Bonsai Portfolio

The bonsai tree is a fascinating representation of compound growth, embodying the principles of patience, care, and precision. Originating from ancient Asian traditions, bonsai cultivation involves pruning and training small trees to create a miniature version of a full-sized tree. This process requires time and skill, reflecting both the art and science of horticulture.

The concept of compound growth in a bonsai tree mirrors real-life situations where small, incremental improvements can lead to significant results over time. Just as a bonsai requires consistent attention to flourish, individuals and organizations can achieve their goals through steady, cumulative efforts.

By nurturing a bonsai tree, one can appreciate the beauty of both nature and the process of growth, making it a profound symbol for personal and professional development.

1. Amazon (AMZN)

In 1994, Jeff Bezos established Amazon as an online book retailer. The business has grown to become the biggest online retailer in the world.

Bezos remains the third richest man in the world today, holding 12.3% of Amazon.

The business will be around in 50 years because:

- Amazon is the industry leader in e-commerce.

- AWS, their cloud division, is expanding at incredibly appealing rates.

- Loyalty is fueled by Prime subscriptions.

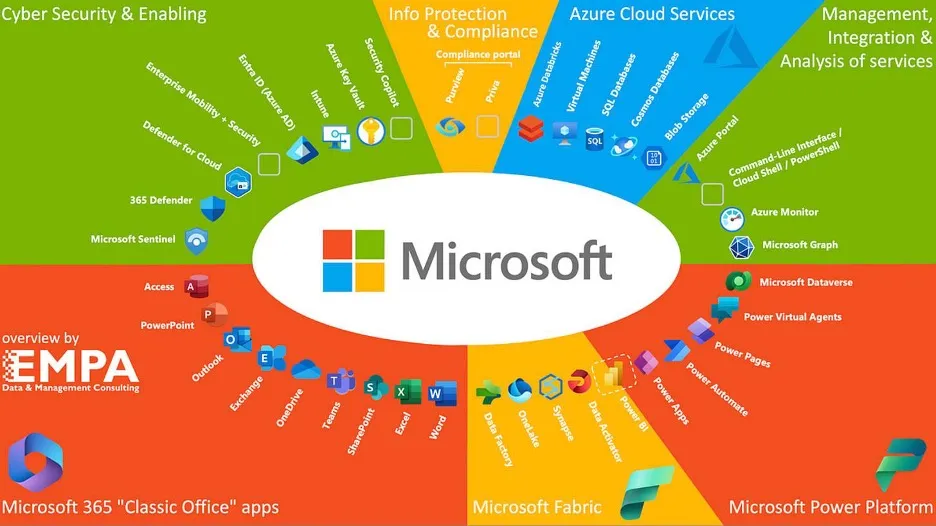

2. Microsoft (MSFT)

Windows is the most used OS in the world for desktop and laptop computers at over 70% market share. They also have an entrenched ecosystem of programs like Word, Teams, OneNote, Excel, PowerPoint, OneDrive, and others.

The cloud is without a doubt Microsoft's largest growth engine. Microsoft Azure is a platform for cloud computing that provides services for networking, AI, analytics, storage, and computing.

The business will be around in 50 years because:

- There are many prospects for growth with Microsoft Azure.

- Clients are incredibly devoted.

- The business is making a lot of money for its owners.

