Week 50: Dec 11 - Hitting 100K in my 401K plan!!

- Dec 11 Markets at 11:30 am (EST)

- Dec 11 Bitcoin move

- Week 50: Passive Income

- Week 49: Dec 8 401K value

- Social Media 401K Details

- Why is the First 100K Mark so important?

- Join me on this journey.

Dec 11 Markets at 11:30 am (EST)

The markets are near "flat" today. It's a reasonably dull Monday morning.

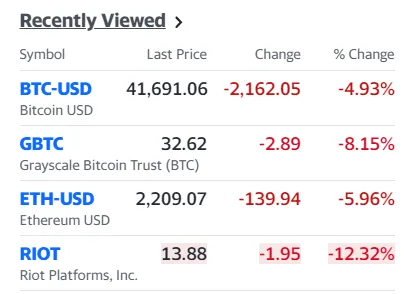

Dec 11 Bitcoin move

The big news is what is happening with BTC/ETH after last week's big move. Today is showing a bit of a correction.

I have mentioned that I don't trade in and out of position on a daily or weekly view. While I trade options frequently, I mainly adjust for the risk based on the market conditions, not changing my opinions on how I value the underlying asset.

Therefore, I don't need to do anything when markets drop like they are now for BTC/ETH.

Week 50: Passive Income - $840

This week's passive dividend from my stock market portfolio is:

On average, I make $230 per week. Since dividends are paid on different dates each quarter, some weeks have zero/low dividends, while others have the bulk payout. This week is one of those weeks where I get the majority of the payout for the month.

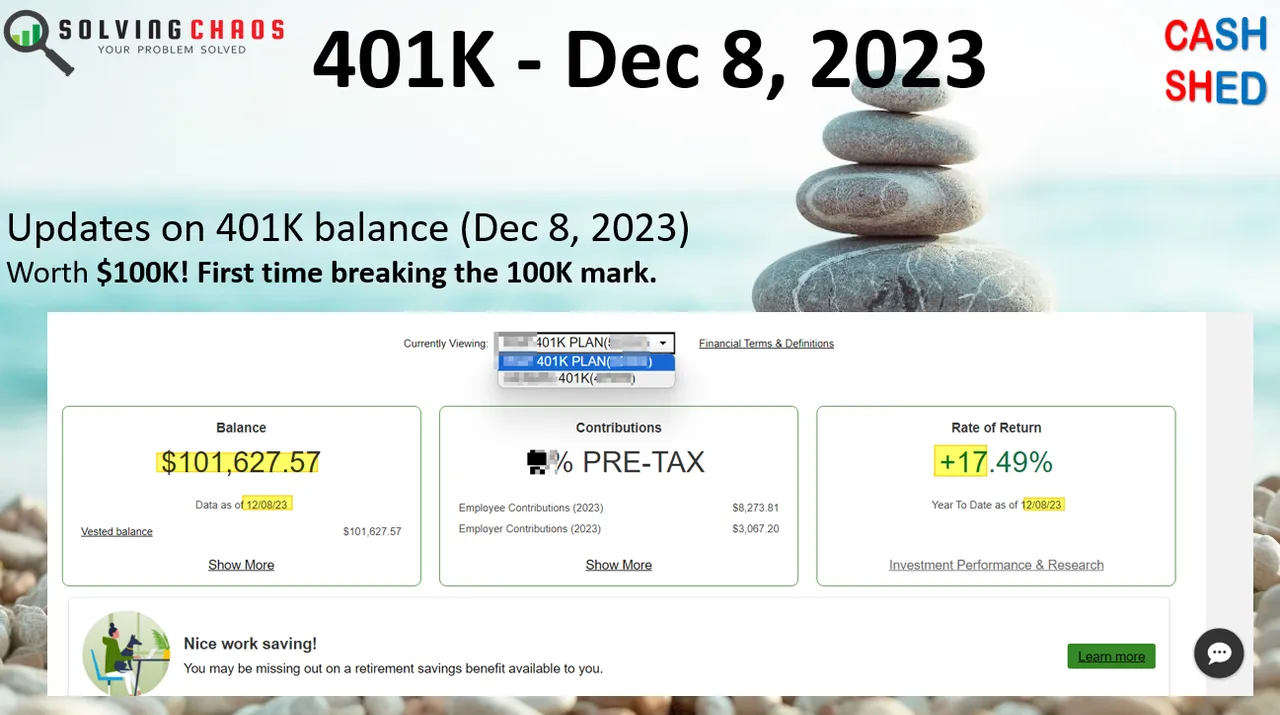

Week 49: Dec 8 401K: Worth 100K!!

