Apr 4 - Options Trades:

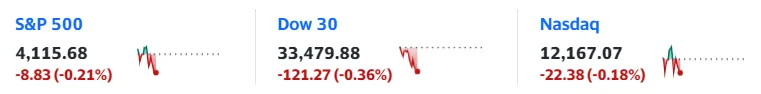

- Current markets are going RED

- Today's Options Trades

- Collecting ~ $70+ dollars

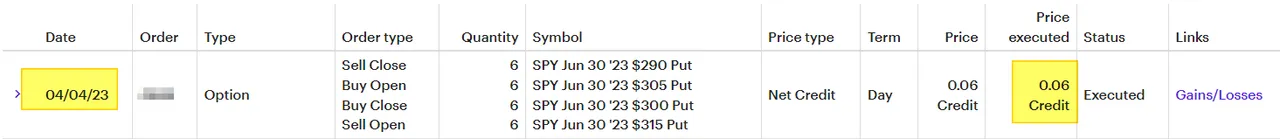

- "4-5-6" Iron Condor SPY June 30 Adjustment. Added risk on PUT legs.

April 4, 2023

Markets are uptrending. 4 out of the last 5 week has been UP (GREEN).

Markets have been GREEN on a "daily" basis.

Today, it is too early to say if the TREND is going red, but we must keep an eye on it. I am looking forward to a few RED days. This will be good for my existing OPTIONS TRADES that I have open.

Today Options Trades

- Adjusted Visa Iron Condor - Added more risk on PUT SIDE.

- Lower Strike Price on SQ Covered Call.

- Adjusting MRVL Covered calls.

- Rolled Out and UP EA Covered calls.

Part of my "4-5-6" Social Media Option Portfolio:

- Adjusting SPY Jun 30 Iron Condor.

- Adding some RISK back into the PULL (as markets are testing CALLS legs).

- This should reduce some "risk" in the trade by offsetting the losses on the CALLS side. The best outcome is the markets trade between 3700-4100 in the coming weeks and I make money on both sides of the Iron Condor.

RED MARKETS, PLEASE!

- I want some RED day in the markets.

- I want to see some RED weeks. Let's start NOW.

- I want to make money in my OPTION TRADES.