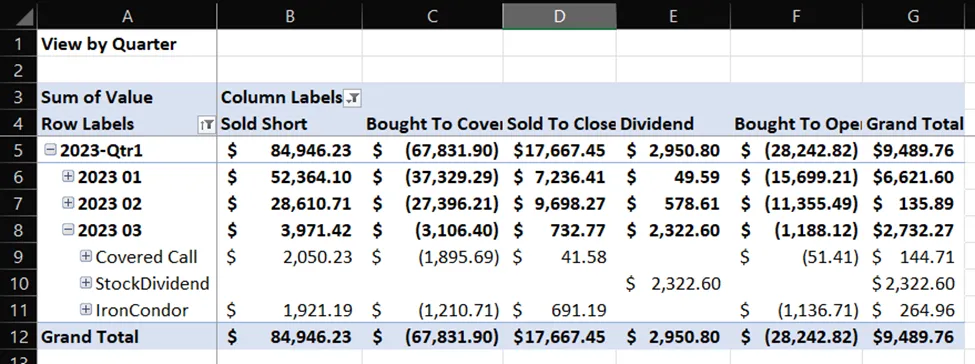

2023 Options Summary - Week #09 (as of March 4, 2023).

Where does this data come from?

- My ETrade Transaction History (copied and pasted)

- Excel Table with a few extra attributes I need to pivot and filter data by on Trade Type.

- I track all my Options, Trades and Dividends.

- Pivot Table used to Present the data you see.

Trade Volume or the dollar amount is not important, only the difference between the two.

If I open a trade for $10,000 and close it with the value of $10,100 then I only made $100 minus the fees and commissions!

As an Option Traders, I track my profit/loss based on the type of trade made. This can get confusing if a covered call gets called early (assignment). To make this much easier, I often roll my covered calls before that would happen. I will not do the wheel strategy.

I will do plenty of Iron Condors or Spreads.

As of March 4, I had eight (8) winning weeks and one losing one (week #5). I lose money when the markets were moving UP and UP in January. I decided to close the position and take my "L". However, February was mostly was a downtrending month and gave up some of January gains.

This helps in my covered call positions so that many of my CC are OTM (Out-of the Money). My Iron Condor are often a "delta-neutral" position or non-directional bet.

During Week #10 the markets dropped nearly 5%. This isn't good for short-term option traders unless you are on the right-side of the trade. I have position my portfolio to use 2 or 3 month before expiration and my risk to GAMMA is much less. However, even in a week where the move is 5%, you need to keep an eye on your position. The 5% move in the markets is often a two or three-deviation move (and that is what causes your options to go for profitable to unprofitable trade).

