Week35- Aug 29 Option Trades

- Aug 29 Options Trades

- Aug 29 Market Moves - 1%+ is more than expected move.

- Need to be prepared to CLOSE position and adjust.

- Dividend for Week35 - $600+

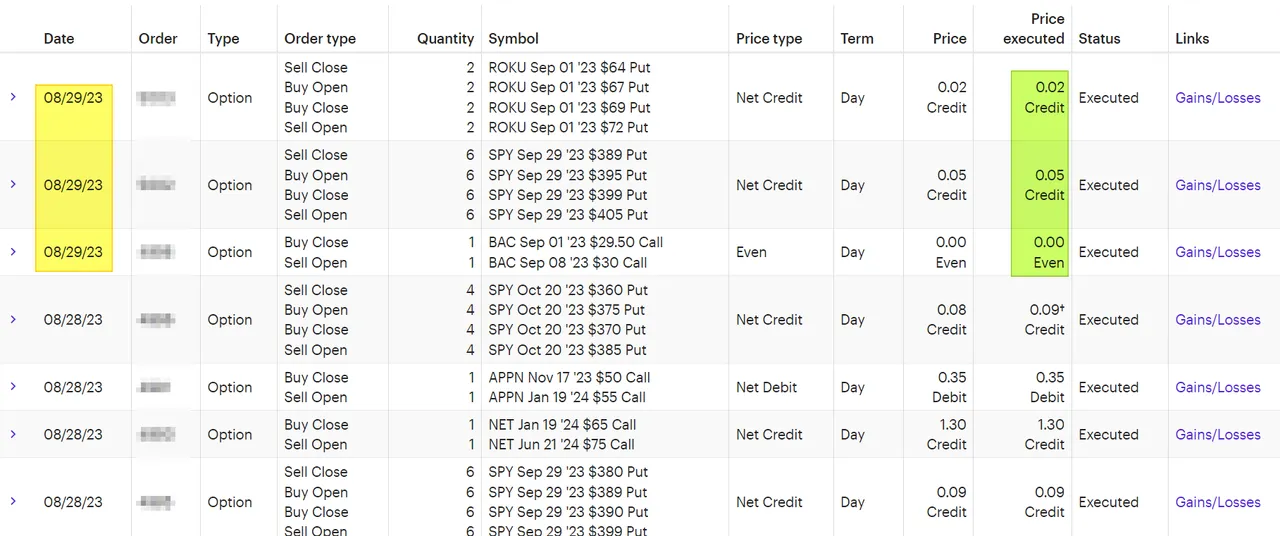

Aug 29 Options Trades

Here are my trades as of 2 p.m. EST. Let me explain what I did.

- 2 Roku Put Credit Spread: Added risk by moving Strike price up $3.

- 6 SPS Iron Condor Sept 29: Added risk on the untested side (Put legs).

- 1 BAC Covered Call: Rolling out one week and up one strike price interval.

Aug 29 Market Moves - 1%+ is more than expected move.

When the markets move more than 1%, that is generally more than the expected move of any given day in a year. When that happens, it will cause all options to be re-priced accordingly.

If we get the same type of move in the next few days, it will cause problems unless that is what we predicted. My existing iron condors will be in trouble and will be TESTED on the CALL side again.

Need to be prepared to CLOSE position and adjust.

Here is a view of my open position using SPY Iron Condors

The calls are starting to move these into a LOSING money position already. I need some RED markets that will cause the MARKET PRICE to be closer to the MIDPOINT of the put-vs-call strike price.

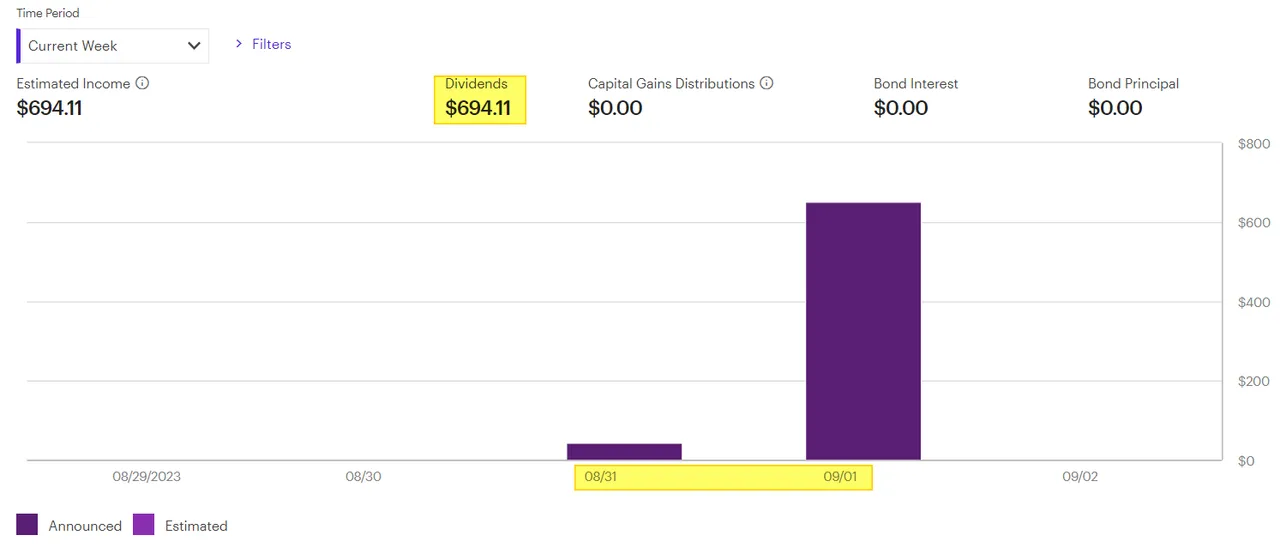

Dividend for Week35 - $600+

I have posted my dividend payments for over a year on various social media sites (Twitter, FB, etc.). Dividend payments can have different payout dates and have a different amounts (based on what has been approved).

My dividends are just a bonus and not my MAIN source of INCOME. Today, the goal is to reinvest that DIVIDEND to purchase more shares of stock that pay a DIVIDEND. Therefore, the FOCUS is not DIVIDEND, but I would rather have portfolio growth (in value and shares).

I make about $13K in yearly dividends to return to that point. My focus in not to "RETIRE" on that $13K today. If I moved to high yield DIVIDEND, I could make over $40K a year in dividends. The timing is not right for me to shift from "building assets" to. "living off assets."

I'm still over 10 years away from my retirement goal, so I will have more time to build a foundation of stocks that will continue to help me reach my asset goal. Then, as I get within one or two years from retirement, I can move my strategy to have a higher rate of return --> to prepare for that retirement (and de-risk my portfolio).

Have a profitable day.

Solving-Chaos