2025 - Week 29 (Week ending July 19) - Investment Update

- Week 29 results

- SKX - Explained (2021 to 2025)

- Most Profitable Option Trade from 2023 to Now

- Worst Loss Option Trade from 2023 to Now

- Bitcoin last 7 days (and last 30 days)

- Mid-July Investment Update.

Week 29 results

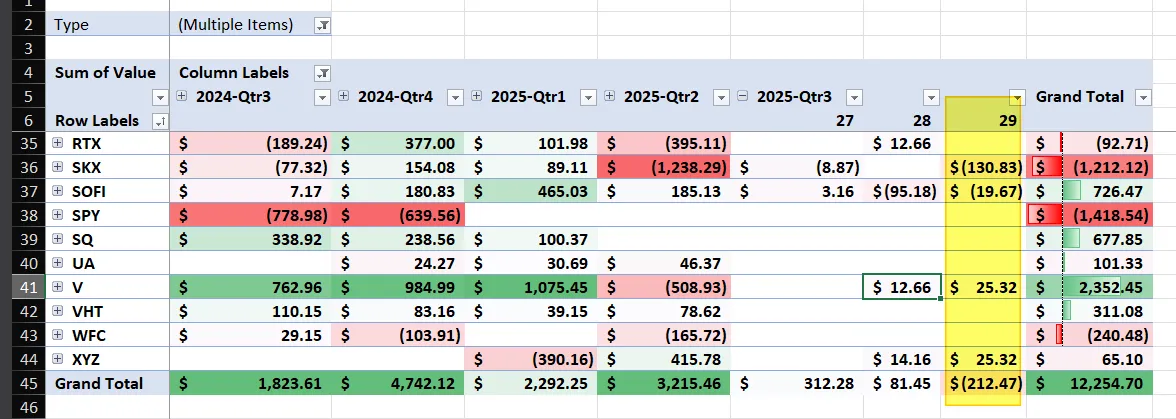

For the week of July 14 to July 19, I lost $153. If you remove the $59 in #dividends, I LOST over $212 this week.

If you go into the details, here is what it looks like when pivoting based on the TICKER Symbol for week 29.

You can see that the Grand Total for week #29 is $-212. SKX lost me $130 in week 29, and I lost over $1,238 in Quarter 2, 2025. What happened and why?

SKX - Explained (2021 to 2025)

If you zoom out, the STOCK #SKX (Skechers) has doubled over the last 5 years. The stock POPPED from 47 to over 62 on the news of the company getting purchased. The result is I lost some money on the option side, but it was offset by the STOCK gain of the underlying.

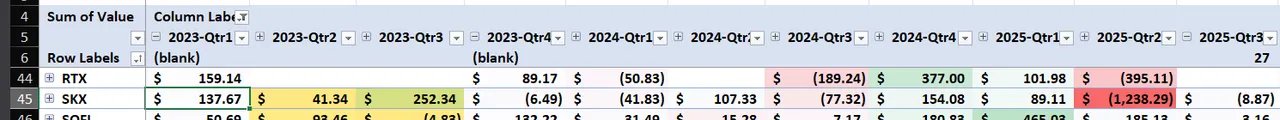

I got into Skechers at under $40 a share. I held on because the shares and the option were PROFITABLE for me to continue to trade around that HOLDING. You will see that with the screen captures I provided below.

I made over $600 in option premium from 2023-2025 (QTR 1) before the $1200 loss.

If I zoom out and include data from 2021, you can see that I made over $1100 in OPTION profit from SKX (including the 2025 YTD).

This data is from a PIVOT table, so the Grand Total is based on the filter rows. My normal view is showing the last "2 years" of data, so it looks like my SKX was a bad investment because of the $62.50 buyout offer. But when I included the data from 2021 to TODAY, the pivot data shows SKX has always been a profitable trade for me.

Most Profitable Option Trade from 2023 to Now

The best REASON to track all your trade data into an Excel TABLE is the ability to view the data in hundreds of ways. Let's change that and show the data by the MOST profitable from 2023.

