Week 36 - Investment Moves

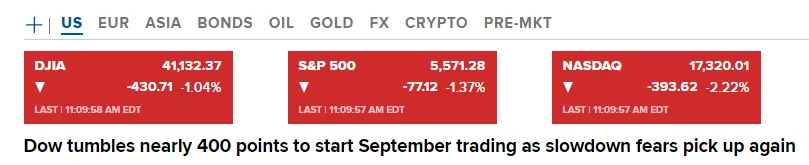

- Current US market conditions

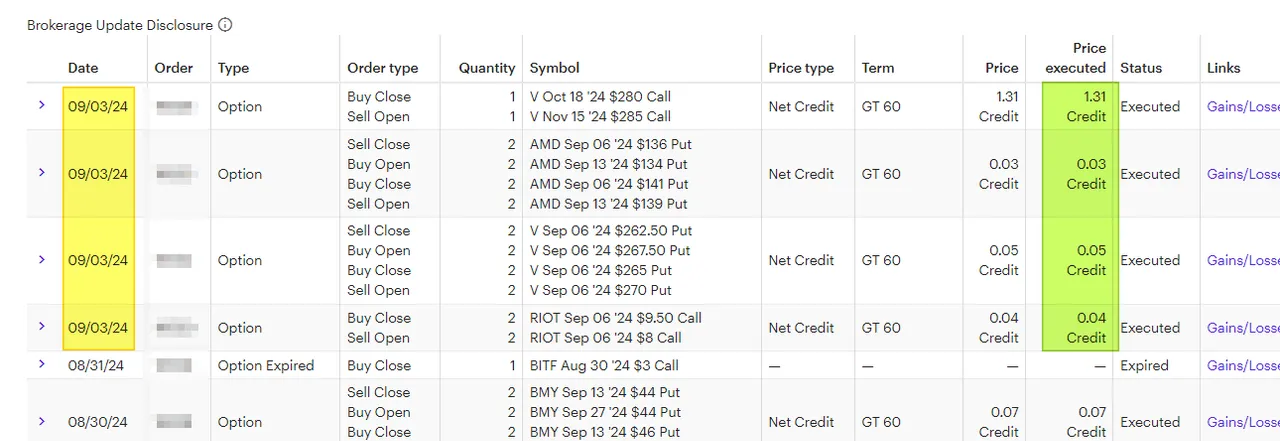

- Sep 3 option trades @ 11:00 am (EST)

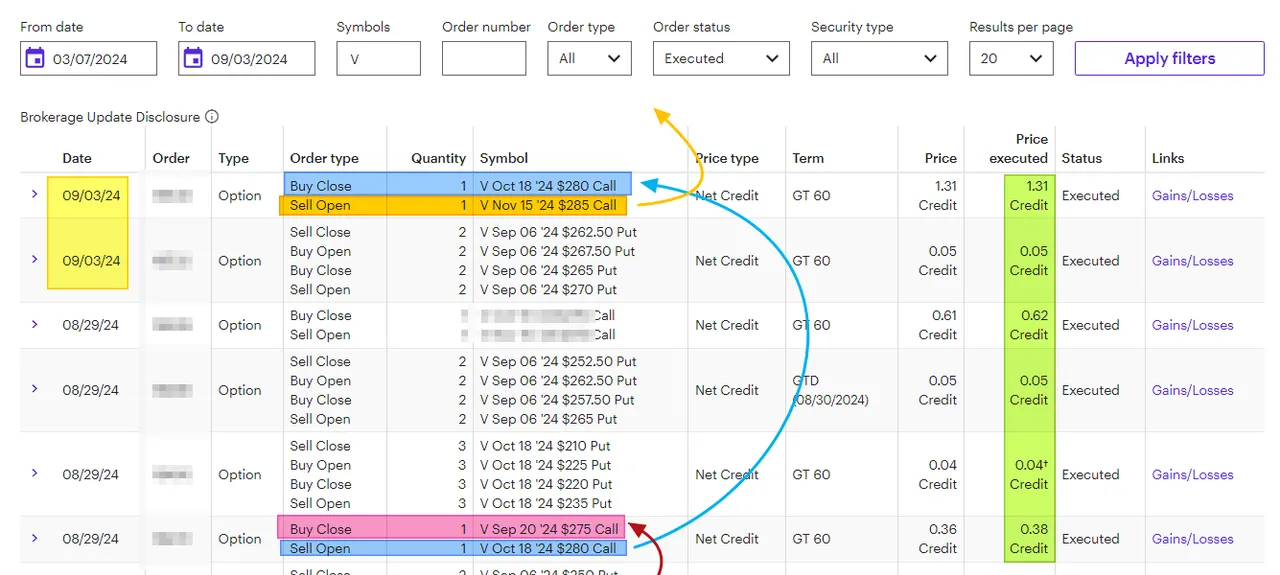

- Visa Covered call explained

- Week 36 passive dividends

Current US market conditions @ 11:10 am (EST)

