2025 Aug 1 - Investment moves

- Aug 1 RED Day

- Aug 1 Investment moves

- Adjusting Portfolio - Slowly

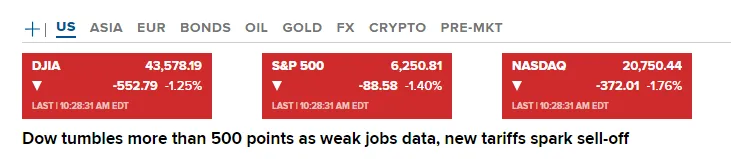

Aug 1 RED Day

When markets are #red, you still need to make moves that either protect your gains or position yourself for future gains.

The markets are still near all-time highs after a good run in June and July.

Losing 1% today is not bad when the markets went from about -10% for the year to over +10% for the year.

Aug 1 Investment moves at 10:30 am (EST)

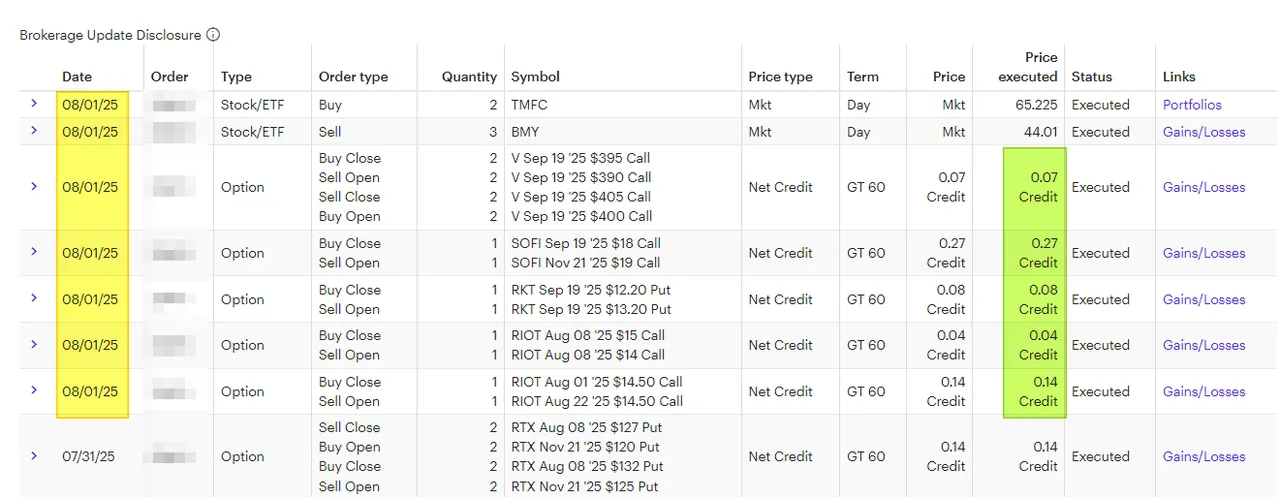

My trades as of 10:30 am (EST) are listed below:

- Dividend (from BMY) - sold off 3 shares of #BMY, and swapped into #TMFC. This is a long-term play that TMFC will outperform BMY, while trimming the position size in BMY.

- #Visa Iron Condor - Added more risk by lowering the Strike price.

- #SOFI Covered call - Rolled up and out for $27.

- #RKT cash secured put - Rolled up for more risk for $8 in premium.

- #RIOT covered call - Rolled down for more risk.

- RIOT covered call - Aug 1 Option will expire #worthless in my favor. Rolled it out for 3 weeks for $14 today.

Adjusting Portfolio - Slowly

The concept of "DCA" (Dollar Cost Averaging) is easy to understand in a 401K plan when you purchase shares when new FUNDS are added from your paycheck with each pay cycle. Over the years, you purchased ETFs/Funds when prices were up or down.

In a stock portfolio with dividend payments, the dividends are the "new funds that are doing the DCA". I have been using the default of reinvesting the dividends for over a decade now. At some point, the position size can increase to more than you like. In my case, I get about $12K a year in dividends, but I add ZERO cash into that "old" account. The only account that I add new FUNDS for is my Current 401K plan.

This is one reason why I'm selling off the dividend and slowly buying new shares in other stocks/ETFs.

