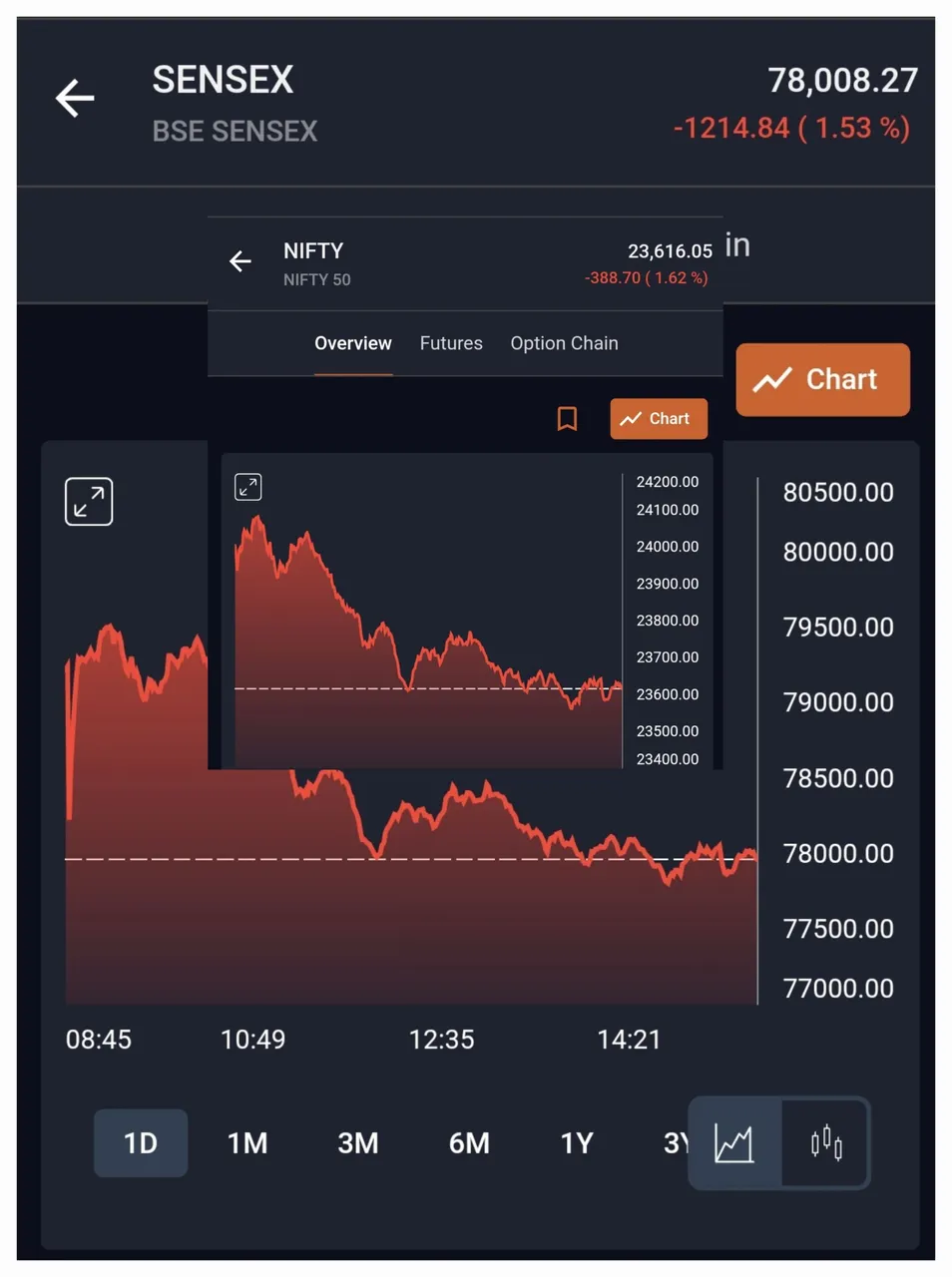

It was one of the Black rather Red day in Indian stock market. It was one such day when the investor would be regretting investing in shares. The stock market fell sharply today. The #sensex tanked -1214 points, while the #Nifty tanked -388 points during the day trading. There are multiple factors that are affecting the shares which makes the market to witness one of the worst fall in recent days.

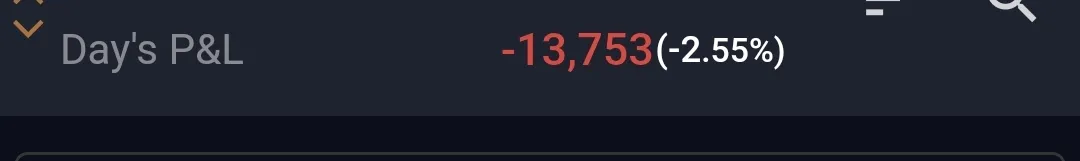

Almost every shares in the stock market fell. The market opens on a positive note promising a good start to the week. My portfolio was in Green, untill afternoon, when I saw my portfolio turns Red with a personal loss of INR 13753 ($165). This was a steep loss for a small time investors like me. My portfolio never ever witness such loss. Losing 13k in a single day is alarming.

Why is the Market Falling?

There are various factors resulting in the market slide. From HDFC Bank weak business update to FII (Foreign Institutional Investors) selling 4227 Cr worth of shares on Friday. However the major concerns affecting the market were the #HMPV virus scare. There are 3 reported cases from India, which soon results in spreading negative sentiments in the stock market. The HMPV cases were earlier reported from China and Malaysia. And, today India reported its 3 cases, which makes the stock market to react sharply.

Meanwhile, while most of the Asian market reacted to the #HPMV scare, the #US NASDAQ, was up by 1.5%. Most of the #technology stocks were rulling the game.

What Should Investors Do?

This kind of situation always creates Panic in investors mind. We had seen it during #covid outbreak. Still we can stick to following points to avoid any major loss.

1. Avoid Panic Selling: Market corrections during health scares are temporary, but emotions often drive such moves.

2. Focus on Fundamentals: Strong companies are likely to bounce back. Use dips to add quality stocks.

3. Diversify Your Portfolio: Defensive sectors can help manage risk in uncertain times.

4. Trade Carefully: With volatility up, keep stop-losses tight and avoid overexposure.

My stance:

This correction reflects uncertainty rather than clear risk. We don’t know how long this volatility will last since the situation is still evolving. While the Indian government assures there’s no cause for alarm, markets are likely to remain cautious until the health concerns are resolved.

There is always a chaos for short term investors who is looking for quick profits. Long-term investors should stay patient and disciplined. Focus on the bigger picture and use this time to pick quality stocks for the future. I have few in mybradar and surely going to grasp the oppurtunity to make portfolio stronger.

In good faith - Peace