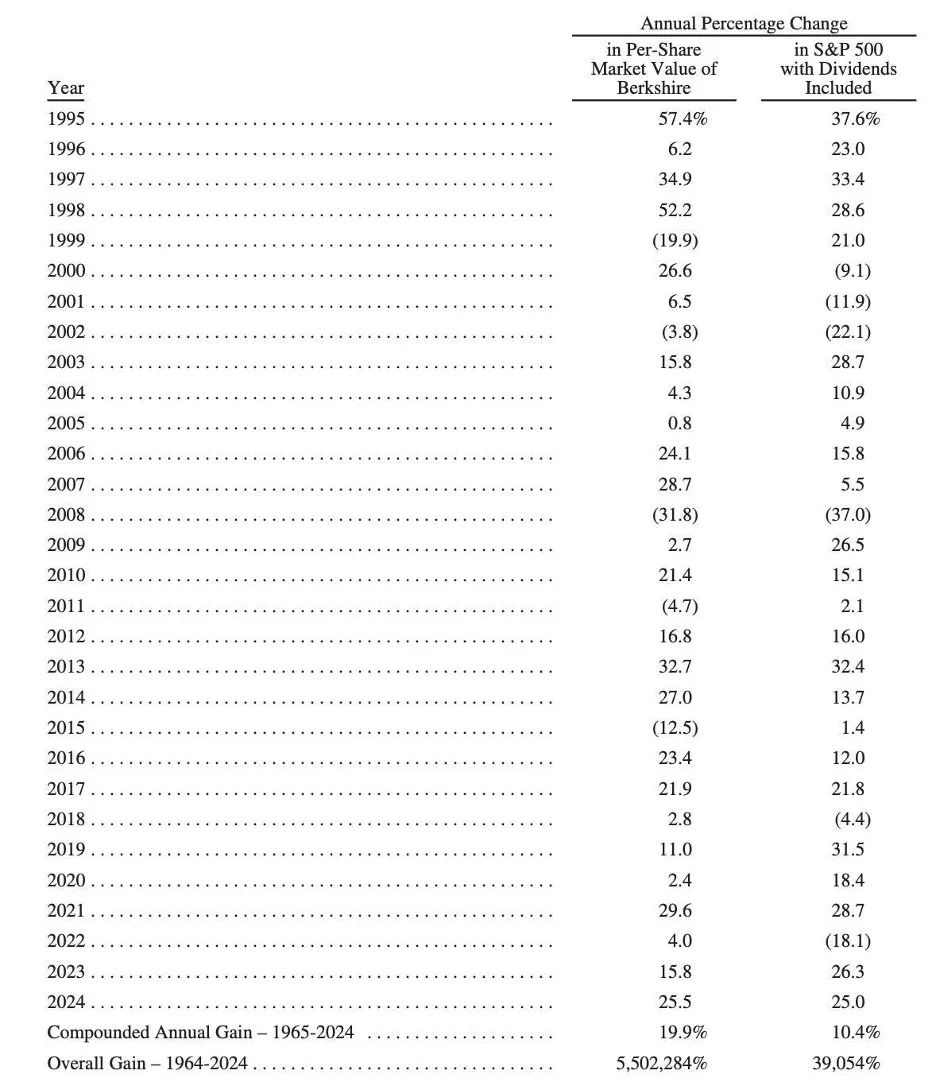

3. Berkshire Hathaway (BRK.B)

Berkshire Hathaway is a great choice since it is like watching paint dry when you invest well.

The greatest investment conglomerate in history is Berkshire Hathaway. In 1964, a dollar investment would have been sufficient to purchase a BMW today.

The business should be able to outperform the market by a little margin even when Warren Buffett leaves.

The business will be around in 50 years because:

- The greatest investing conglomeration in history

- One of the world's greatest corporate cultures

- Constant attention to generating wealth for shareholders

4. Visa (V)

Visa is a multinational provider of payment technology. Through a network of branded credit and debit cards, they offer electronic payment solutions.

Similar to Mastercard, Visa's primary role is to run a payment network that links banks, cardholders, and retailers.

The merchant pays Visa a fee to process the transaction when you make a purchase using Visa.

The company's payment network handled 276 billion (!) cash transactions and payments last year. This indicates that 757 million transactions were made using Visa every day.

The business will be around in 50 years because:

- In an industry that is expanding quickly, Visa has a sizable market share.

- A net profit margin of 52.9% indicates extremely high profitability.

- Trying to compete with Visa and Mastercard is nearly impossible.

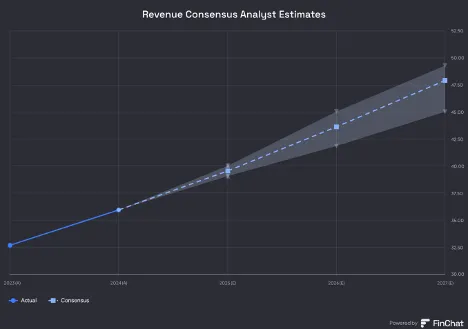

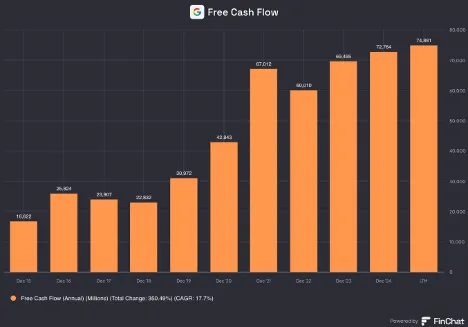

5. Google (GOOGL) Alphabet

Alphabet, the parent company of Google, generates revenue through online advertising on YouTube, its search engine, and other platforms.