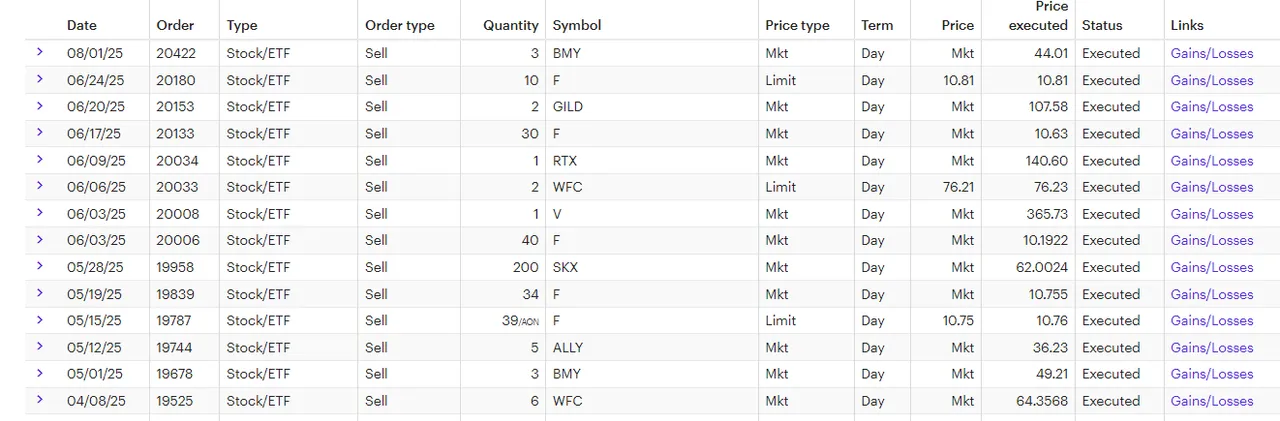

Here is a list of the stocks I sold recently:

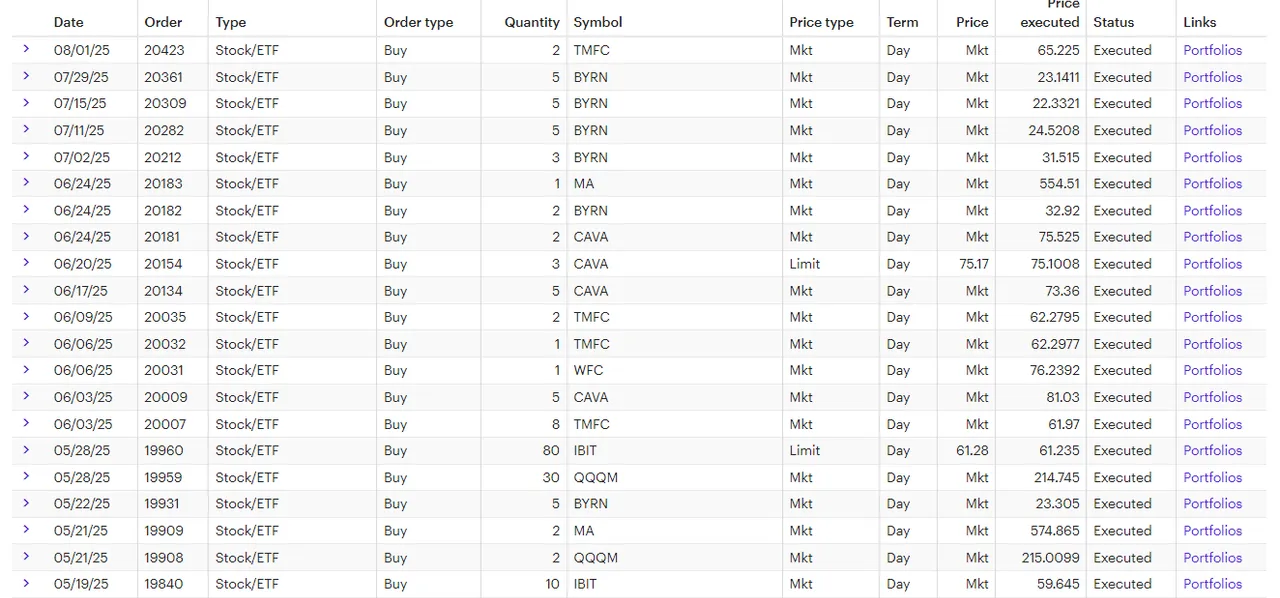

Here is the list of the stock I bought recently:

The pattern is clear. I'm selling stuff that is a BORING dividend companies (even good ones like RTX, V, and GILD) and switching them into more risky holdings like QQQM, IBIT, CAVA, BYRN, and TMFC.

My goal is to get more into QQQM, IBIT and TMFC. I want to focus less on "single stock" holding and more on indexes that will do well over 2 decades. This means that my bet on CAVA and BYRN will be small position sizes and won't have a big impact on my core holdings.

Regards,

Solving-Chaos