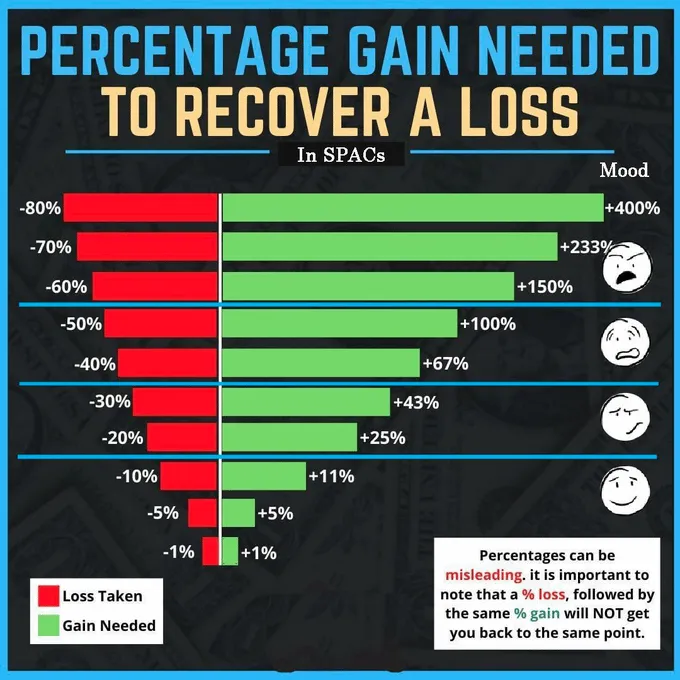

The share market roller coster ride has been ongoing since last few weeks. On some day, market shows a positive sign while , the next day it get into Red. It is hard to predict, which way the market is moving. In few trading session, I recovered some losses incurred during the recent bear market. During the downturn trend, I lost more than 100k INR in my portfolio. I have invested in different shares, and each of them took some string beating. Investing isn’t just about making gains, it’s about avoiding heavy losses. But the recovery is not as fast paced as the loss. The recovery involved a mathematical calculation to estimate the losses. As per a rough calculation, a 50% loss needs a 100% gain to break even, and an 80% loss requires 400%. This typically makes the recovery too lengthy process.

To recover a loss, the percentage gain needed is calculated using the formula:

[1 / (1 - (% loss))] - 1;

meaning, the larger the loss percentage, the larger the gain percentage required to break even. Example:

20% loss: Requires a 25% gain to recover.

50% loss: Requires a 100% gain to recover.

10% loss: Requires an 11% gain to recover.

The bigger the initial loss, the higher the percentage gain needed to recover.

This formula is based on the concept that once you lose a portion of your investment, you need to earn a larger percentage gain on the remaining amount to reach the original value.

To recover from such losses the smart investors focus on managing risks. Instead of chasing high returns blindly, protecting the capital should always come first.

“The first rule of investing is not to lose money. The second rule is never to forget the first rule.” – Warren Buffett

Protecting capital is crucial because it ensures that our initial investment remains intact, safeguarding our wealth against market fluctuations and allowing us to maintain access to funds for future needs. When you cannot afford to lose our principal, like during retirement or when saving for a near-term goal, prioritizing capital preservation often means opting for lower-risk investments with stable returns over potentially high-risk, high-reward options. In volatile markets, prioritizing capital protection helps minimize potential losses.

It is worth noting that, Small, consistent gains are better than risking huge losses for big wins.

In good faith - Peace!!