Week 39 - Sept 25 Options Trades

Here is what we are covering in this post:

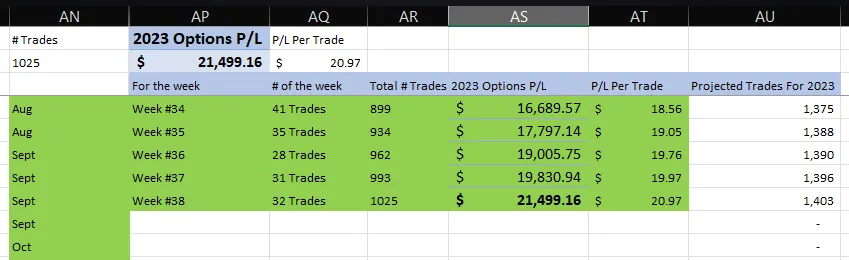

- Week 38 Summary - 21K YTD

- Week 38 Summary - Weekly: 32 Trades. $1668 profits! or $948 excluding dividends.

- Week 38 Summary - 4K Iron Condor Visa and "4-5-6" Iron Condor SPY.

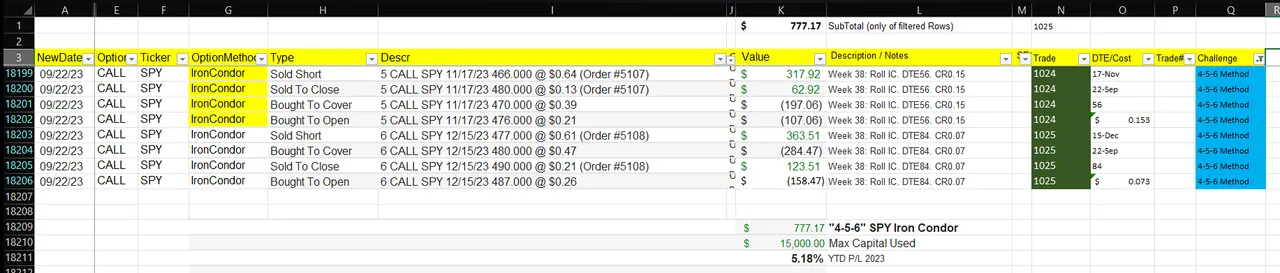

The 2023 "4-5-6" (15K) - Iron Condor on SPY ($777 or 5% YTD ROI)

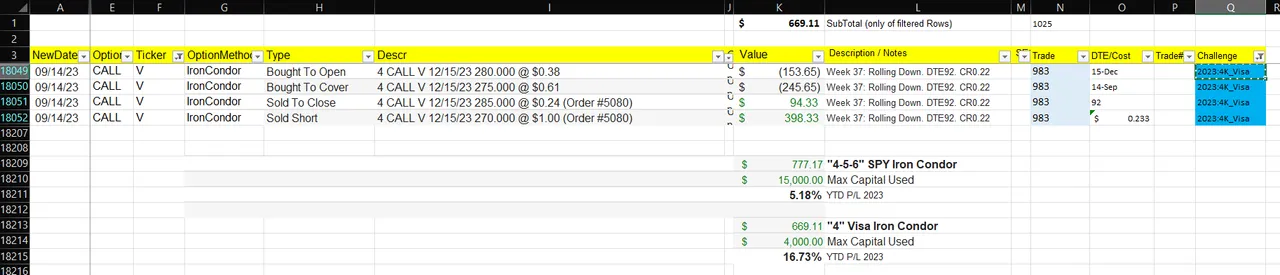

The 2023 4K - Iron Condor on Visa ($669 or 16% YTD ROI) - Week 39 Sept 25 Option Trades for today (as of 11 am EST)

- Week 39 Dividends For this week

Week 38 Summary - 21K YTD

This week was the second down week in a row. Most traders experienced LOSSES this past week, especially those trading OPTIONS.

This week, we are finally in the GREEN for Q3. We suffered losses in the multi-thousands area back in JULY. That three-week period took this long for us to go from a LOST to a GREEN profitable YTD ROI.

Week 38 Summary - Weekly: 32 Trades. $1668 profits! or $948 excluding dividends.

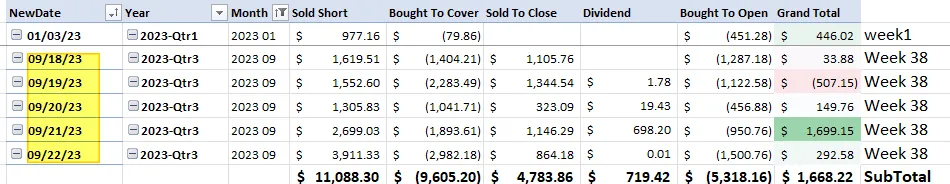

The weekly data is posted above. Here is the daily view. You will notice several things:

- Dividends account for $700+

- Big loss of $600 on Tuesday.

- Yet we still finished with a net gain of $1668 or $948 w/o dividend.

Let's dive into the details of the trades.

-$600 on ROKU. The PUT credit spread was ITM (In-The-Money), and I had to PAY UP to close my position. And you see, this caused Tuesday 9/19 net value to be -$507!!

+$600 on Riot Blockchain. I have a short-term negative view of BITCOIN and expected the stock to drop (which it finally did). My Long Put was up in value, and I closed that position. This impacted the Sept 21 net value.

Don't forget that opening new long positions (call/put or credit spread), it costs MONEY. SHORT positions get a premium (like a Covered CALL, Iron Condor, etc.). I had a LONG put option and was betting on weakness in BITCOIN in SEPT. It took about 2 weeks longer than I expected, and I was worried about running out of TIME on my option, so I closed my POSITION when it turned PROFITABLE.

- +$719 from Passive Dividends. If you remove this, you can see I made about $948 from Options Trading this week.

Week 38 Summary - 4K Iron Condor Visa and "4-5-6" Iron Condor SPY.

Here are the two methods we use for the 2023 social media challenge. We are doing these trades all year to share our results of using a single "trade" all year with the reader. As you can see the "4-5-6" is still recovering from the big losses in JULY!! A +3% ROI is falling behind the market right now. The Visa trade has recovered since July and shows a 16% ROI. At this pace, I think the VISA trade can be in the 20% ROI for the year.

The 2023 "4-5-6" (15K) - Iron Condor on SPY ($777 or 5% YTD ROI)

The 2023 4K - Iron Condor on Visa ($669 or 16% YTD ROI)

No trades that are part of the "4K Visa Iron Condor Portfolio". The last time was last week (week 37).

Week 39 Sept 25 Option Trades for today (as of 11 am EST)

Next is what trades I made for Sept 25, 2023.

I ended up closing the 5 SPY Iron Condor "Nov 17" for $1.16 each. Next, I opened 5 "Jan 19" for $1.02 each. On the surface, it appears that I loss money on this trade, but if you added all the premium I collected for Nov 17, I made money on this trade.

Since markets are weak on Monday Morning, I decided to add more risk baco into the CALL LEGS.

Week 39 Dividends For this week

This week's dividend is far from last week's $700! We will only get $60 in passive dividends this week.

Have a profitable day,

Solving Chaos