What is rehypothecation and how does it effect the price of Bitcoin...

What is rehypothecation and how does it effect the price of Bitcoin?

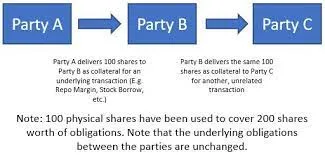

Rehypothecation is a practice used by banks and financial institutions that allows them to use the same assets, such as stocks or bonds, more than once.

In other words, they can use the same assets as collateral for different loans at the same time.

This practice is similar to fractional banking, which is when banks lend out more money than they actually have on hand.

source

Rehypothecation Pros and Cons Pro

Often leads to lower costs to borrow funds Helps promote efficient use of capital in markets and institutions Generates higher profitability when rehypothecation is successful Allows risk-seeking investors to leverage capital source

Cons

Results in potentially not transparent practices May be unsettling to customers who do not want their assets touched Often increases the risk of default May entice bad actors to misuse assets source

Rehypothecation's effect on Bitcoin Price

Rehypothecation can have a big impact on the price of Bitcoin, which is a decentralized digital currency.

Bitcoin is different from other currencies because it is not controlled by any government or financial institution.

This means that the supply of Bitcoin is limited and its value is determined by supply and demand.

When a financial institution uses assets as collateral for multiple loans, it increases the supply of those assets and reduces their value.

This is because the assets are being used in multiple places at the same time, instead of being held in one place as collateral for one loan.

This same principle applies to Bitcoin.

When Bitcoin is used as collateral for multiple loans, it increases the supply of Bitcoin and reduces its value.

Rehypothecation also has the potential to create a chain reaction of sell-offs in the market.

If one loan goes bad and the borrower can’t repay the debt, the lender will sell the assets they have as collateral, including Bitcoin.

This can cause the price of Bitcoin to drop, which could lead to more sell-offs and a further drop in price.

Last Words

You now understand that rehypothecation is a practice that allows banks and financial institutions to use the same assets more than once.

This practice can have a big impact on the price of Bitcoin, which is a decentralized digital currency.

When Bitcoin is used as collateral for multiple loans, it increases the supply of Bitcoin and reduces its value.

This practice is similar to fractional banking, which is when banks lend out more money than they actually have on hand.

It is important to be aware of these practices and their potential impact on the value of Bitcoin.

That's it.