Sep 3 option trades @ 11:00 am (EST)

- Rolled a Visa Covered call

- Rolled AMD Put credit spread.

- Rolled Visa put credit spread for more risk.

- Rolled RIOT covered call.

Visa Covered call explained

Why do I roll Covered calls? Let's follow a covered call trade from several weeks ago:

- Closed V Sep 30 $275 (RED highlight)

- Open V Oct 18 $280 (Blue Highlight). For a net of $38 (the diff between the cost to close and the premium for the opening of Oct 18).

- on Sept 3 Closed Oct 18 for $280 (blue highlight)

- on Sept 3 Opened Nov 15 for $285 (Orange highlight) for $131.

- I will now limit my upside to $285 from $275 before Aug 29 (the RED highlight). So, I would gain up to $ 1,000 if my Visa stayed above $285.

- I collected $38 plus $131 = $169 (in total) using the option to LIMIT my gains.

- If Visa stays under $285, I keep my shares. If my Visa stays between $275 and $285, the best outcome happened for me.

- If Visa go under $275, I would have lost money without the option. So the option PREMIUM only helps offset the PAIN by $169 in CASH I collected so far. As a stockholder, this is why adding the OPTION on the TOP of an asset helps reduce some of the risk of just holding the STOCK.

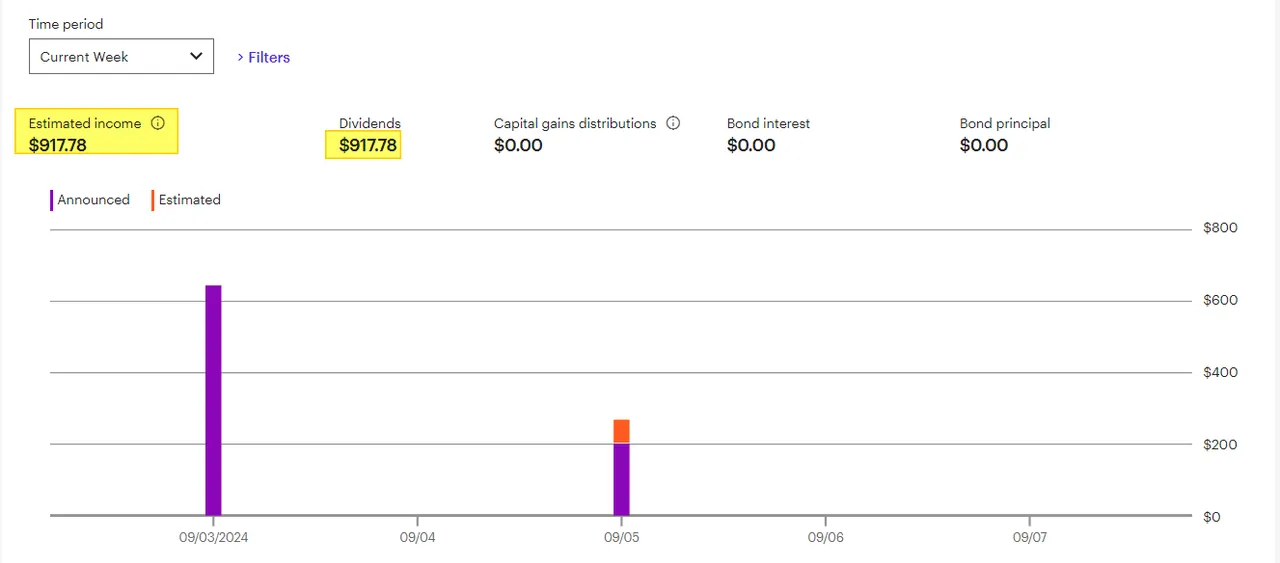

Week 36 passive dividends

This week's passive income:

Most of it comes in today. I will wait until tomorrow to see if I want to do any selling and buying from some of the proceeds.

Have a profitable day!