I hear a lot of stories about coins that pump a lot.

Basically any meme coin on solana fits this narrative

But, one thing you might also know, is that most of these solana meme coins are honey pots or have no liquidity.

which is a nicer way of saying you can buy as much as you want pushing up the price thanks to low liquidity and you simply cant sell, or if you sell you slip the price against yourself so much you basically haven’t really made anything

Now, is this for ALLLLL of the coins on solana, maybe, probably not, I am sure there are some projects there trying to do a good thing and failing. At least they tried to do the right thing, but most of the coins there are scams.

There are also a plethora of other projects I think have some chance of doing good, but today I have one specific project in mind.

This one is called 9mm exchange.

They have one 1 token and will NOT have anymore tokens, there is only 1 so they can concentrate all their efforts, and the market can concentrate all their buying power to this one token.

What is 9mm?

9mm is a DEX built on top of pulsechain.

Pulsechain is basically ethereum but far less expensive to use. As a matter of fact if you held any Eth or ERC20 tokens may of last year then you have a copy of all your tokens simply waiting for you over on pulsechain, they took a system state snapshot of the entire ethereum chain and made the worlds largest airdrop.

9mm is one of the top exchanges built on top of pulsechain.

The 9mm token is their one and only token.

They plan to launch their exchange on other chains as well, I believe they wil be launching on BASE, but like I said, there will only be 1 coin, no new version of the coin for the other chains. But why launch an exchange on other chains? Well, its so they can bring the fees accrued on those other chains back onto pulsechain..

A little explainer as to why would someone want to buy the 9mm token when there are millions of other tokens out there, why buy 9mm?

Before going on let me remind you I am not your financial advisor, I do not know you, your financial situation etc, so how in the world can I advise you, do your own research.

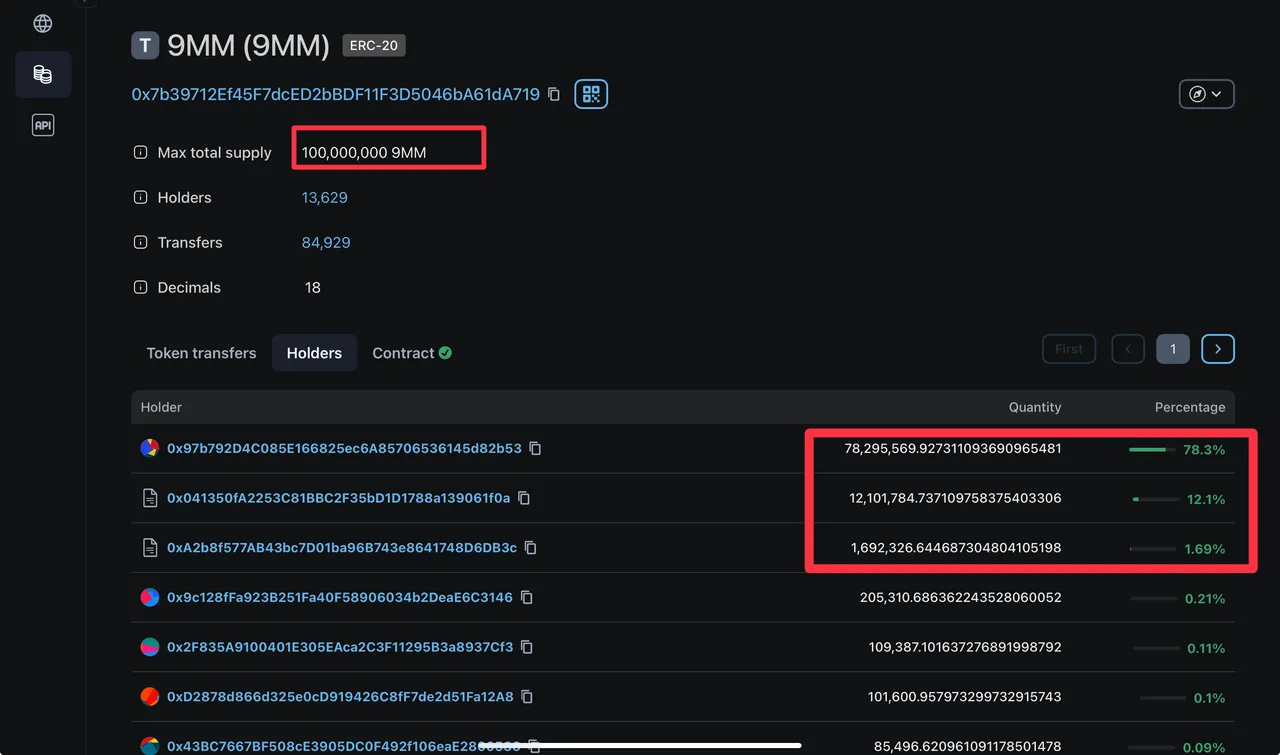

So, this coin will only ever have 100,000,000 million tokens. There will never be any more. No inflation either.

