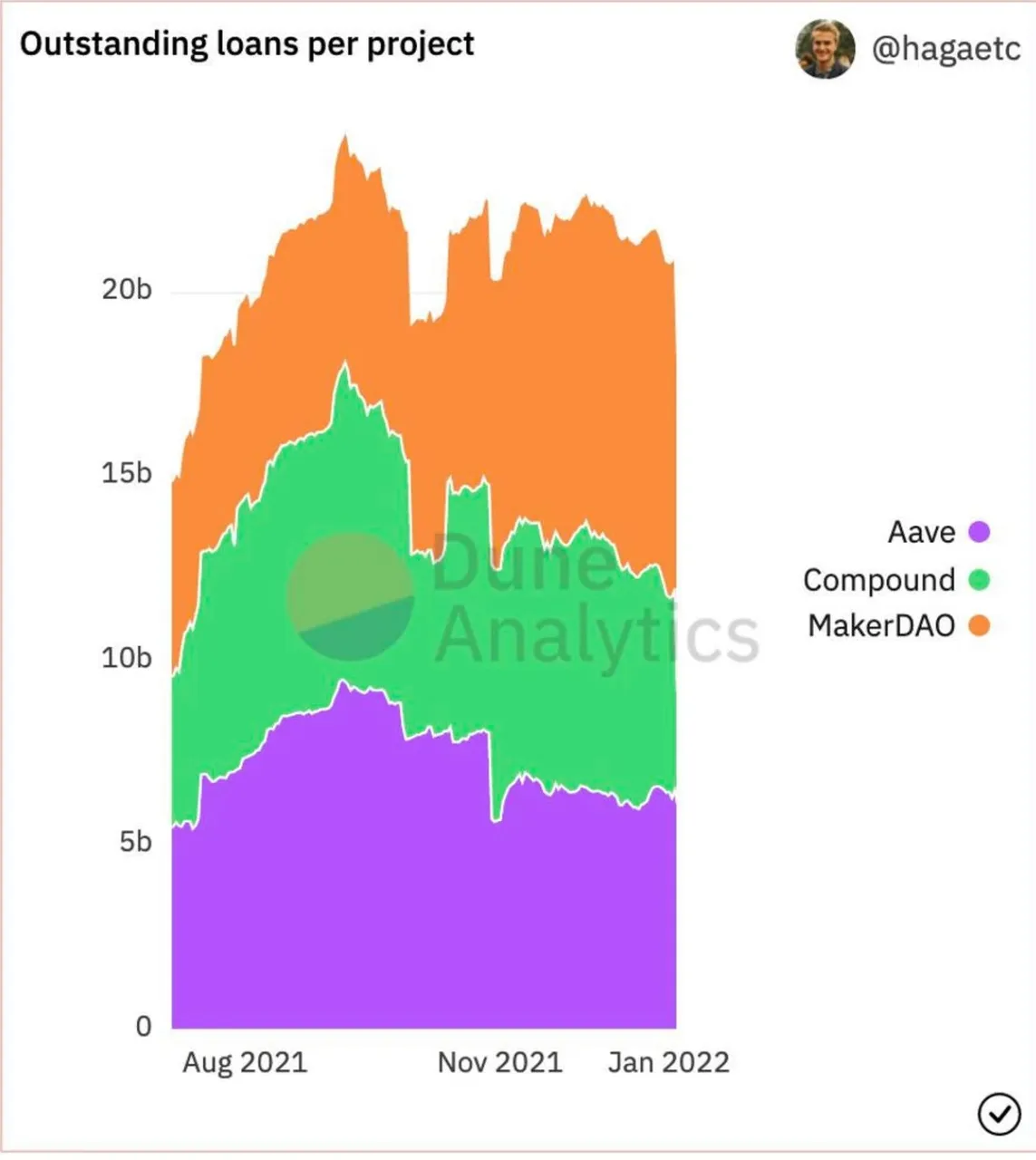

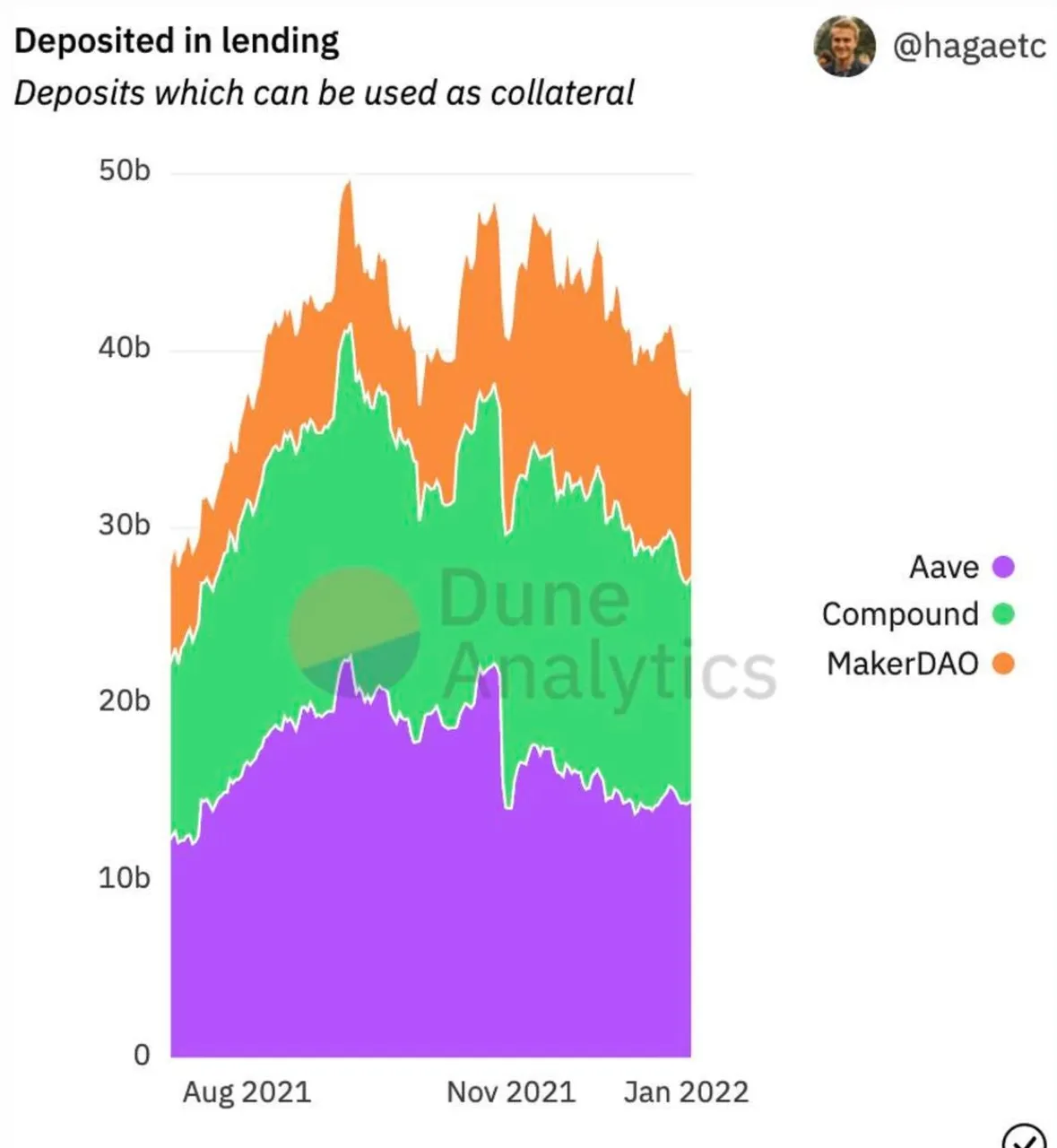

These two graphs below are from Dune Analytics, by way of Twitter personality @hagaetc

The first is the amount of loans which is between 20-30 billion, and the second is the total value of assets deposited, which is between 40-50 billion. So the average investor appears to borrow a very conservative 50% of their position. Which would be extremely safe and allowing for up to a 50% price drop in assets before a liquidation would occur.

Total Value of Loans.👇

Total Value of Assets deposited.👇

The Top Lending Platforms

Lending Projects include names like MakerDao, Compound, Aave, Abracadabra, PhoenixDAO, Alchemix, Venus, Mango, Nexo and Unchained Capital.

And the number of projects offering some type of lending is growing, but they seem to be a smaller number of projects then your typical exchanges or staking and earning projects. Lending projects seem more stable, feature steady growth and appreciation of their token.

While many loans are based on potentially volatile assets like Bitcoin or Ether, but many deposited assets are Stablecoins and their deposits are practically 100% safe, barring rug pulls, and a few are insured.

The growth in the platforms size and revenues have lead to bigger teams and improved security.

This has also given rise to other induries such as contract auditing firms who specialize in removing vulnerabilities to hacks, and insurance companies who insure crypto investors against losses.

While the reputation of cryptocurrency as being the wild Wild West of finance lives on, and robberies do occur. Life for investors in large platforms is relatively boring and safe.

I am encouraged by the inclusion of Collateralized lending on PolyCub, and I am happy that this feature will one day be available on Cubfinance. I think it demonstrates maturity of the project, and a tool for wealth creation within our Hive-Leofinance Community.

Khal let the Lion Roar!

@shortsegments