Week 30 July 24 Investment moves

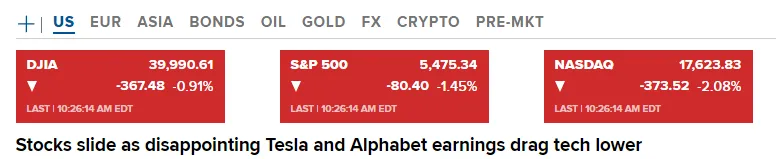

- Current US Markets @ 10:26 am (EST)

- Today (July 24) moves

- Why ETH (Mini Trust)?

- Spot Ether ETF

Current US Markets

Here is the marked data as of 10:26 am (EST)

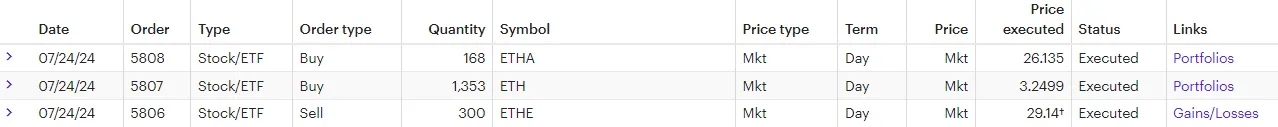

Today (July 24) moves

Why these moves?

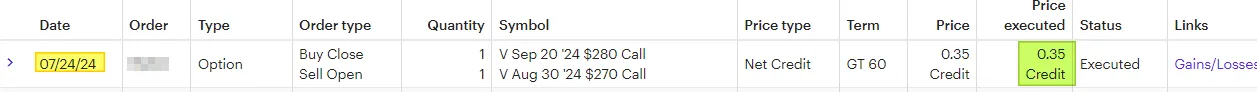

Visa earnings were just fine but the stock dropped $10 today. So I adjusted my covered call (rolled in and down) for $35 (adding risk) to the existing trade. I could have done nothing and most likely the covered call would have expired worthless. I used covered calls as "income" trades that helps me purchase more assets in the future. The key for me is to do it over a long period, so it acts like a "dividend stream".

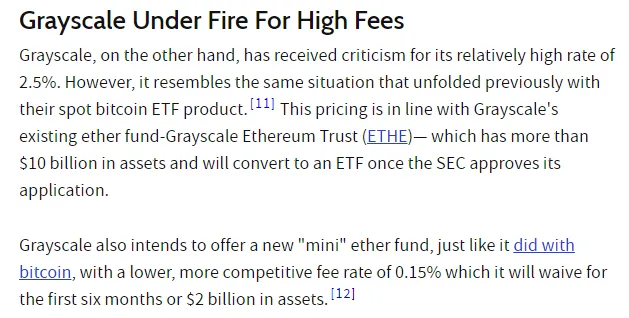

Yesterday, SPOT ETF was introduced to the marketplace. Before that, only Grayscale UNIT TRUST was available. For those that don't know, the unit trust was very expensive.

Before:

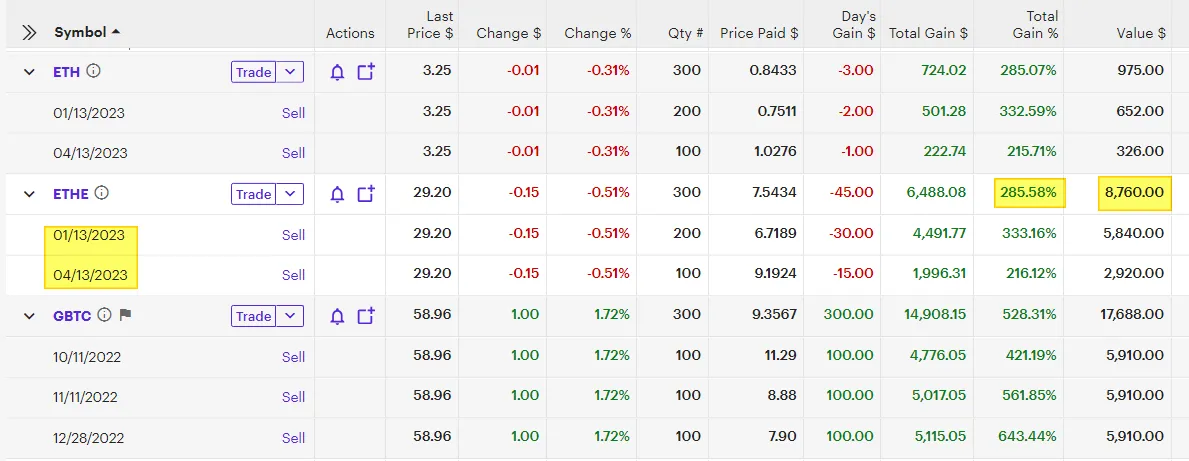

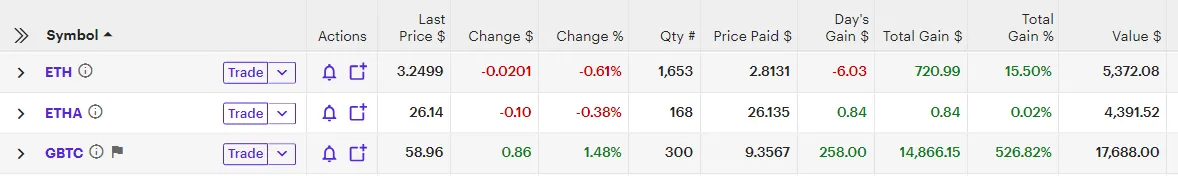

Before July 23, I was willing to pay a 2.5% fee to hold ETHE (Grayscale unit trust). Holding it for about a year and a few months cost me about 3% in total fees, but I gained 285%! Now that I have different options, I will make that move to save money while holding ETHER ETF for 5 or 10 years.

After:

Why ETH (Mini Trust)?

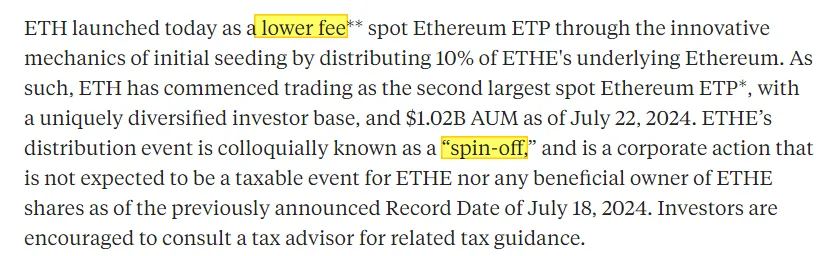

The mini trust will be the lowest cost based on recent data at 0.15% per year (SEE NEWS HERE).

As you can see, I was given the spin-off holdings into my ETRADE account as of this morning (July 24). But why would I want to pay 2.5% a year now if I have 8+ different other choices now? So I ended up moving half my funds into ETH (Grayscale Mini) and the other half into ETHA (Blackrocks).

Spot Ether ETF

There are others ETH and you see read this.

Knowing what your options are should help you make better choices. Prior, the only easy way to play ETHER was using Grayscale. Today, I have plenty of choices and my investment moves today reflect that.

Have a profitable day!