2025 - Week 31 (July 30) - Investment Update

- July 30 Investment moves

- Visa Trades Explained

- LFUS Trades Explained

- Long 401K, Options for Income

- TCG: Pokemon Cards

July 30 Investment moves

Visa Trades Explained

On July 29, Visa reported after the market closed. They beat expected EPS guidance, and it tells a story that consumers are still using their credit cards.

Their shares are up $4 today to $355.

Here are my investment moves:

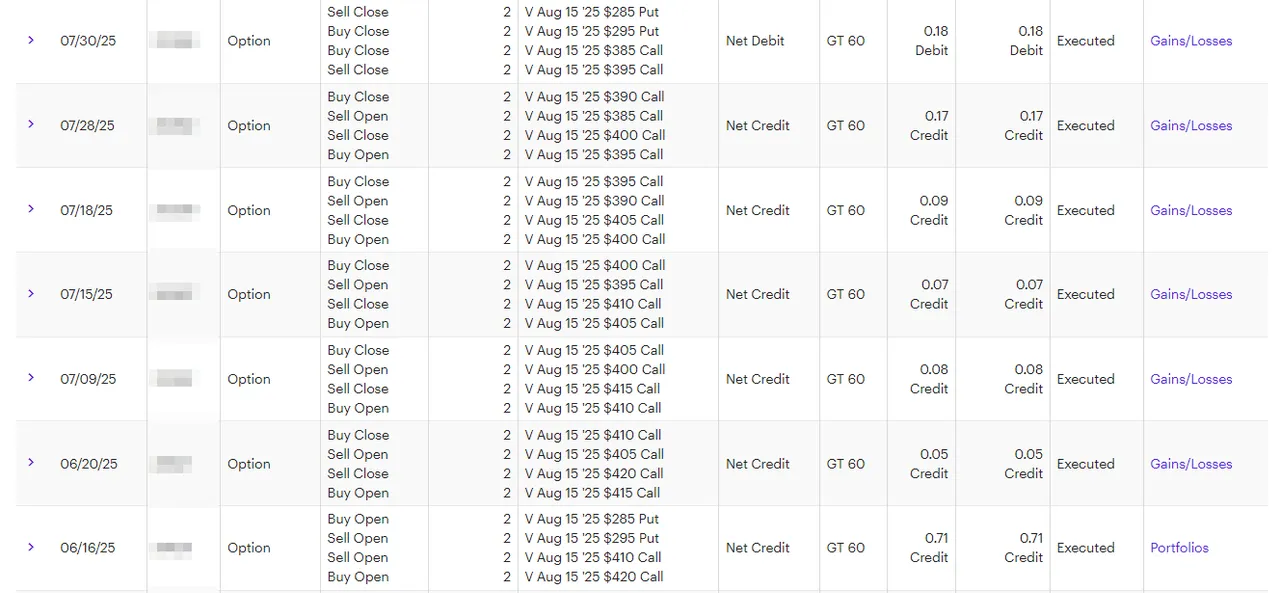

- On 6/16 I opened an Iron Condor on Visa for $0.71 ($71) per contract.

- On 6/20 I rolled the Call side for $0.05 ($5)

- On 7/09 I rolled the call side for $0.08 ($8)

- On 7/15 I rolled the call side for $0.07 ($7)

- On 7/18 I rolled the call side for $0.09 ($9)

- On 7/28 I rolled the call side for $0.17 ($17)

- On 7/30 I CLOSED the IRON Condor for $0.18 ($18) per contract.

- On 7/30 I OPENED an Iron Condor on Visa for $0.62 ($62) per contract.

I have a covered call on Visa:

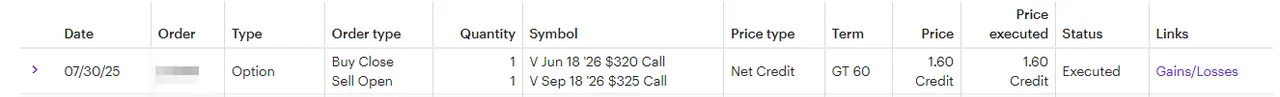

- Closed the June 2026 Covered call $320 strike price

- Sell to Open Sept 2026 Covered call $325 strike price.

- Net $160 in cash today.

- Gain a potential $500 in strike price movement in my favor as long as Visa is above $325 in Sept 2026.

LFUS Trades Explained

What happens if a stock POP after EARNINGS? Visa did not move much, and the IV dropped like a rock. So, I ended up closing the Position on Visa since there was much profit to be made if I waited until August 15.

However, LFUS is a different story:

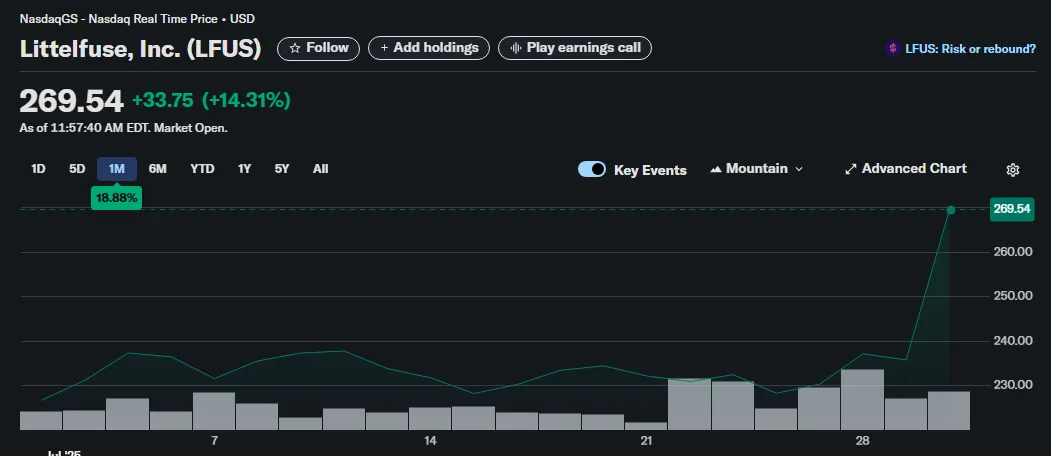

The stock moved 14% today, which means OPTION has a big moves also.

