Week36-Sept 8 Options Trades.

- Up or Down Week -- Sept 5 - Sept 8?

- Sept 8 Options Trades as of 11 AM (EST)

- Sept 8 Tesla Put Credit Spread Explained.

- Sept 8 SPY Iron Condor - Oct 20 Explained.

- Why use Iron Condors?

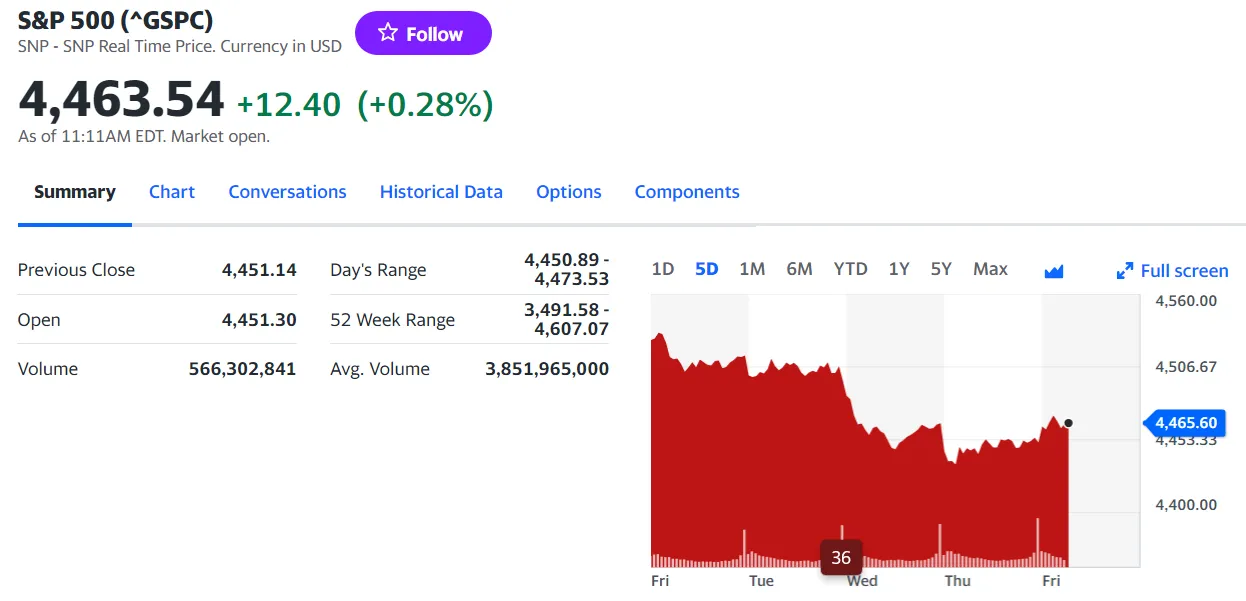

Up or Down Week -- Sept 5 - Sept 8?

Does it matter which way it goes? UP or DOWN?

Based on this, the market was GREEN on Sept 8 @ 11 a.m. (EST). However, for the week, it still looks to be a RED WEEK (see below).

My trading needs to be done regardless of whether the markets are GREEN or RED. So, I can't base it on what I think the markets will do or which NEWS event will move the markets. I need to focus on a way where I can make money 70% of the time.

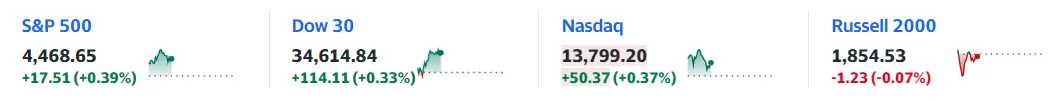

Sept 8 Options Trades as of 11 AM (EST)