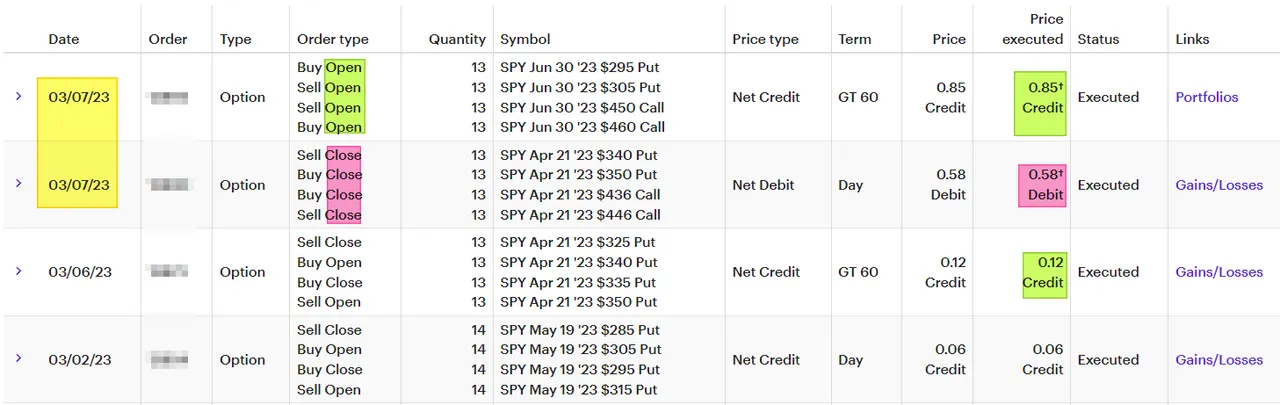

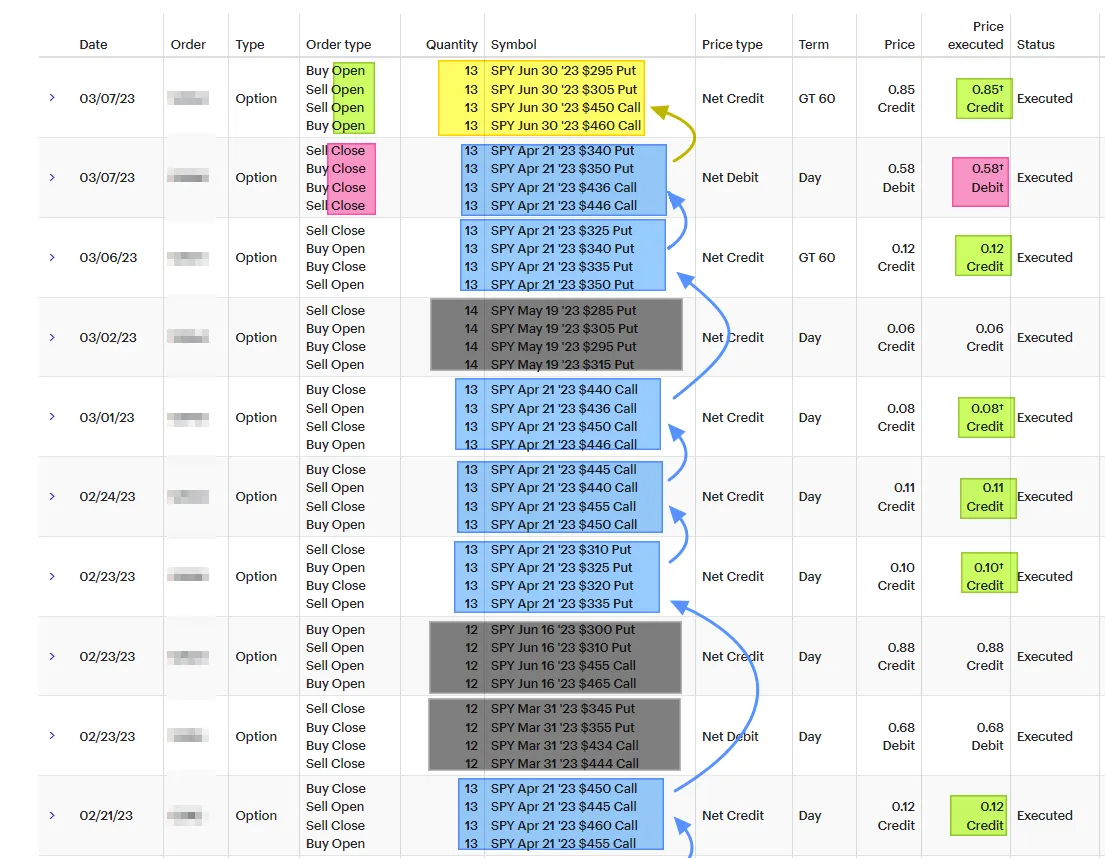

March 7:

- Closed Apr 21 Iron Condor for 0.65!

- Open Jun 30 Iron Condor for 0.85

How did I make money on the April 21 Iron Condor?

- Follow the Blue Box Trade ("13" contracts).

- Closed the Bloe Box on March 7.

- Open Yellow Box on March 7; which is the Jun 30 Iron Condor Trade.

