Week 24: June 12 Investment Moves

- US market condition as of 11:00 AM (EST) (#investor)

- June 12 Option trades as of 10:00 am (EST) (#optionTrader)

- RIOT trade explained

- Bitcoin recover. Back to 69K (#bitcoin)

- Waiting on dividends (#dividends)

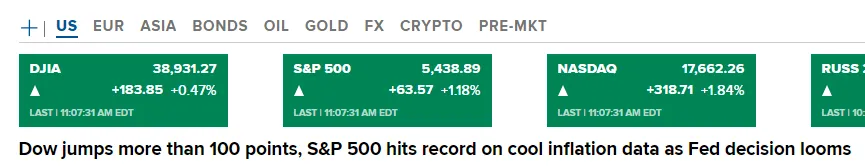

US market condition as of 11:00 AM (EST)

Here are the markets right now:

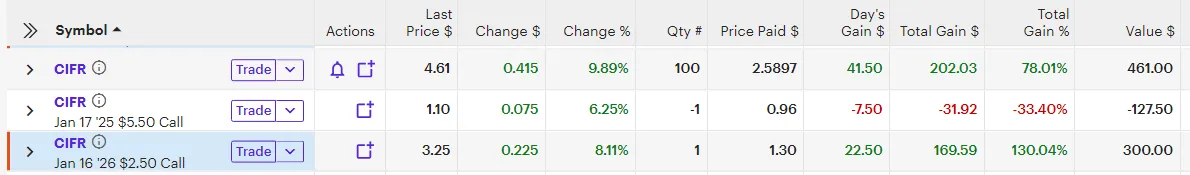

June 12 Option trades as of 10:00 am (EST)

Here are my trades so far today:

Summary:

- Rolled EA covered call up and out (3 weeks) for $9 prem.

- Rolled BMY covered call up and out for $5 prem.

- Rolled put leg of V's Iron Condor for $5 prem each.

- Rolled RIOT covered call up and out for $8 each.

