Week34 - Aug 23 Trades - Details

- Disclaimer:

- Here are my Aug 23 trades

- 2 Tesla Put Credit Spreads

- 1 SOFI Covered Call

- 1 SKX Covered Call

- 1 SQ Covered Call

- 1 MRVL Covered Call

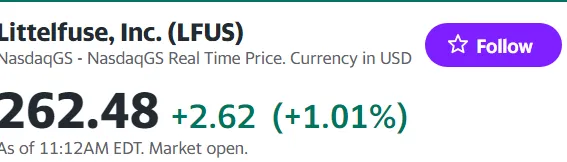

- 1 LFUS Covered Call

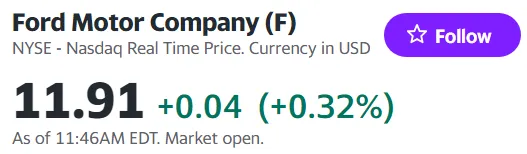

- 2 F Covered Call

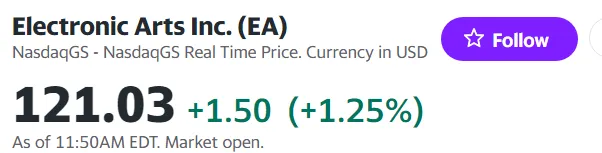

- 1 EA Covered call

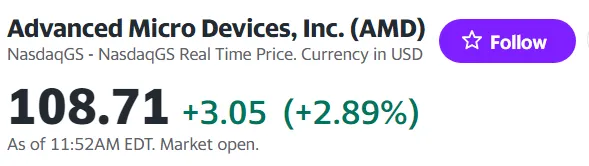

- AMD Covered call

Disclaimer

This post is showing what trades I did today. This does not mean I am telling you what to do with your money. The purpose is to educate and teach how options can be used in a portfolio. Never invest more than you are willing to lose. Seek professional help before investing, as there are risks involved.

Here are my Aug 23 trades.

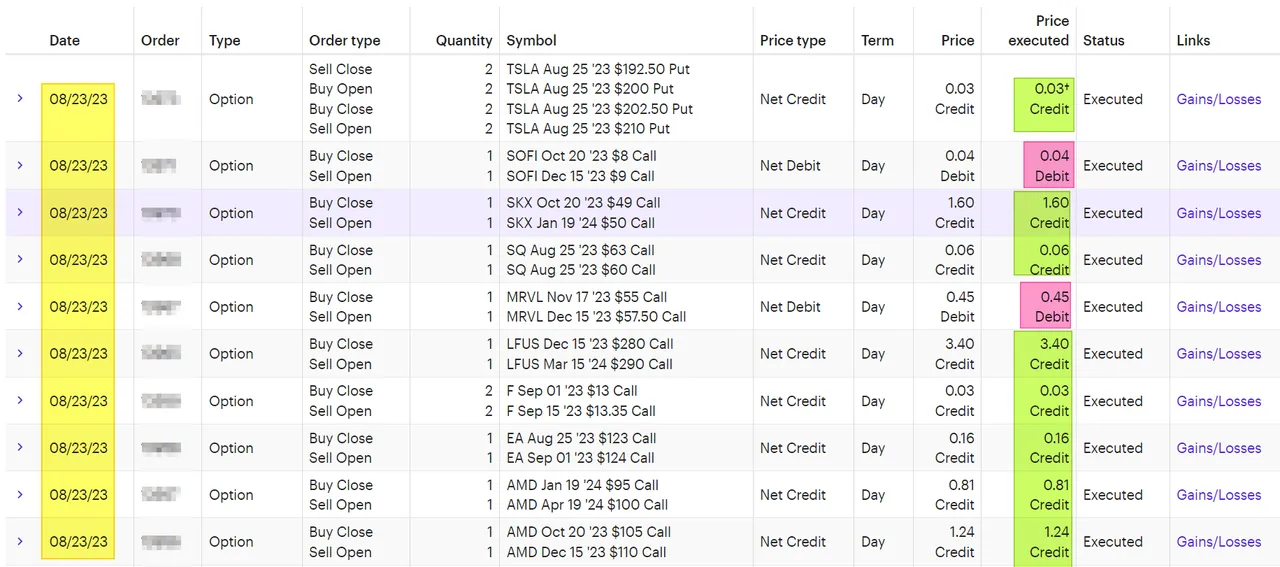

This is from my E*Trade account as of 11 am (EST):

2 Tesla Put Credit Spreads

There were 2.5 days of risk left, and the PUT was losing value. I added more risk to the trade by moving the SHORT PUT from $202.50 to $210. Tesla is at $234 right now. I think Tesla would end around $220 by Friday, a good "risk/reward" for me to take on for an additional $2 in premium.

