Too much Risk (Overexposed)? Or not enough risk?

- Aftersound's YT video

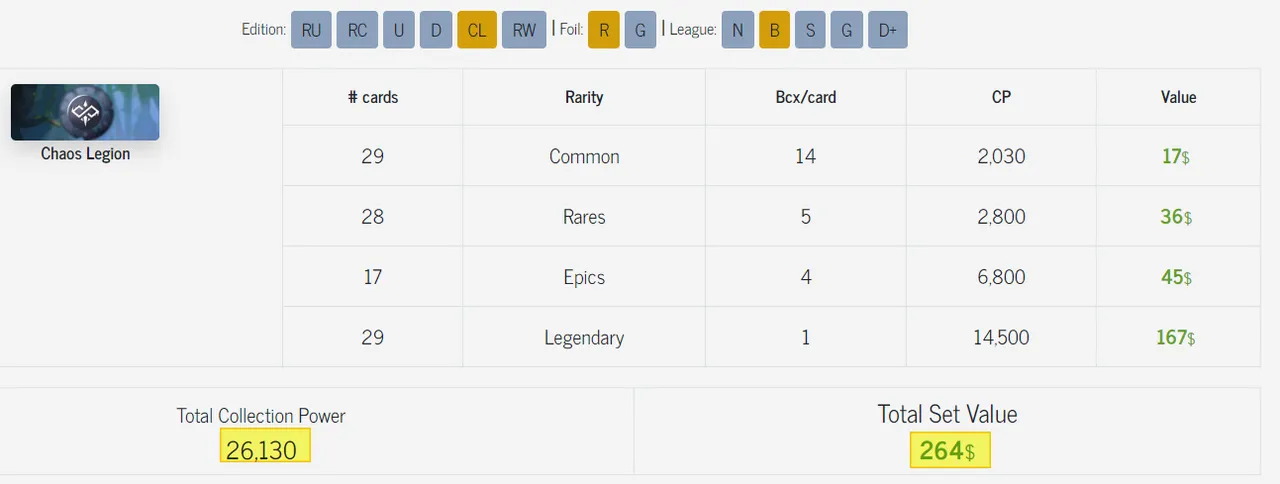

- Solving-Chaos's Bronze Level Deck.

- What are my RISK in BTC/ETH and Crypto?

- Adding more RISK. More Exposure to BTC needed

- Using Options (Covered Calls) for Additional Premiums.

Aftersound's YT video

I was watching #Splinterlands Videos on YT and came upon this video..

Aftersound explains that some folks (or many) might have too many Digital Assets locked up at risk in Splinterlands's assets. In one sense, they make converting BITCOIN or ETHER into SPL/DEC very easy. This helps bring money into the SPL game economy, and sometimes we get caught up in the FOMO, and we want to buy "them all."

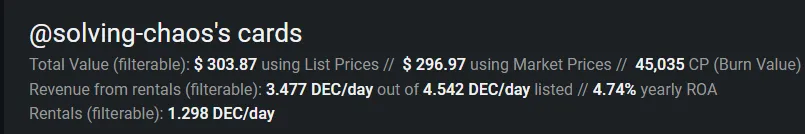

Solving-Chaos's Bronze Level Deck.

My deck is mostly a Modern Bronze-level deck. I am missing many EPIC and LEGENDARY cards from Chaos Legions and Riftwatchers.

For Chaos Legion:

- I have all the GF commons (and have the RF also) cards.

- Missing 8 Rare (GF).

- Missing 8 EPIC (RF or GF).

- Missing 23 LEGENDARY (RF or GF).

From a Splinterlands player, my asset is on the smaller side. Many folks have a MAX Bronze Level deck or MAX Silver Level deck. Building a complete deck takes lots of hard work and plenty of money.

If I only use RF, I can have a complete set using about $300 in card value. But I've been selling my RF cards and moving them into a GF card. This is why I'm missing plenty of cards. However, I think using GF for Common/Rare might make sense to me. The 10% RP bonus might be worth it over years of playing the game.

What are my RISK in BTC/ETH and Crypto?

My Crypto exposure is minimal. I don't have much Satoshi (BTC), nor do I have lots of ETH. I buy $25-$50 monthly using Coinbase to take advantage of a Dollar Cost Averaging (DCA) into this asset class.

So when I watched @aftersound video, it got me thinking about my position. I have a small wallet of Crypto. I have a small DECK of #Splinterlands assets (NFT).

My exposure to BTC/ETH/NFT is less than 1%!!

It is so "little" most of you might even consider me a "NOCOINER". This isn't where I want to be after considering what I believe.

Adding more RISK. More Exposure to BTC needed

I already have an exchange account with COINBASE. The problem is I don't have "extra" cash at the end of the month.

So the easiest way for me to add more risk is by using my traditional brokerage account.

I ended up buying 100 Shares of RIOT. They are a Bitcoin MINER business and don't make any products. So their shares are like 80-95% correlated to the price of Bitcoin. There can be external events that can impact the share price. The last year, RIOT sold some of the BTC they mined that month to help raise CASH. We assume they use that CASH to pay for salary, buildings, bitcoin miners, etc.

Using Options (Covered Calls) for Additional Premiums.

Since I'm an options trader, I don't like to own the asset and let it sit there something nothing. Most of the STOCKS that I own also have covered calls on them. When done right, you can earn a few percentage points in ROI to make it worth your time.

So I added:

- $1150 more risk of BITCOIN / Digital Assets (100 shares of RIOT).

- Collected $25 in a covered call for May 12 (7 days of risk).

- Goal is to play the May 2024 BTC halving. That might pump the BTC price in 2024, so I am making my moves now. I can always add more shares later if needed.

This is not financial advice. I'm doing this because I lack exposure to BITCOIN, ETHER or Splinterland's assets. This is one way for me to add some exposure today. I want to bring my RISK exposure to around 2% - 5% of my total portfolio. I don't know where I end, but once I feel like too many assets are in BITCOIN, I will stop accumulating BITCOIN. I don't think that will be anytime soon, and I can see the next 2 or 3 years adding more and more holdings.

Regards,

Solving-Chaos