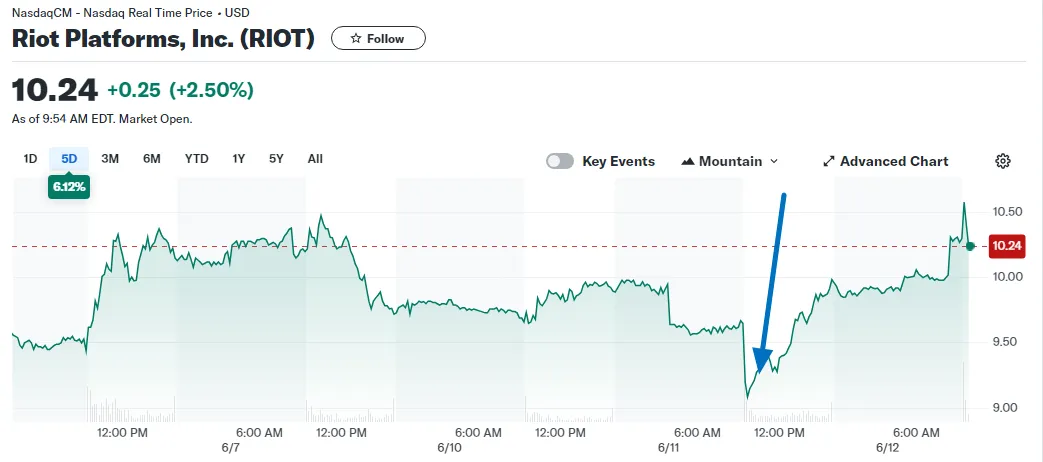

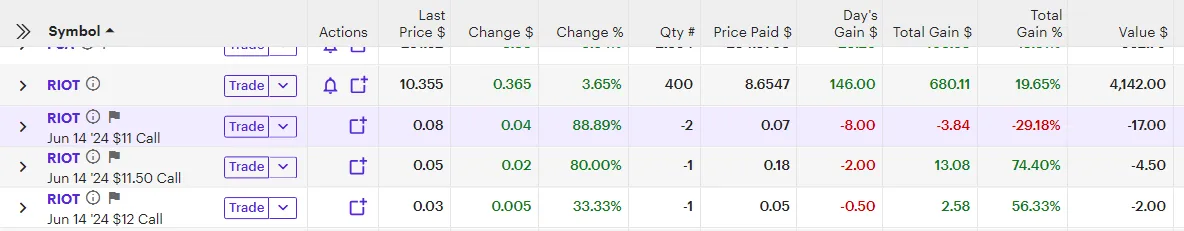

RIOT trade explained

Yesterday on June 10 I adjusted the trade to have more risk.

However, when I did the trade it was under $9.30 a share. As we headed to 4 pm, RIOT share ended up GREEN and closed at $9.99 a share. Today, it is already up to $10.24, so my $10.50 covered call (for June 14) is being tested. To not have assignment risk in the next 2 days, I decided to roll this covered call UP (in strike price) and Out (in time). Collecting the $24 (8x3) today in CASH with the potential of making another $300 (100 x 3) if the shares move to $11.50 is the right thing to do.

If you do nothing, I cap my max earning at $10.50 a share. This adjustment put cash in my pocket today and then we still what happens to RIOT in the coming weeks.

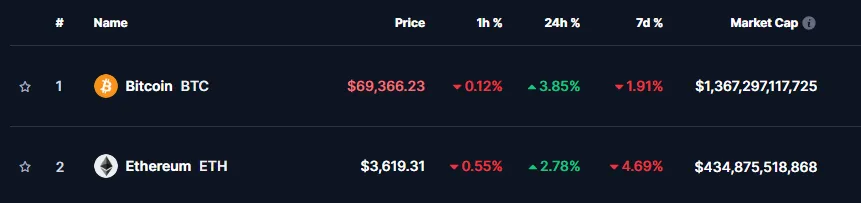

Bitcoin recover. Back to 69K

Overnight, Bitcoin was near $66K. It recovered before the US market opening at 9:30 am (EST). You can see Bitcoin is trading at 69K right now.

This shows up in my portfolio with anything related to Bitcoin to adjust upwards. Here is one example of CIFR is up 9% so far today, while RIOT only up 3% (which matches the Bitcoin 24H move).

This is what RIOT looks like today:

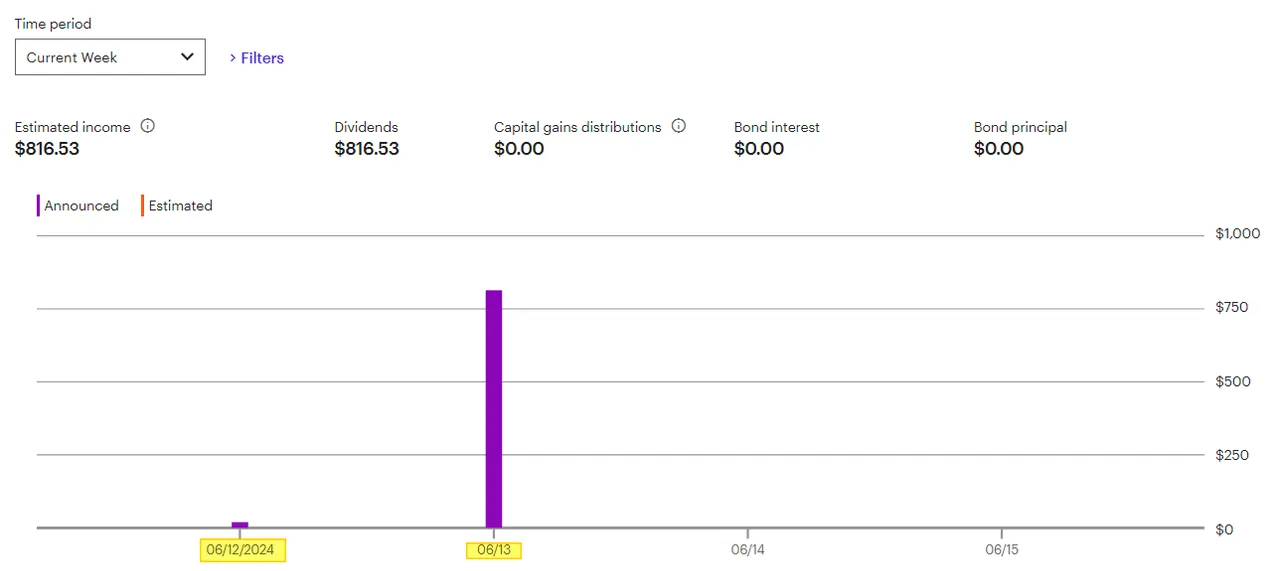

Waiting on dividends

I got some dividends yesterday and will get some today. However, the bulk of this week's (#24) dividend will be paid out tomorrow.

This gives me time to think about what I want to do with the money. Since it automatically reinvested into the underlying security, I will need to think about it. Taxes are not an issue, as I do this in a tax-deferred account (an IRA). In the last several weeks, I have been selling shares from the dividends and then using the proceeds to purchase 'QQQ'.

There are about 3 area where I been focusing on:

- QQQM --> Tracks the Nasdaq 100, but using a lower fee ETF.

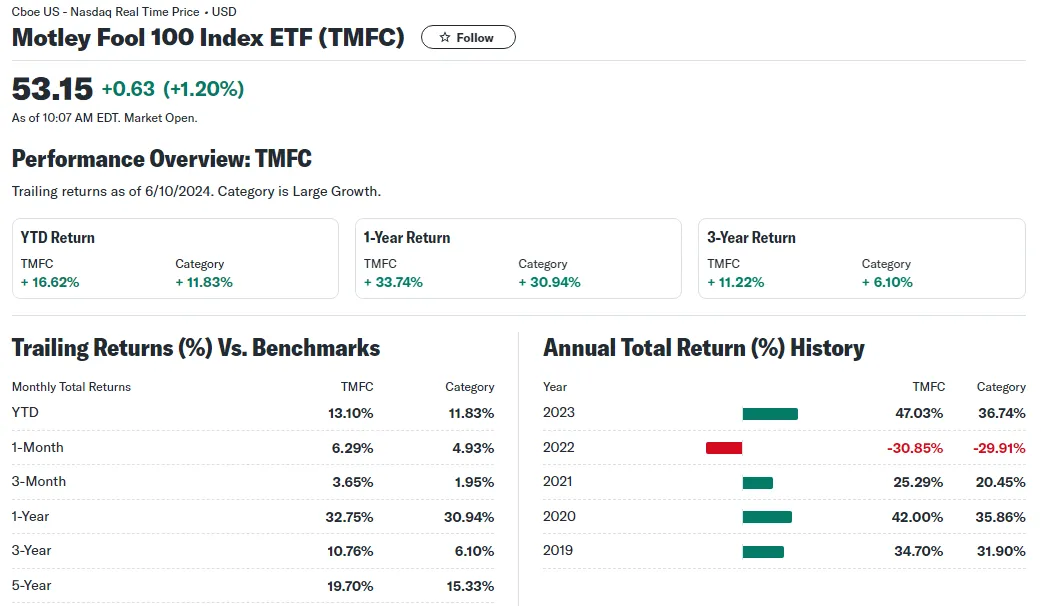

- TMFC --> MOTLEY FOOL 100 INDEX ETF, which track their Investment suggestions.

- VHT - Vanguard Health Care Index Fund ETF Shares

So far, I am happy with investing in these funds. The S&P 500 is the benchmark. That is the standard. I want to be "average" and I invest in the SPY (Spiders).

Adding in QQQM/TMFC adds more risk to the portfolio, but so far the trend will continue to outperform. If that holds, then it a great investment. Adding in the Health CARE Index was a bet on the aging population (baby boomers and Gen X'ers). So far, that has been a "poor" investment as the returns has lagged.