Week 23: End Of Week Summary

- Options Summary for week ending 23.

- New Positions in the portfolio

- RIOT Short position by Kerrisdale Capital.

Options Summary for week ending 23.

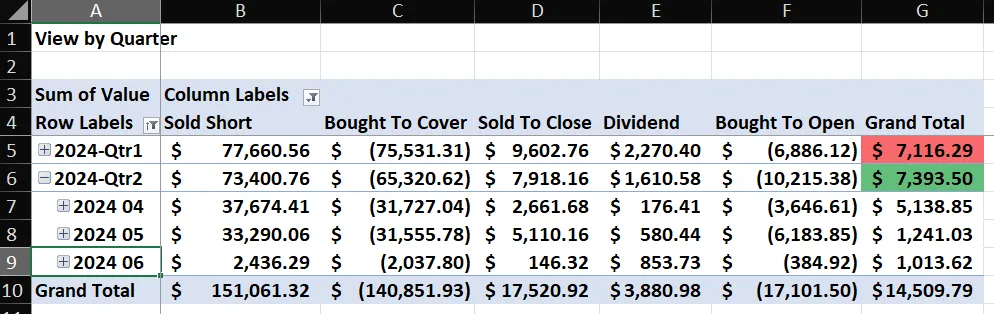

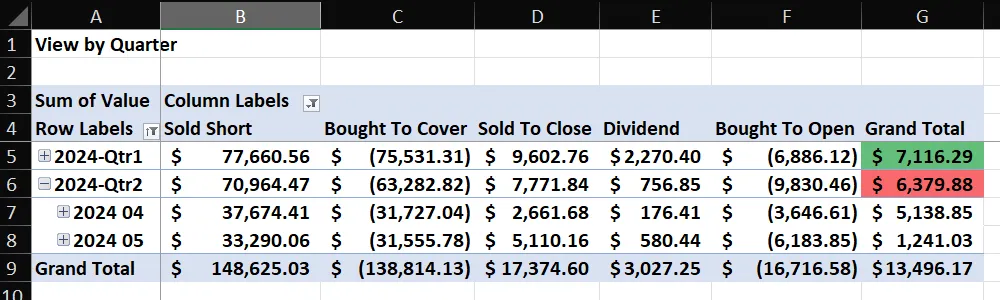

Here is what my tracker shows at the end of the week:

- $1K for Week 23

- $853 from passive dividend

Here is the data before week 23 was entered:

You can see the delta is $1K coming from week 23. $853 was coming from dividends and the rest was from the option trades. The reason why I track dividend is because it is passive and I have a choice on what I want to do with it.

All my data is copied into an Excel sheet. I used this to track my options trading and dividends collected over the last 5 years. As you can see, I have over 20K rows of data and can pivot the data by ticker, date, option method type, or a combination of them.

New Positions in the portfolio

One thing I love about tracking all the data is I can see where I need to adjust my portfolio. I can see what is working and what is not. This is helpful for an option trader as well as someone who tracks their dividend.

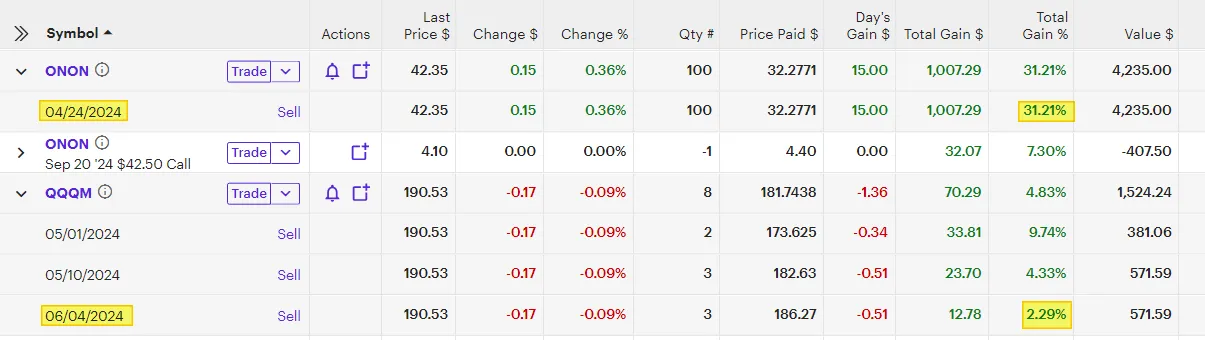

New positions:

- On Holding (ONON)

- QQQ (QQQM)

I added ON recently and it is already up 30%. I already own SKX (Sketcher) and I wanted to add another sports apparel/sneaker company.

This week I explained what I did with some of the dividends I got. I sold some stock because I have too much exposure in a safe boring dividend and I wanted more exposure to companies that will do better than the "safe boring dividend" stock. To do that, I decided to start a new position in QQQ. As you can see, on June 4, I added 3 shares of QQQM (worth about $560).

The goal is to use the proceeds from the dividends, and then add more QQQM over the next 4-5 years.

RIOT Short position by Kerrisdale Capital.

This week, RIOT showed a small gain this week. As you noticed, the BIG news this week was the SHORT RIOT by Kerrisdale Capital. They said the Bitcoin mining sector is a bit of a scam. This news caused the RIOT to drop.

"It's a horrible business model." is what Kerrisdale Capital. However, anyone has ever mined BTC/ETHER with ASIC or GPU mining understands that the concept of mining is to hold the underlying asset over time. You make money because BTC and ETHER go up over time, whereas the USD (Dollars) drops.

The keys are the miners could sell some BTC to fund the operations (electricity, lights, salary, rent/mortgages, etc.) and keep the rest of the BTC on their balance sheet. What you want to see is the number of BTC growing each month. Marathon Digital reported that it sold 65% of the BTC it mined in MAY. That means the rest were not sold and added to their balance sheet.

I'm still long on BTC and ETH. I will continue to hold my positions that reflect this view.

Whether we are at the peak or within 6 months of the peak, I don't care. I'm not trying to time the market's peak and valley, but rather being patient and using OPTION to collect some premium as we go.

It's always good to end the week with some profit. It makes it easier to move into the next week.