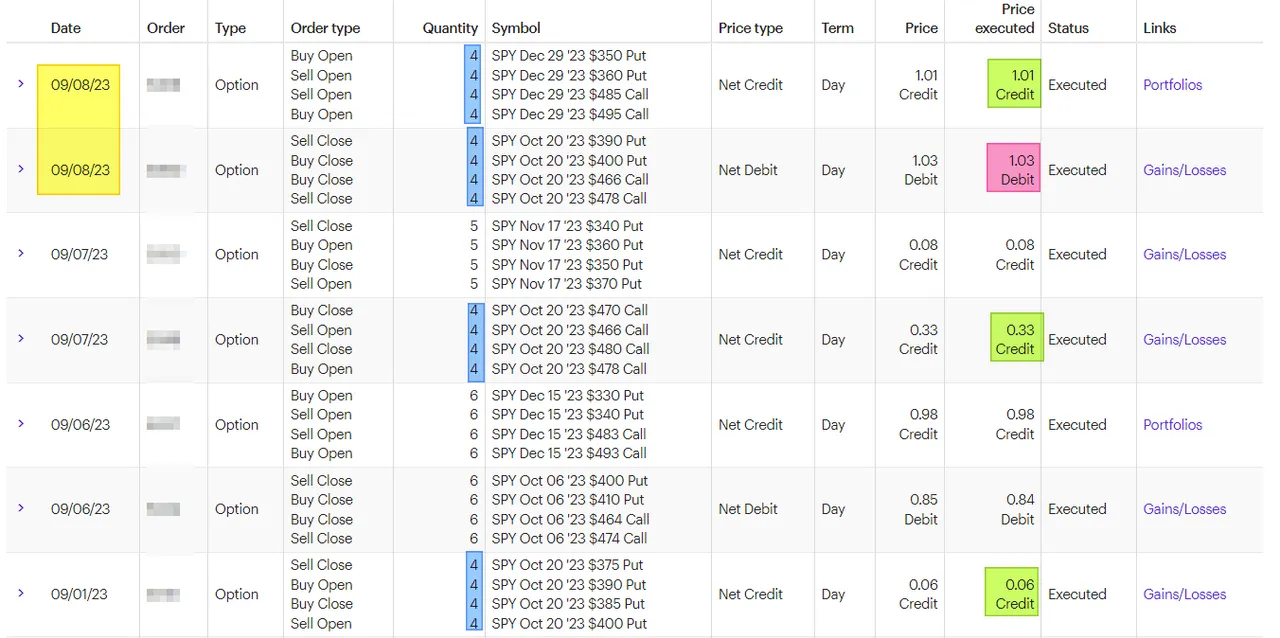

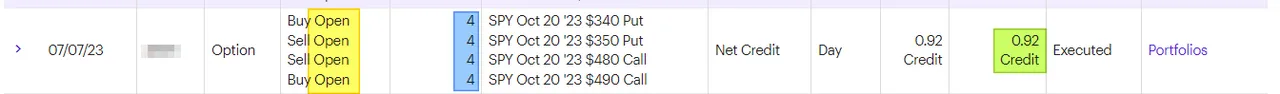

Here is what ETRADE transactions show for me (Sept 8).

I included the Sept 7 Tesla trade to see how I made 0.14 (or $13 x 2 Contract = $26) with one day of risk.

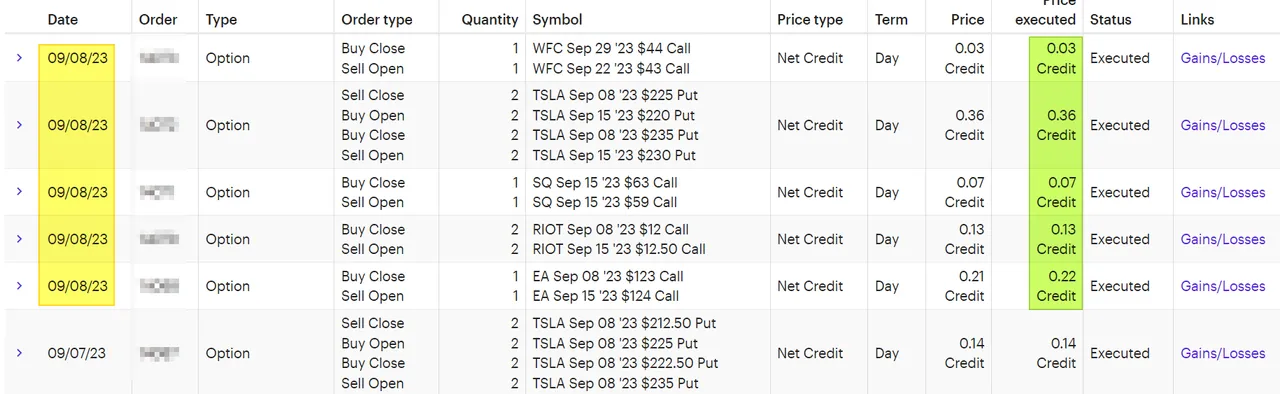

Sept 8 Tesla Put Credit Spread Explained.

Let me show you the history of TESLA, so you understand what I did this week.

- On Aug 28, I Rolled the PUT Credit Spread from Sept 1 to Sept 8 (not shown).

- On Aug 29, I Rolled the PUT LEGS from 200 to 212.50 (the Short Leg)

- On Aug 31, I Rolled the PUT LEGS from 212.50 to 217.50 (the Short Leg)

- On Sept 6, I Rolled the PUT LEGS from 217.50 to 222.50 (the Short Leg)

- On Sept 7, I Rolled the PUT LEGS from 222.50 to 235 (the Short Leg)

- On Sept 8, I Closed the position for (Sept 8)

- On Sept 8, I Opened the position for (Sept 15) using a "Roll."

Collected $0.36 for each contract.

Sept 8 SPY Iron Condor - Oct 20 Explained.

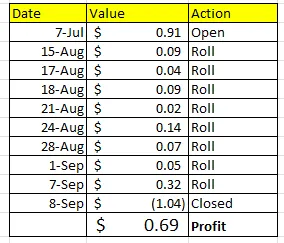

Summary:

Once you see that the trade is profitable, you might understand why I would lock in the profits and move on to the next trade. Today, I closed the OCT 20 Iron Condor and opened a DEC 29 Iron Condor.

You need to see the detailed history of the trade:

Why use Iron Condors?

I use Iron Condors because I don't want to predict the direction of the markets. I want to make money if it is UP, DOWN or FLAT. By selling the Iron Condors, I can get the PREMIUM up front and wait for TIME to pass. I only LOSE when the market moves towards the SHORT LEGS of the position. The concept is called "Theta Decay," which is how I make money.

If you like Credit Spreads, Iron Condor is just a CALL credit spread AND a PUT credit applied together. You must still learn to manage RISK and SELL/CLOSE your position before losing money.

What options trades do you prefer?

Have a profitable day,

Solving-Chaos