Update the FILTER to "2023 to now".

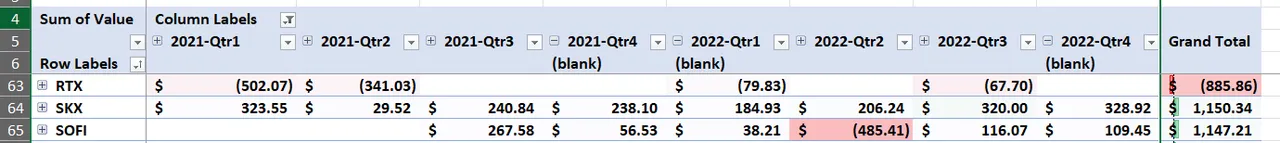

Change the sort order to "Grand Total".

On this list, only 4 out of the 6 items were Tickers that I traded in the last two quarters (Q2 and Q3). SPY was last traded in Q4-24, and SQ (Square was last traded in Q1-25. Square had a ticker change to XYZ, and it is now listed as XYZ on my pivot table.

Out of the active tickers, RIOT is the big dog with over 5K in the last 18 months. That does not surprise me because when BITCOIN moves, so does the increase in Option premium.

SPY is on the list even without any trades in the last 7 months. The reason is from Q1-24, with a 4K profit. How is that possible? I used to do trades in SPY using 2-3-4 (9K BP) and 12-13-14 (39K BP) set of contracts. That means I was using nearly 50K in Cash Buying Power to put those trades on. However, I stopped doing that because I was taking too much risk on ONE ticker.

Ford (F) is a surprise hit because I don't get much PREMIUM when I roll the options. The one thing I'm learning with Ford Option is you can't open Option with 1 (<5 day) or 2 (<14 day) weeks before expiration. Those covered calls don't pay enough premium to even take that position. Instead, I have learn that if I use 2 or more months out in time, then the income is stable. You have to ladder into it using this method for several weeks, and when I roll (close and adjust new position), it has to be 8-12 weeks out. I will continue to monitor this to see if I can make between 400-600 in Q3-2025.

LFUS has been a stock that trades in a range (between 190-260). The option return of 2K over 18 months is not bad if you view this as a 6%-8% yield per year. This play was mostly because I see the CAR industry play for power train and the iPad-like center console.

MRVL is a chip play. This is much easier than the NDVA or AMD play. MRVL does not move as much as those other two popular stock. I'm not surprised that the option profit is in the top 6.

Worst Loss Option Trade from 2023 to Now

Now let's look at the opposite side of the chart:

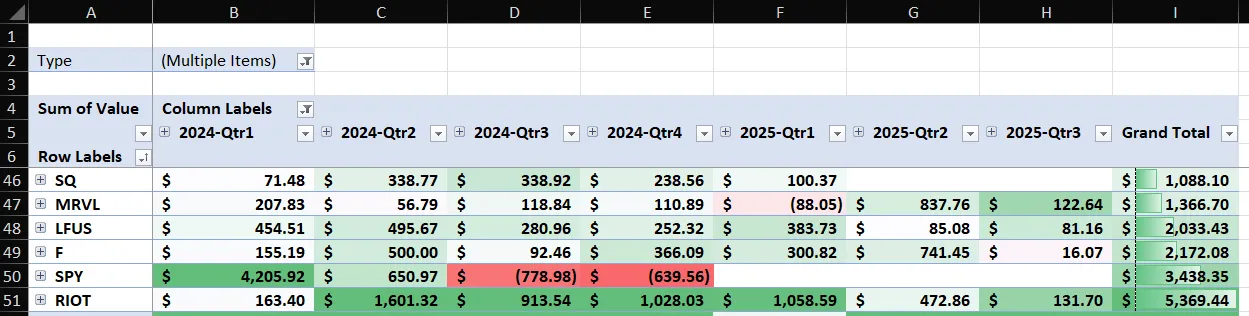

What is interesting in this dataset is that most of these stocks have moved up over that period. This suggests that my covered call has moved from OTM (out of the money) and moved to ITM (in the money).