How are these tokens distributed?

If you notice in the bottom right there is 78.3% of the coins in a single address.

Is this a whale holding it all?

No

This coin has a 12 month launch phase. Those 78.3% are coins waiting to be distributed over the next 10-11 months.

The coins are distributed to:

Users of the exchange, the more you use it the more your share of the pie is

LP providers

Holders/minters of certain NFT’s

All of these ways to earn are based on how much of the activity is yours.

If you are 1% of the activity you will get 1% of the month issuance rate.

Every month its reset, and you accumulate “points” per say, based on your activity.

So already thats pretty cool.

But heres the coolest part.

This exchange like almost all dexes, collects fees.

What can you do with your 9mm tokens? You can stake them to earn yield

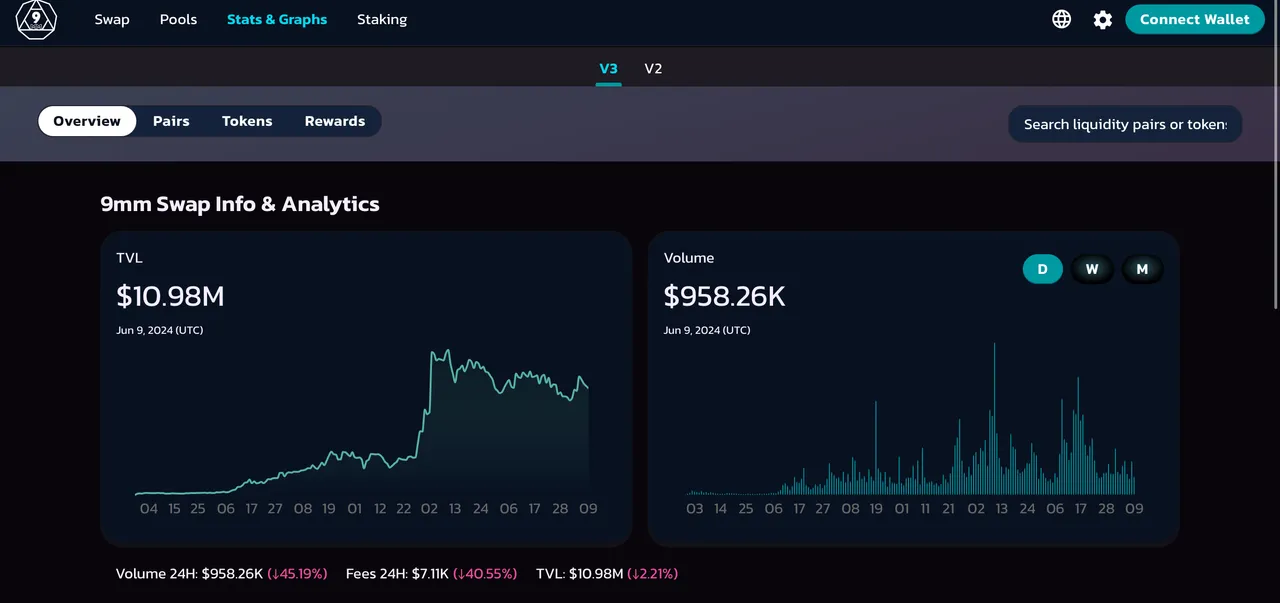

This is a screenshot for today, a sunday (usually Sundays are slow)

As you can see there was around $7,110 of fees made by the exchange.

Half of those fees are sent to 9mm stakers every month in the form of pls (pulse, the native token for pulsechain, just like eth is the native token for ethereum)

Why pay out in pls instead of 9mm?

Well, if they paid out in 9mm then they would have to restructure their whole issuance model, but also, people tend to dump yield (anyone in hive knows this well) and when you dump the 9mm coin it wouldn’t paint the prettiest price chart…

So, by paying the fees out in pls, they are protecting their token’s price.

These airdrops and fee payouts are done at the 9th of every month.

No, you cant just show up a day before a stake and get a big chunk.

To maximize your yield you should stake on the 9th, that way you are staked for the full month, to maximize your share of the pie, if you unstake before the payout you will miss out on the yield.

Before I said half of the DEX fees are paid out to 9mm stakers, what happens to the other half?

Well, the other half will be used to buy and burn 9mm

What is a buy and burn?

Well, 9mm will be bought off the open market, and burnt, never to be sold again.

This is huge, as the coin is being issued, it is also being burnt every month.

So that 100,000,000 maximum is already being reduced even before it is all released.

The more coins that are bought and burnt, the less there will be on the market, this should naturally push up the price since 9mm’s volume has been steadily growing, and as pulsechain matures 9mm will have more and more volume, more and more features, which all translates to more fees, more yield for stakers, and more coins to be bought and burnt forever.

Again, this is not financial advice, but this coin is around 15 cents right now and I can easily see it go to $1…$2….$5….$10…$20…

We have another 11 months before all the tokens are released and by then I wouldn’t be surprised to see a massive chunk of the total supply being gone forever already.