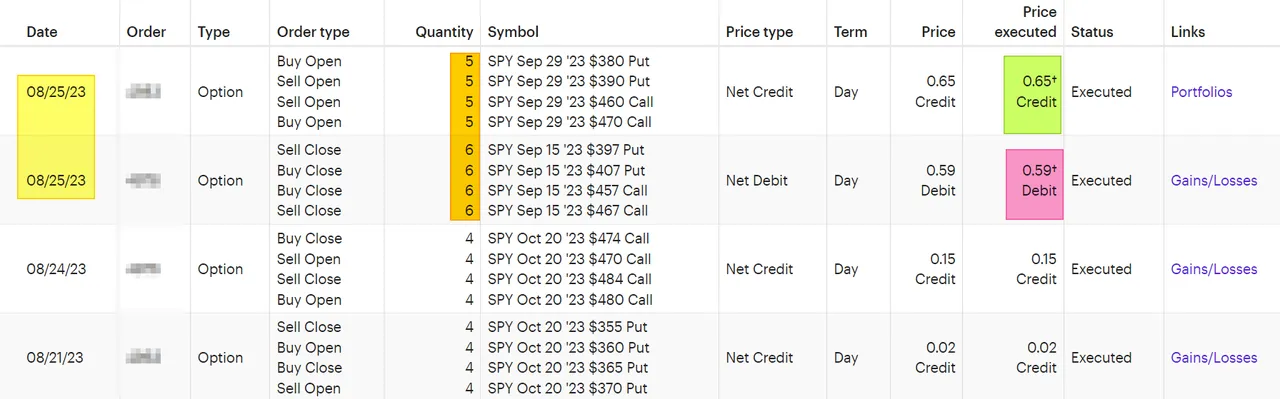

Week34-Aug25 OptionTrades

- Closed (6) Sept 15 for $0.59 (Debit)

- Open (6) Sept 29 for $0.65 (Credit).

- Week 34 - Good week

Closed (6) Sept 15 for $0.59 (Debit)

Closed for a profit. You need to see the trade history to understand that I "added" risk into the trade by rolling the untested side (PUT LEGS) in the past.

- Open (6) Sept 29 for $0.65 (Credit).

**Note: ETrade shows 5, but I did 6 Options Contracts on this trade.

I opened the new position with "two" weeks of extra time (meaning a bit of more time PREMIUM) but using a wider range between the short legs (390 PUT vs. 460 CALL). I bet SPY will stay range-bound, and this position should be safer than the one I just CLOSED. Theoretically, it depends on the expected move and what happens between now and Sept 29.

Week 34 - Good week

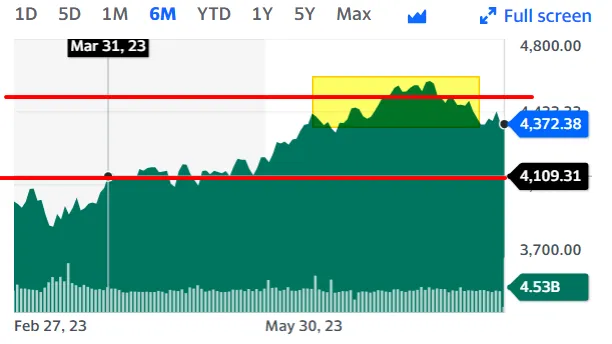

This week has been good for my options trades. SPY has moved closer to my MID point (the distance between the two short legs of my iron condor). That causes the option prices to lose value and increases my chance of making a profit. Time decay did not matter in this trade since it was TESTED on the CALLS side early on in the trade. I had unrealized losses of over 3x when SP500 marched to over 4500.

My red lines are the SHORT legs of my Iron Condor. This trade went bad fast when SPY rocked towards 4600!! I marked the area in Yellow to show how long I was in danger. Only recently did the option adjusted downward when the odds of closing over 4550 were around a 20% chance of happening before the TIME is up. This is when TIME Decay did work, and I was finally seeing a chance to get out of this trade with some profit.

Have a profitable day,

Solving Chaos