Additionally, they make money from cloud computing services such as Google Cloud. Through its venture capital division, Alphabet makes investments in cutting-edge initiatives and companies, including as medical sciences and self-driving cars.

The business will be around in 50 years because:

- Unchallenged leader in the online advertising market

- Over half of the votes are still cast by insiders.

- A highly profitable cash flow machine

6. MercadoLibre (MELI)

MercadoLibre is an online marketplace. The business plan is comparable to that of Amazon.

They began in Latin America and currently provide services to numerous nations in the region. Consumers purchase toys, clothing, electronics, and other items. Additionally, MercadoLibre offers a payment system called Mercado Pago that makes it simple and secure for customers to make payments online.

The business will be around in 50 years because:

- Controls the rapidly expanding Latin American e-commerce market.

- FinTech companies are expanding quickly and making large profits.

- Estimated EPS increase over the long run: 16.5%

7. Kelly Partners Group (KPGHF)

Kelly Partners Group is an accounting sector serial acquirer.

The Australian firm provides chartered accountancy and consultancy services to high-net-worth individuals and private companies.

KPG's founder and CEO is Brett Kelly. He truly is an absolute Buffett fan in the best possible way. The Kelly Partners Group is currently making significant inroads into the US market.

The business will be around in 50 years because:

- Nearly half of the shares are still owned by Brett Kelly.

- Many potential for reinvestment

- Serial acquirers find the accounting sector to be very alluring.

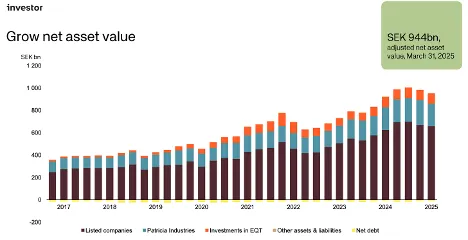

8. AB Investor (IVSBF)

Founded in 1916, Investor AB is a holding corporation based in Sweden. Major Swedish corporations like ABB, AstraZeneca, and Atlas Copco are owned by them.

What is so intriguing about this holding company? As an investor, you are constantly searching for businesses that offer the highest potential returns at the lowest possible risk.

Investor AB possesses both:

Creating value for shareholders: Over the last ten years, Investor AB increased its intrinsic value by 12.2% annually.

Minimal risk: A balanced and well-diversified portfolio

The business will be around in 50 years because:

- Investor AB owns dependable, superior businesses.

- An extensive history spanning more than a century

- Investor AB is still in the Wallenberg family's ownership.

9. LVMH (LVMUY)

LVMH is a luxury goods manufacturer and distributor with a global presence.

Under the leadership of Bernard Arnault, the French corporation is a major player in the luxury market. They encompass a broad spectrum of consumer goods and experiences.

Around the world, LVMH runs over 5,000 outlets. After Hermès, it is the second-biggest company in Europe.

Just their purses proved to be a wise purchase. A Louis Vuitton bag cost $150 in 1979. That same bag was valued at $1,490 in 2022.

The business will be around in 50 years because:

- Luxury is always in style.

- The expanding middle class in Asia will help LVMH.

- Outstanding company with a focus on shareholders.

10. ASML (ASML)

Among the most significant corporations globally is ASML.

They construct the devices that produce computer chips. These chips are the little brains that power your laptop, phone, and even automobile.

Their machines are quite sophisticated and precise. This is the unique quality of ASML. We all depend on chips every day, and the company helps chipmakers make them faster, smaller, and more powerful.

The business will be around in 50 years because:

- High profitability and many prospects for reinvestment

- ASML's industry dominance

- Growing demand for chips worldwide in the coming years

Disclosure: The author currently has no plans on purchasing any stock mentioned at this time. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.