I have 1 LFUS covered call for DEC 2025 at $270 strike price. This means I will most like cap my upside if I wait 5 months from now. In order to reduce that RISK, I will adjust the position by ROLLING the covered call UP and OUT.

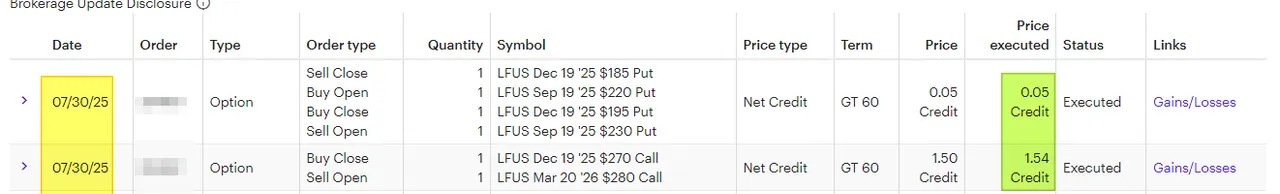

- Close Dec 2025 $270 strike price covered call

- Open Mar 2026 $280 strike price covered call

- Collected $154 in CASH Today.

- My upside is now at $280 rather than $270 (a potential of $1K more).

On the PUT side, I had a PUT credit spread for DEC 2025 at 185/195. That position is profitable and near MAX profit. I ended up moving the PUT to 220/230 and reducing the time by 3 months. This gives me less risk of dropping back down. I collected $5 cash today.

My goal is to have an offset position with the concept of making money when the STOCK stays within a range. Now my range is $230 (Put Credit Spread) to $280 (Covered call). The worst is you LOSE on one side of the trade, but NEVER on BOTH sides of the trade.

Long 401K, Options for Income

I will be 100% long in my 401K plan. My Options are for reducing risk using covered call, Put Credit Spread, and #IronCondors. I mostly #SELL #options and make money on the TIME DECAY.

The #dividend side of my portfolio has been collecting dividends for over a decade. I now sell the DIVIDEND and buy GROWTH stocks like QQQM, IBIT, WING, MC, CAVA, and a few other positions.

This will serve me well going into the next 5-10 years. I would expect my GROWTH from the portfolio to come from companies that are 2x-5x in size. This is why it is important to have QQQM/SPY ETF in your portfolio.

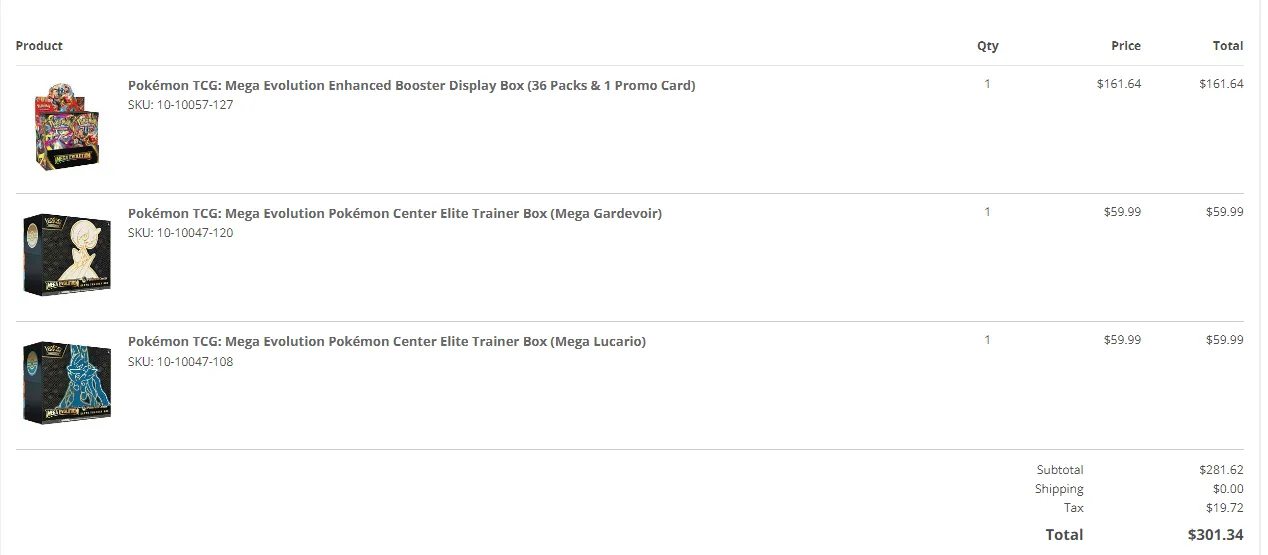

TCG: Pokémon Cards

I'm looking forward to the next set as I got the #Pokemon Center Pre-Order:

I will continue to collect the Black Bolt and White Flare ETB.