I crossed a super important benchmark in my public 401K portfolio. I hit the $100K mark for the first time in 2023.

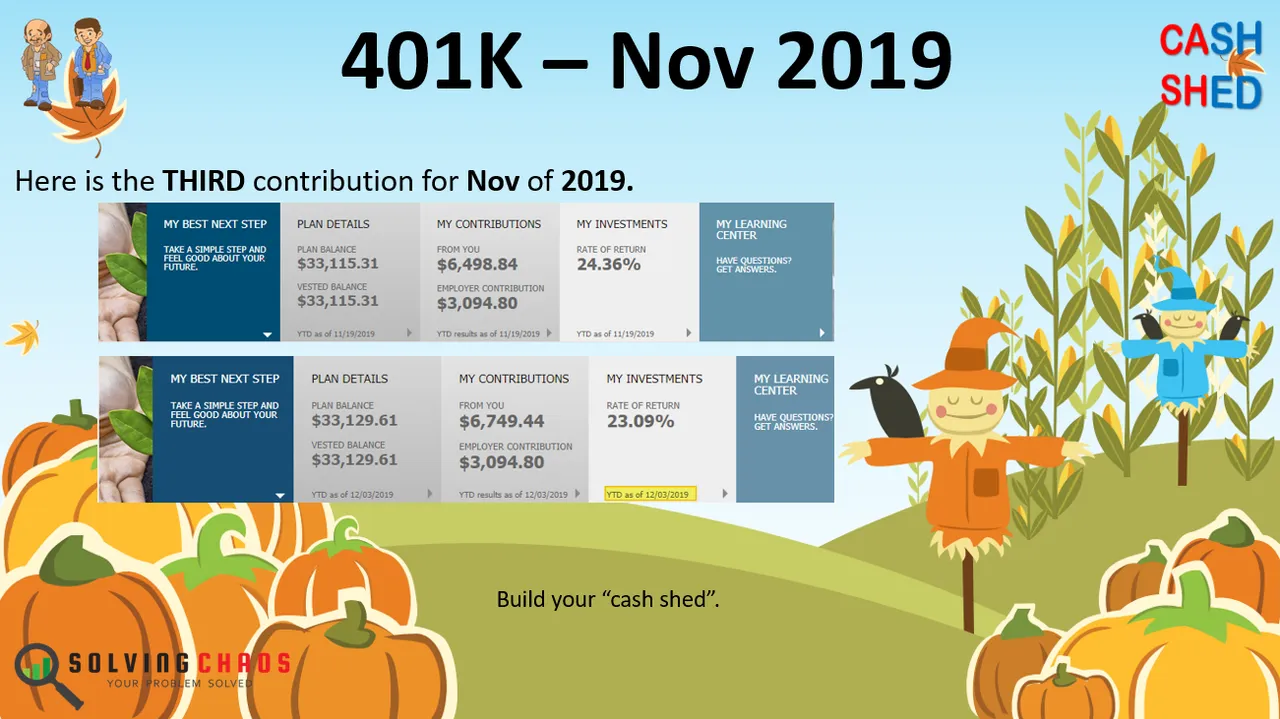

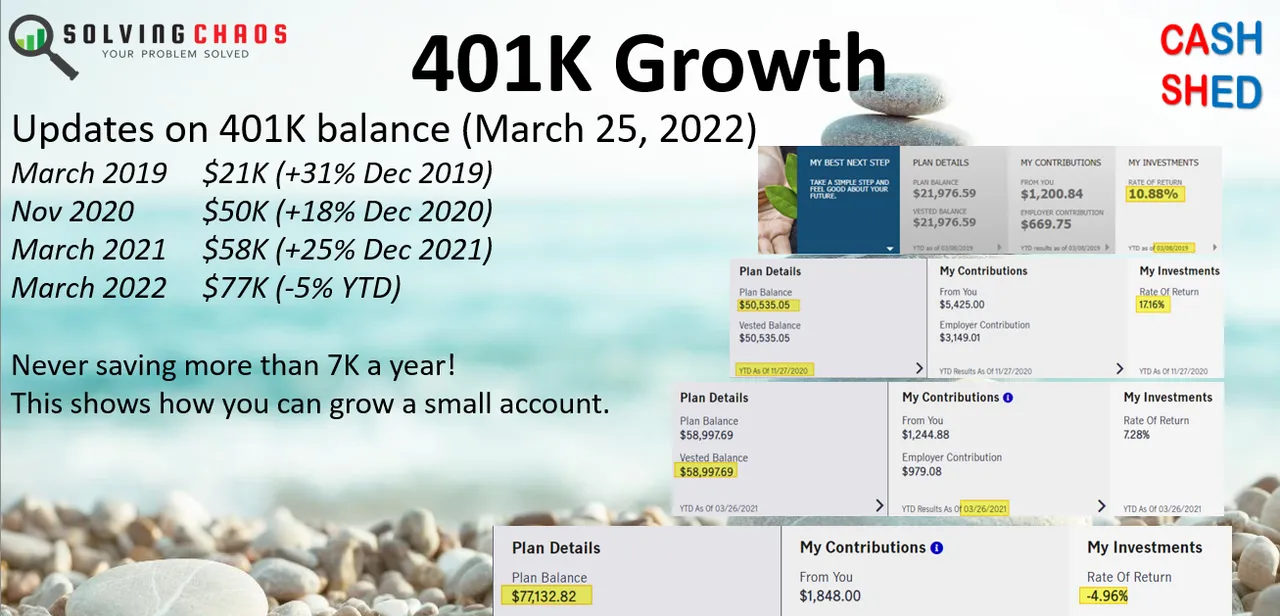

I have been sharing this portfolio on social media since 2018 or 2019. I wanted to show people how saving a few thousand dollars a year can be life-changing.

This 401K started in 2018 (and you can see that I have a different 401K if you look at the current 401K slide (Dec 8). I will only share the value of this 401K over the next decade, assuming I will still be working at the same employer during this time. My other 401K is from my previous employer in 2012.

Here is another slide from March 2022 that shows the value over time:

Social Media 401K Details

I wanted to share details of how much $$$ was put in, but this portfolio recently switched plan providers. I don't know if the historical data is correct, and I will have to do it based on some previous social media posts.

Current 401K - 100K Market Summary:

- Time: From 2017 to 2023 (Dec). 7 Full Years to go from zero to 100K.

- I did not contribute 10K a year in any of the years (2017-2023).

- 2017: 3K? not sure.

- 2018: 5K? not sure.

- 2019: 7K is my contribution. 3K in matching funds (10K added)

- 2021: 7.4K my contribution. 3.5K in matching funds (10.9K added)

- 2022: 8K contribution. 3.1K in matching funds (11K added)**.

401K switched provided on Nov 2022. That is the best data I have. - 2023: 8.2K contribution. 3.0K in matching funds (11K added).

- Matching Averages out to 41% of my contributions.

- I was not fully employed during that time. I had small gaps of unpaid time off during the last six years.

Why is the First 100K Mark so important?