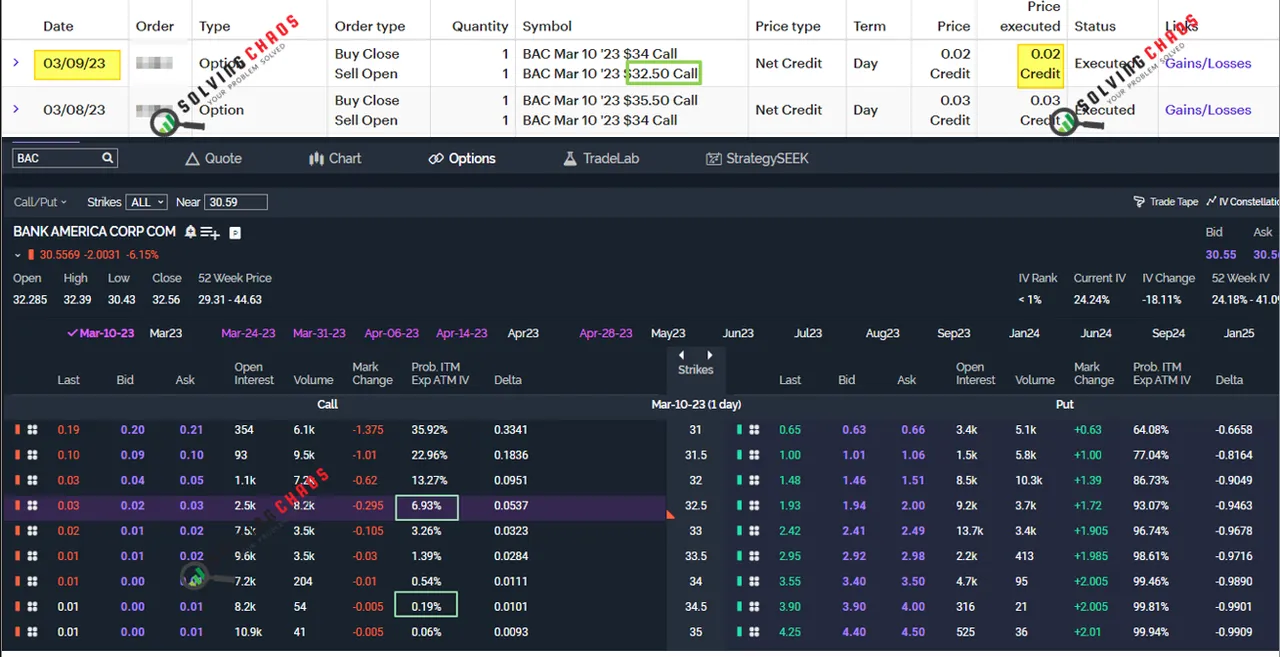

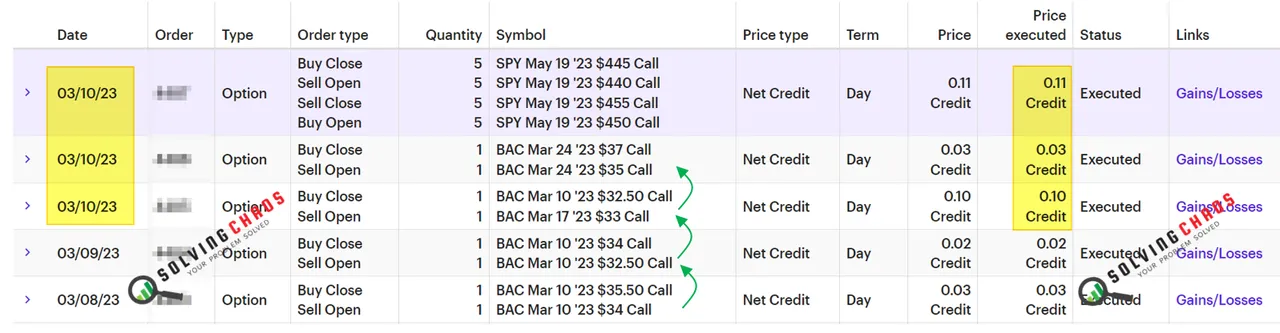

Mar 9:

- Rolled BAC Covered call Down for more risk

- Moved from a 1 DELTA to a 6 DELTA position.

- Collected $0.02 (or 1 dollar after FEES).

Mar 10:

- Rolled BAC Covered call Up and Out (Mar 10 --> Mar 17).

- Rolled BAC Covered call Down (Mar 24 $37 --> Mar 24 $35).

- Adjusted "5" Iron Condor. Added Risk on the CALL Legs by lowering Strike Price by 5 dollars.

Add these trade data (Week #10) will be added to my Excel, and the data will be update in a future post.

Solving-Chaos

Let do this 1 dollar at a time!