1 SOFI Covered Call

I rolled my SOFI covered call up $1 in strike price ($100 of potential value) and paid $0.04 for the new covered call. I spent $4 today to capture the $39 (or more) if SOFI stays above $8. While it seems like a risky move because SOFI can trade down in the next 3 months. $4 is cheap to reap the potential to gain $100 more should SOFI trade above $9.00 by DECEMBER. Also, remember that I adjust my position for multi-years, which is just one step in that process.

1 SKX Covered Call

I rolled my SKX-covered call-up $1 in strike price ($100 of potential value) and got $1.60 credit for it (or $160 today). Here is an example of why some traders love covered calls. I used the $4 from the $160 to help pay for the rolling of covered calls for SOFI.

1 SQ Covered Call

I rolled my SKX-covered call down $3 in strike price and got $6 for 2.5 days of risk. My goal is to roll on THURSDAY or FRIDAY to next week. So, I use these short-term trades to make a few dollars when possible. The goal for these trades is the volume. If I can make 5 trades that make $1 or $3 each week, that is an extra $5-$15 in profit.

1 MRVL Covered Call

I rolled my MRVL covered call up $2.50 in strike price ($250) for $0.45 DEBIT ($45). This covered call is ITM (In-The-Money). By rolling the strike price up, I potentially gain $250 in value if MRVL stays above $57.50! The net gain would be over $205. This is generally a no-brainer move. The risk is when MRVL trades under $57.50 in the future. I'm not afraid of my options going ITM. The key for me is to adjust the strike price slowly based on what I think is the stock's good/fair value.

1 LFUS Covered Call

I rolled my LFUS covered call up $10 in strike price ($1K) for a credit of $3.40 ($340 today). This roll adds 3 more months to my covered call. I wanted to stay ahead of the "up move" with the share trading at $260, and I wanted to move my strike price to $290. This stock has traded above this price recently and will continue to trade around my strike price. Trades like this need to be done before the move happens so as not to limit my upside potential. Once you ITM (or DEEP ITM), you will not get credit for rolling, and you will have to SPEND money (a Debit) to roll the strike price up.

2 F Covered Call

I rolled my F-covered call up $.35 in strike price (for a potential gain of $35 per contract). While I don't know if F will move that high, I am happy to take the $3 premium today. Since I often trade these "weekly" or bi-monthly, the volume of trades adds up over the year.

1 EA Covered Call

I rolled my EA-covered call up $1 in strike price (for a potential gain of $100) and got a premium of $0.16 (or $16 today). EA has been range-bound, and I have been rolling up and down over the last 6 months.

AMD Covered call

Both of these covered call are ITM (In-The-Money) as of today. However, AMD has dropped down from $120 to $110 area. I used this opportunity to continue to roll my Covered call UP and OUT in time.

1 Jan 19 $95SP Call --> 1 Apr 19 $100SP Call

I moved this up $5 in strike price ($500 in potential value) for a credit of $0.81 (or $81) today.1 Oct 20 $105SP Call --> 1 Dec 15 $110SP Call

I moved this up $5 in strike price ($500 in potential value) for a credit of $1.24 (or $124) today.

The sweet spot for me is trying to stay ahead of the current price. I dislike being ITM with my covered call, but it will happen. Then I will trade them with much more time on the Covered Call so it is less likely to be assigned to a new owner early—the purpose of rolling up in strike price is to return more "gains" into my pocket.

Do you like covered calls?

I know it is a love-hate relationship.

I'm not here to convince you of anything. I only share my trades and try to show you what I do. I don't chase returns or have a target profit on a trade. The goal is for me to make money each week, which will lead me to try to make money each month, which turns into a profitable QUARTER. When I do that right, I will make money for the full year. Do this long enough, and I will make money in any 5-year window!!

Have a profitable day!

Solving-Chaos