Week 24: June 10 Investment Moves

- US markets as of 1:00 pm (EST)

- June 10 Option Trade

- This week (24) passive income

- Turning 1 share into 40 shares (Nvidia)

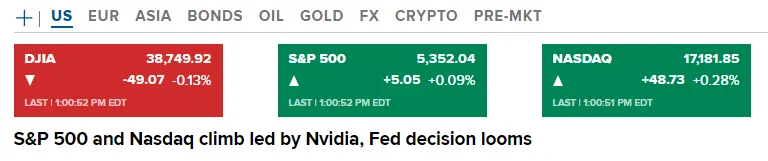

US markets as of 1:00 pm (EST)

Here are the current US market conditions:

The US markets index has been at new highs. I would like to see cooling off and have a correction or profit-taking.

In order to "play" this prediction, I recently opened an Iron Condor using SPY to capture some TIME DECAY PREMIUM. I believe the indexes will be range-bound over the last two or three weeks and I will make money because I don't think we will continue the trend.

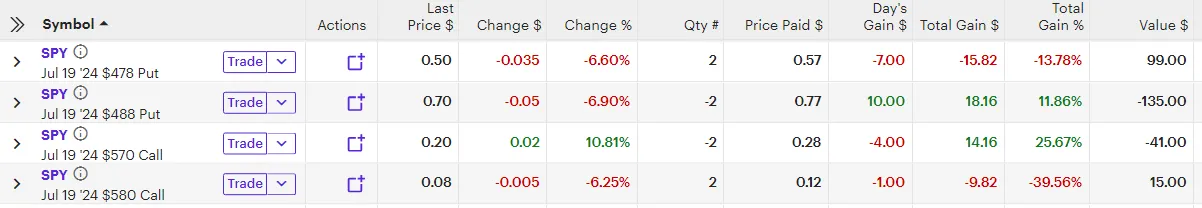

June 10 Option Trade

Here are my trades are of 1:00 pm (EST). I was busy at 9:30 AM today and did not do any trading in the morning. After having my afternoon coffee, I jumped onto ETRADE and did my trades for today.

- Rolled RIOT covered call down and out for $7 each.

- Rolled F covered call up and out for $11 each.

- Rolled F covered call up and out for $1 each.

- Rolled F cash secured put out (3 weeks) for $2 each.

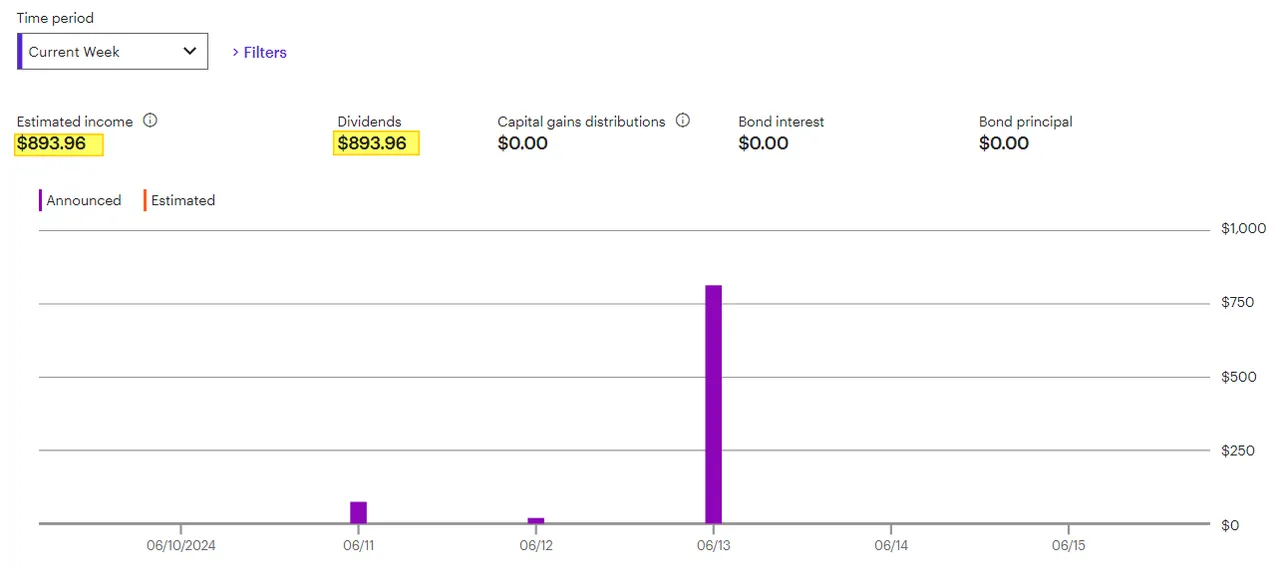

This week (24) passive income

Last week was a big week for dividends. This is another week where it is over $700.

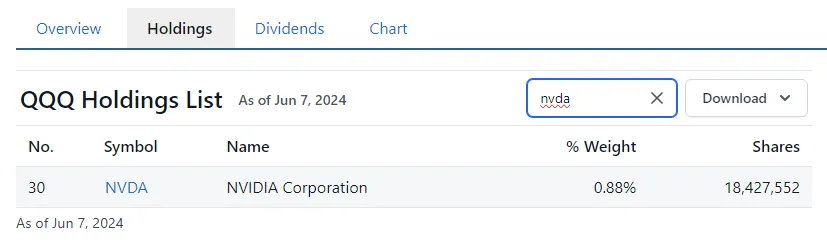

I might sell off some dividends and continue to add more to "QQQ". This is how you can dollar cost average into a position without worrying about the current price. I will be looking at this holding 5 years from now and I might wish I was adding more now!!

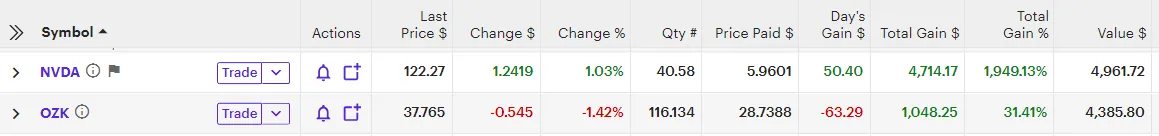

Turning 1 share into 40 shares (Nvidia)

At the closing for Friday, for each share, you got 9 more (a 10-for-1 split). I had a single share before the last split:

- 1 share => 4 shares (4-for 1)

- 4 shares => 40 shares (10-for 1)

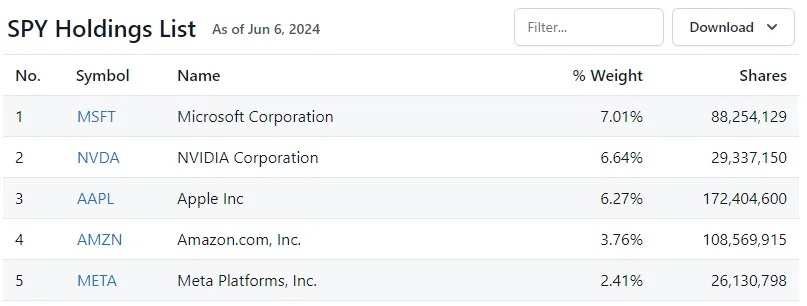

This is how it looks in a portfolio if you had the share before Aug 2021. I will not add cash to this position as I own it via "SPY" ETF and "QQQ" ETF. The top 10 holdings of those ETFs generally have a large percentage.

Here is the QQQ with NVDA at #30.

Here is the SPY with NVDA at #2:

Have a profitable day.

Be an #investor.

Use #option for income/or hedging.

Plan for #retirement.

Go long on #bitcoin.