Some websites talk about the first 100K, which is the hardest. I created a YouTube video in 2021 on this topic, showing it differently from other videos here. I stopped making YouTube videos because I only got 1 or 2 views per video and switched to blogging on HIVE in 2023. If, at some point, my followers want me to make videos, I might consider that in the future. But for now, you can find my content on the HIVE blockchain.

The first 100K is hard to hit, which is why less than 10% of Americans are millionaires. The power of compounding interest is demonstrated after you hit the 100K mark. It is not the "raises" or my job that creates millionaires, but rather, it is more commonly found in those that have acquired ASSETS (not just 100K in 401K), but any assets.

My journey was dull, and I only gathered a small following between 2019-2023. As the portfolio snowballs into the future, I may make 30K or 50K in a single year while only investing 10K (or less) of my contribution from my paycheck. I'm older than most financial influencers on social media (in the age 50 and over crowd), and I don't believe I have the time to show how this portfolio will hit a million or two million dollars.

Transparency was the goal of my social media account. Too many gurus only show the "get rich quick" methods. I often use 7% or 8% in my model forecast. I use a boring Option Trading Strategy that might only make me 5% a year (as I don't have enough data to show what my "true long-term" averages are). I show my dividends and how they add some "safety" to my portfolio.

Join me on this journey.

Being a millionaire or having financial independence is not about money or titles. Instead, it is for those who understand that life has more important things than "work" while being a good steward of the blessing. Money is just a tool that, when used properly, will allow you to have more options and choices that are not available to others.