The bank stock losses were because I moved the strike price down, and then the sector moved UP (or recovered) faster than I expected. This means that I'm spending CASH to ROLL the covered call UP (in Strike Price) and OUT (in time).

RTX has moved up because of the global conflicts going on between Russia/Ukraine and Israel/surrounding area. My covered calls are #DEEP ITM.

NET (Cloudfare) is a great company.

Back in May 2025, my covered call was at $87.50 --> moved to $90!

Back in June 2025, my covered call was at $90 --> moved to $92.50!

This week (July 2025), my covered call was at $92.50 --> moved to $100!

In the last 3 months, I spent ~$271 to move the covered call strike price from $87.50 to $100 (or $12.50/contract or $1250) in my favor. If you reduce that CASH out of pocket, that means I'm making about $1K in profit more than if I did nothing to adjust my position.

This is what most beginners or those who don't track their trade HISTORY, don't understand. Adjusting a LOSING position can reduce the "PAIN" and often it is worth trading in CASH today for making more in Total Value (or more accurately stated as LOSING LESS MONEY in the FUTURE).

Bitcoin last 7 days (and last 30 days)

The big news of the last 7 days is #Bitcoin hitting new ATH. It has moved back down a bit, but the news hit all the News, Social Media, and Finance magazines.

The demand for #BITCOIN has increased from spot ETF like #IBIT, #FBTC, #GBTC, and Bitcoin Holding Companies like #MSTR, #MARA, #RIOT.

Talking about Bitcoin holding, keep an eye on the top 10-15 companies:

Everyone knows about MSTR(#1), Metaplanet (#1 in Japan), Tesla (#8), and Coinbase (#10). But it might be an opportunity to follow other companies that have not MOVED, even if they hold lots of BITCOIN (like MARA Holding and RIOT).

Mid-July Investment Update.

I am excited about the market opportunities in July 2025. Here is why:

- The stock market is at or near all-time highs (ATH).

- My 401K plan is still buying more with each paycheck.

- My ESPP plan is buying more STOCK at a 15% discount, which in turn gives me more DIVIDENDS.

- My options trading profits - added 4 shares of IBIT in one account so far.

- My dividend rotation method - added 15 shares of BYRNA TECHNOLOGIES and 5 shares of PROSHARES BITCOIN ETF so far in JULY.

- BITCOIN reached an ATH this week. I will buy for the next 10 years or more.

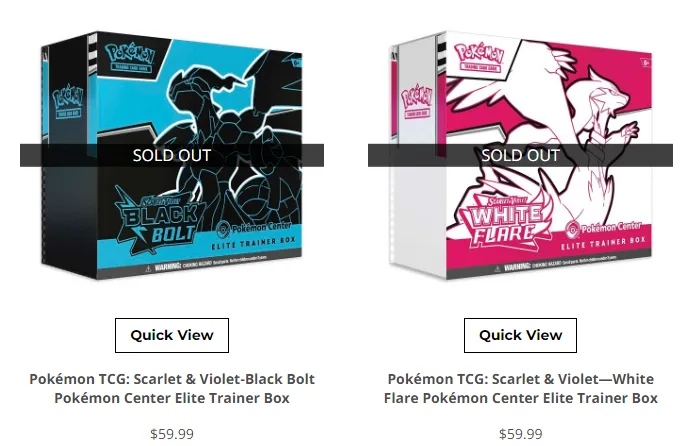

- Pokémon Black Bolt and White Flare were released on July 18. I got the PC ETB (Pokémon Center) and Regular ETB.

- I am looking forward to 2026 with Mega Era and the 30th Anniversary.

I still believe that these Trading Cards (#TCG) are good "Collector" items, and they're more popular than sports cards. The traditional sports card industry is mostly for MEN, but Pokémon has a global audience with about 30% FEMALE, and kids are also part of the target audience.

The ROI of the Assets of Pokémon products can be 20%. So on average, these assets can outperform the STOCK MARKET and REAL ESTATE. I just started this in 2025, and I don't have years of DATA to back my claim.